Roadblocks to Growth

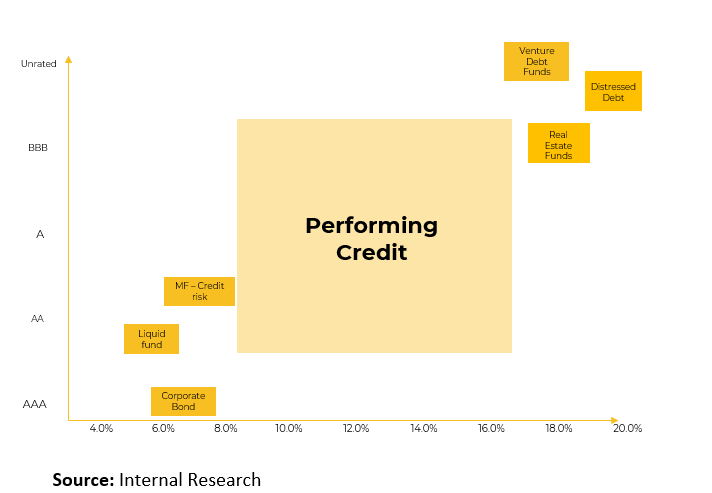

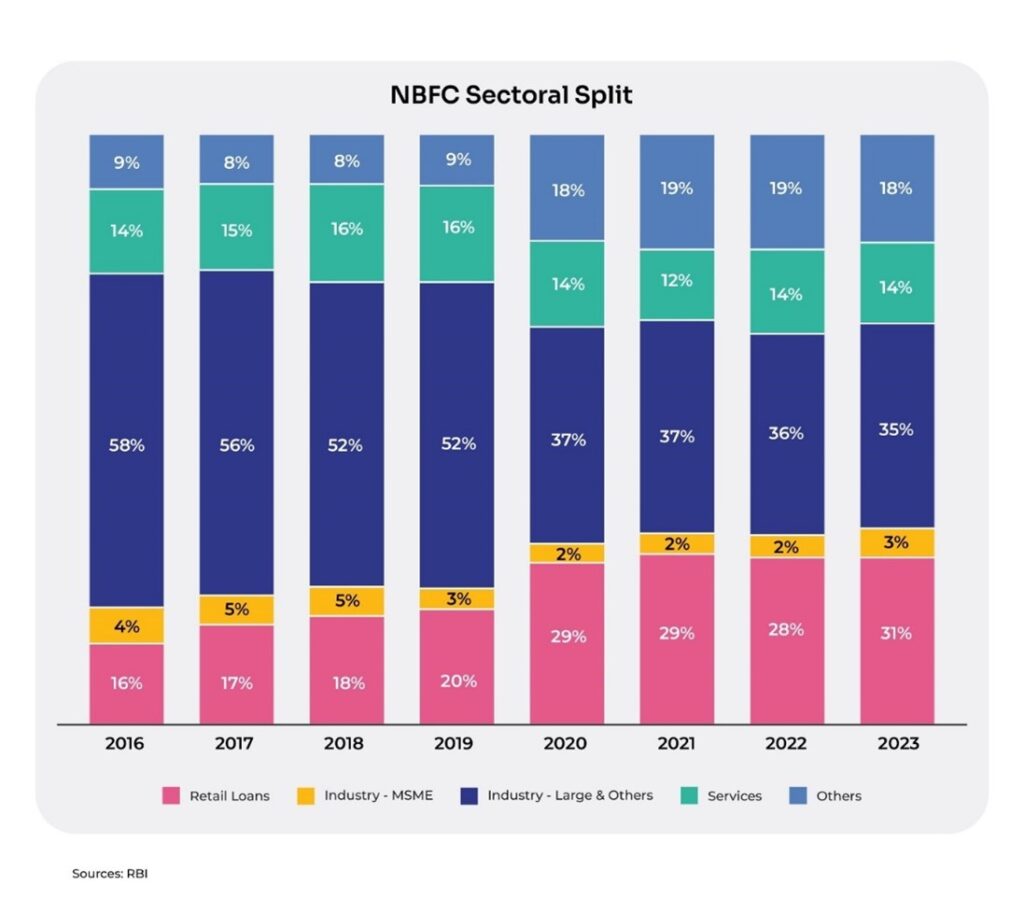

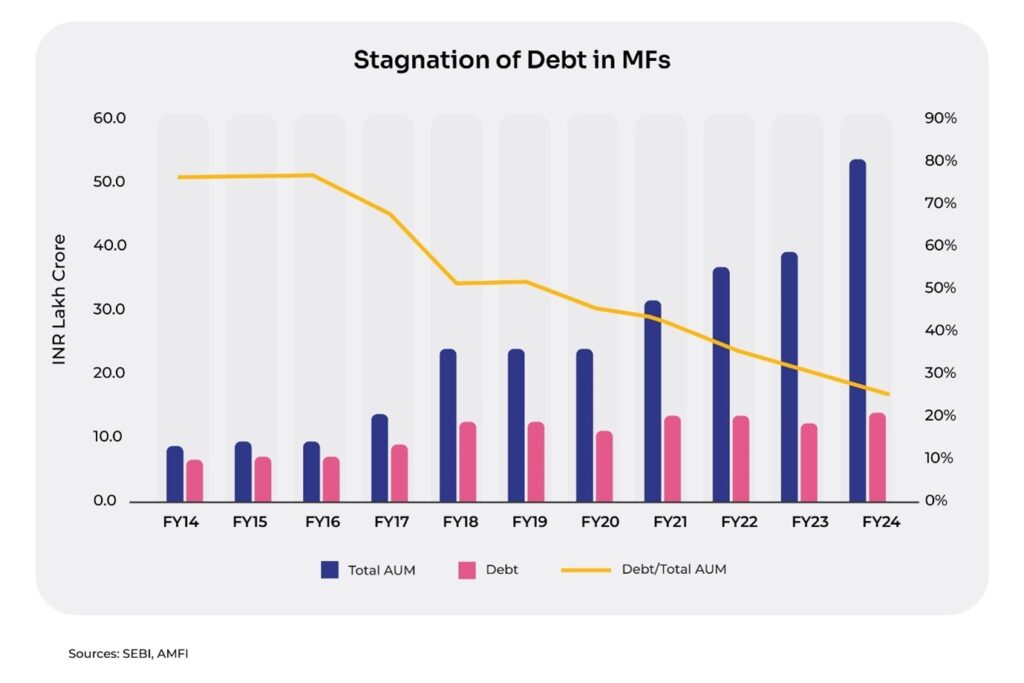

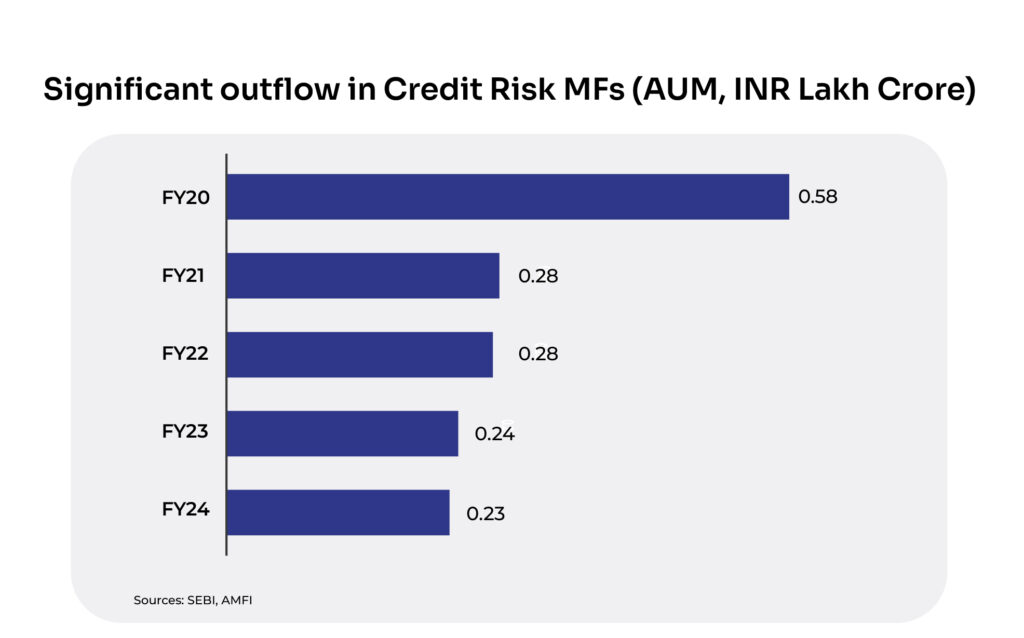

Traditional lenders such as banks and larger NBFCs are inflexible in enterprise lending and tend to serve the most vanilla needs through policy-based lending. On the other hand, mutual funds and insurance companies are restricted by their respective regulations and face lack of access to this space and limited ability to assess credit worthiness.

Most of these entities rarely have the expertise to navigate public capital markets, further exacerbated by the perils of asymmetrical information and smaller ticket sizes which may not garner investor interest.

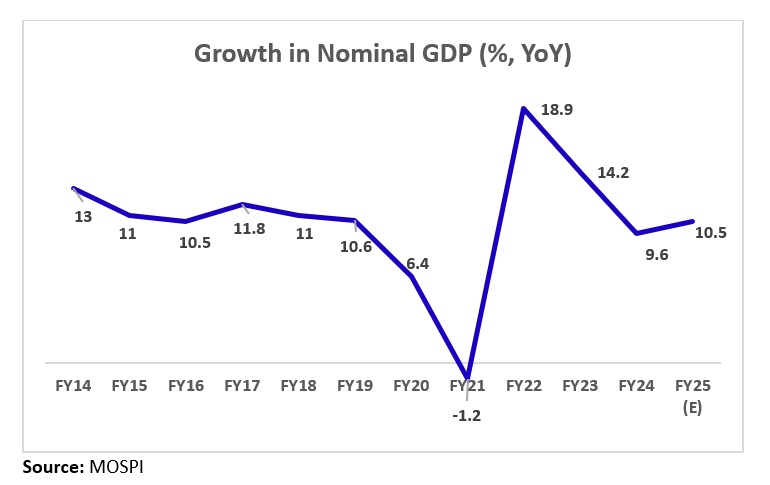

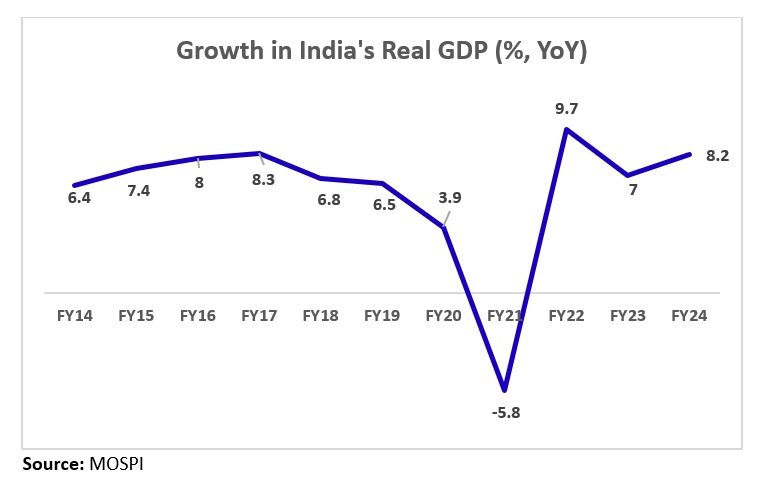

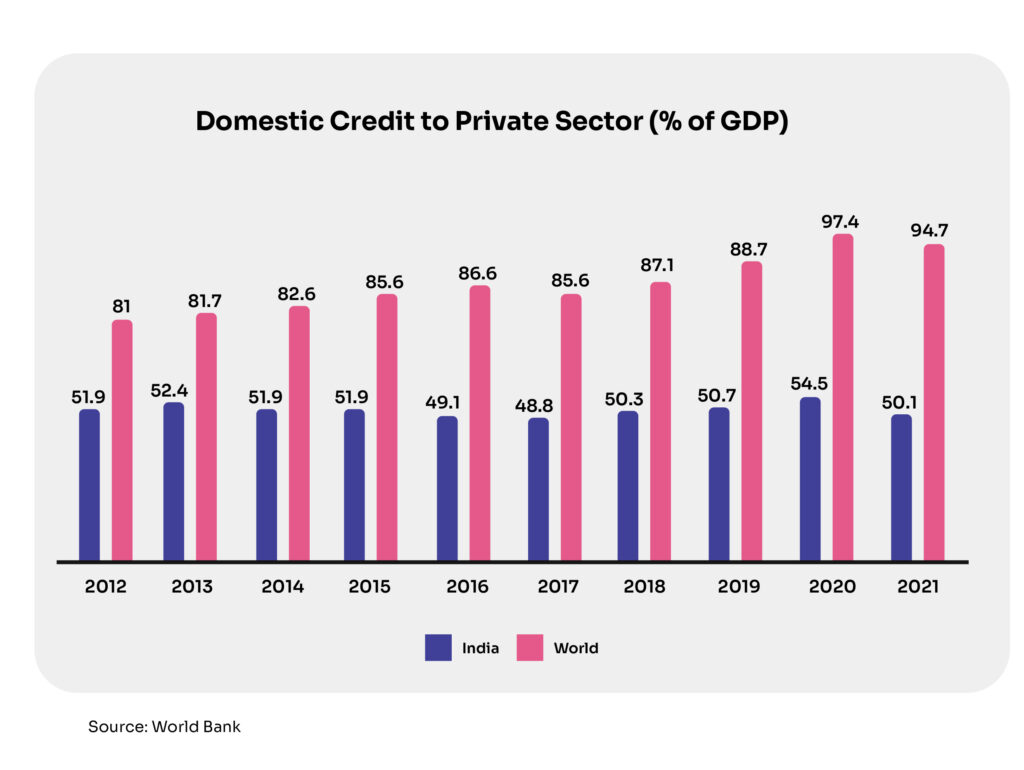

Banks and NBFCs have largely pivoted towards retail lending with loans to industry growing at a slower pace than average disbursements. In the past 12 years, retail loans by banks clocked a CAGR of 16% while banking credit as a whole rose ~10%. In the same period, bank lending to large businesses and MSMEs has relatively stagnated with a CAGR of 3% for each, respectively.

In such a scenario, what can plug the significant gap in enterprise credit, mainly the mid-market enterprises that hold the potential for the next leg of growth in India?

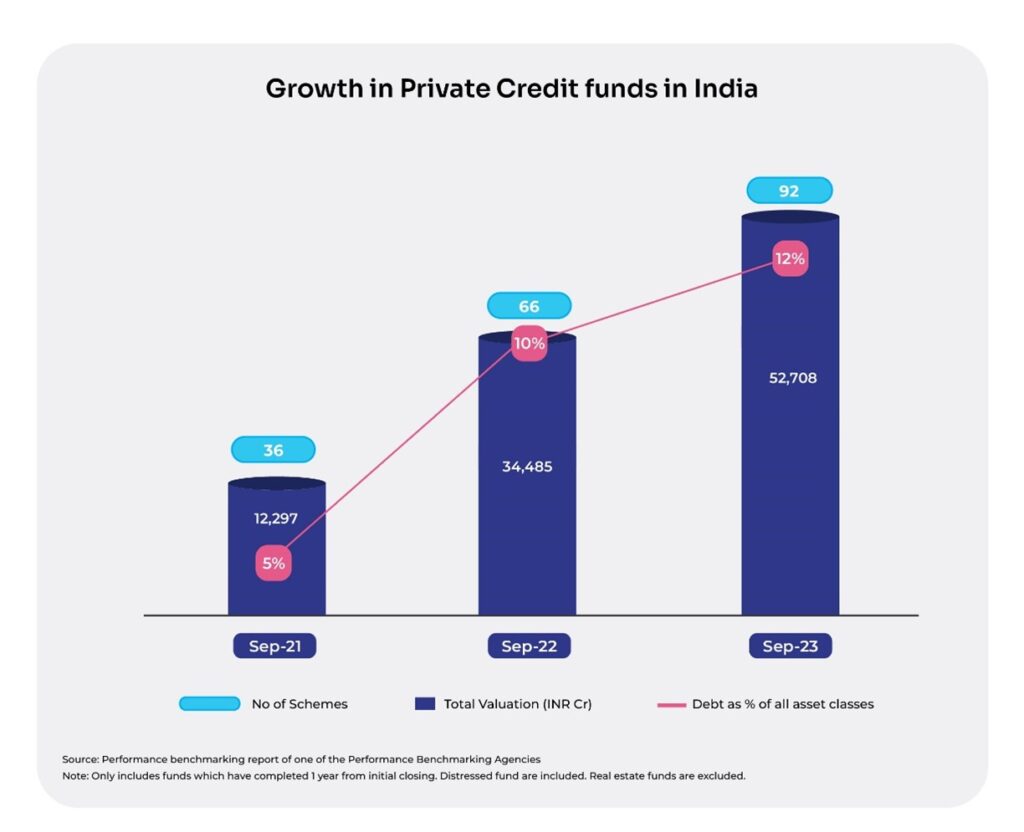

The Emergence of Private Credit

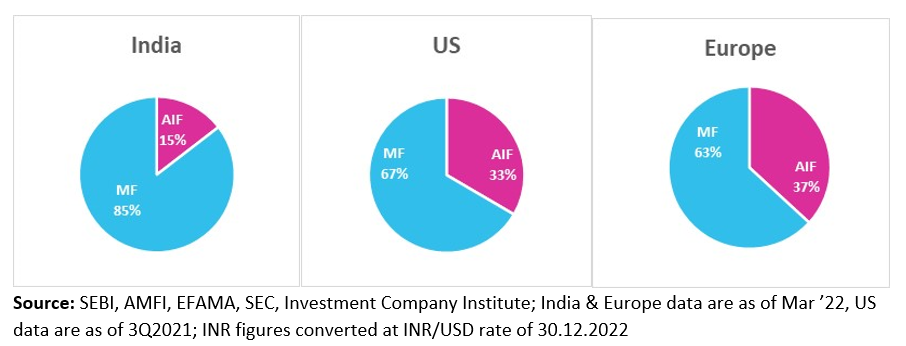

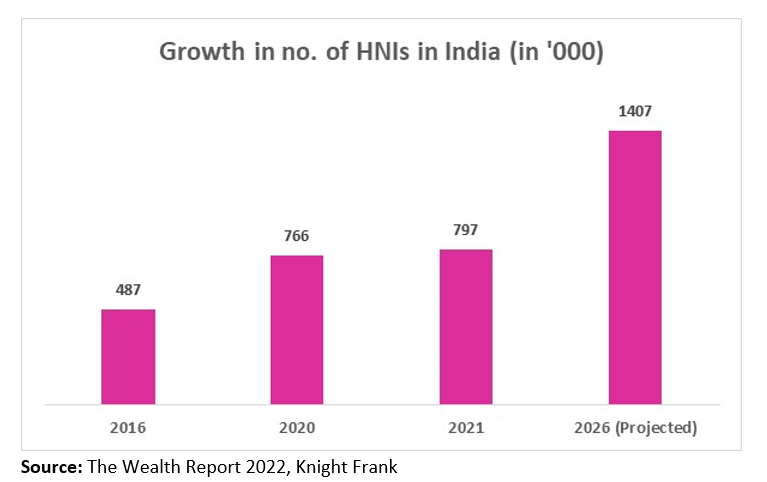

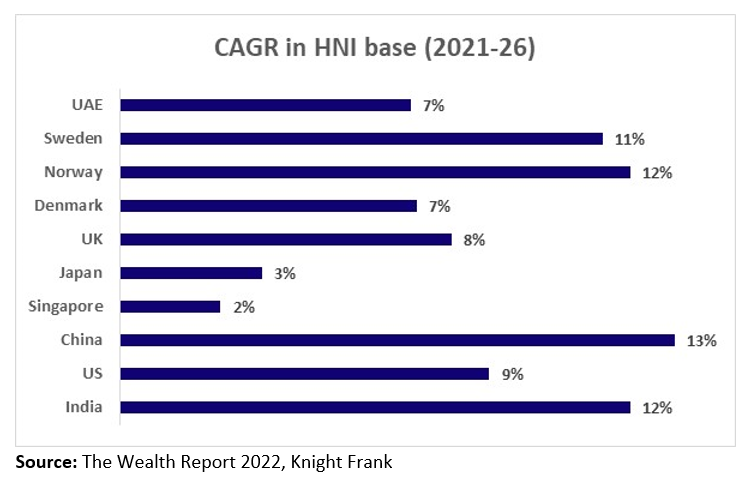

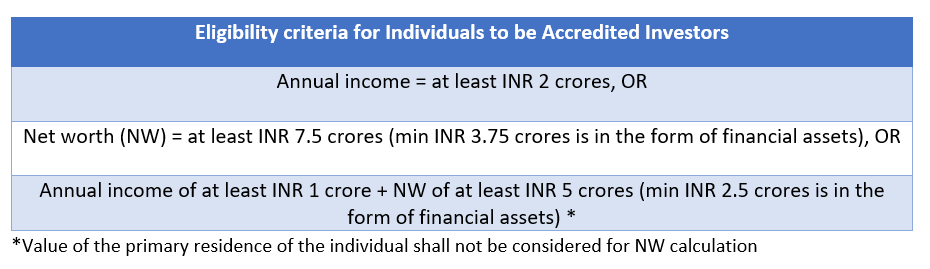

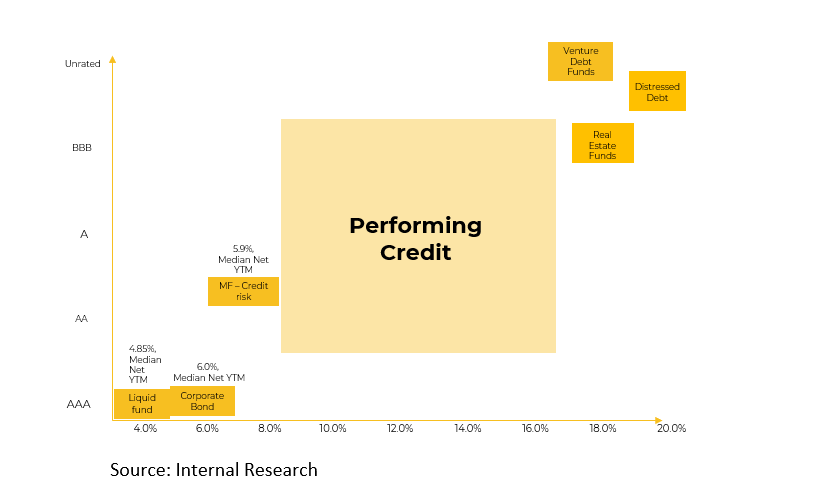

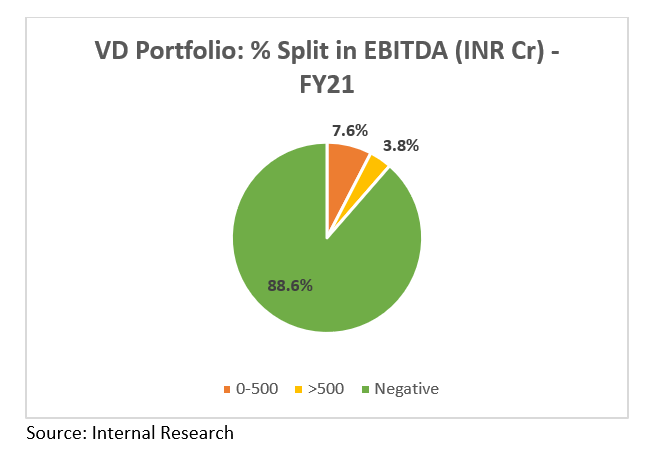

Private credit provides an alternative source of financing for businesses with unique funding needs and irregular cash flows, cases which banks may avoid due to inflexible policies and regulatory restrictions. Private credit lending takes place mostly via funds/investment vehicles handled by specialized asset managers. In such funds, money is raised from sophisticated investors which are then deployed to entities as per covenants that suit the risk-return spectrum of the vehicle. The tasks related to origination, due diligence, monitoring and recovery (if required) are handled by the fund. With this, investors get access to a professionally managed portfolio consisting of 10-20 entities.

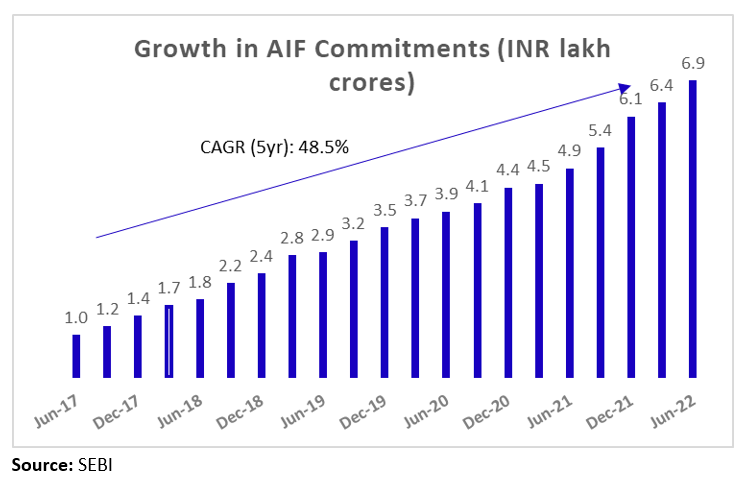

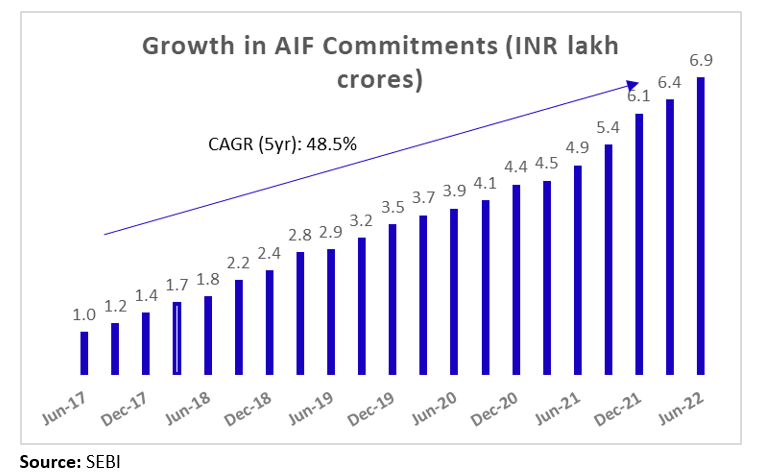

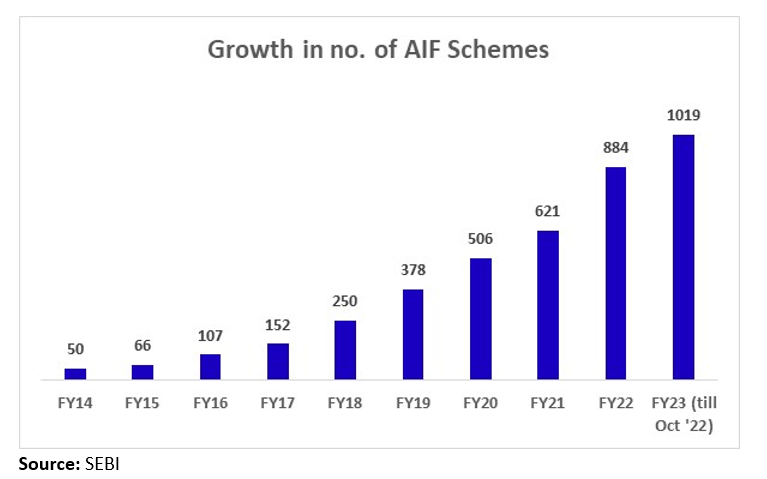

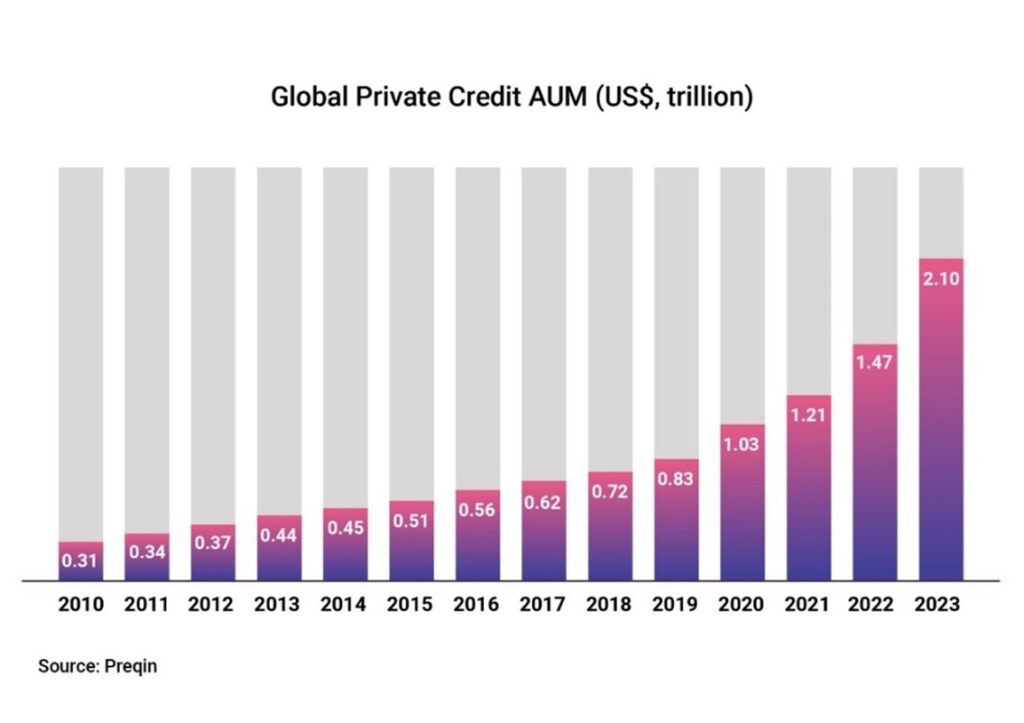

The Private Credit market has been growing at a fast pace across the world, and India is no exception. It witnessed a 5x growth in assets under management (AUM) over the last 10 years to over US$2 trillion in 2023.

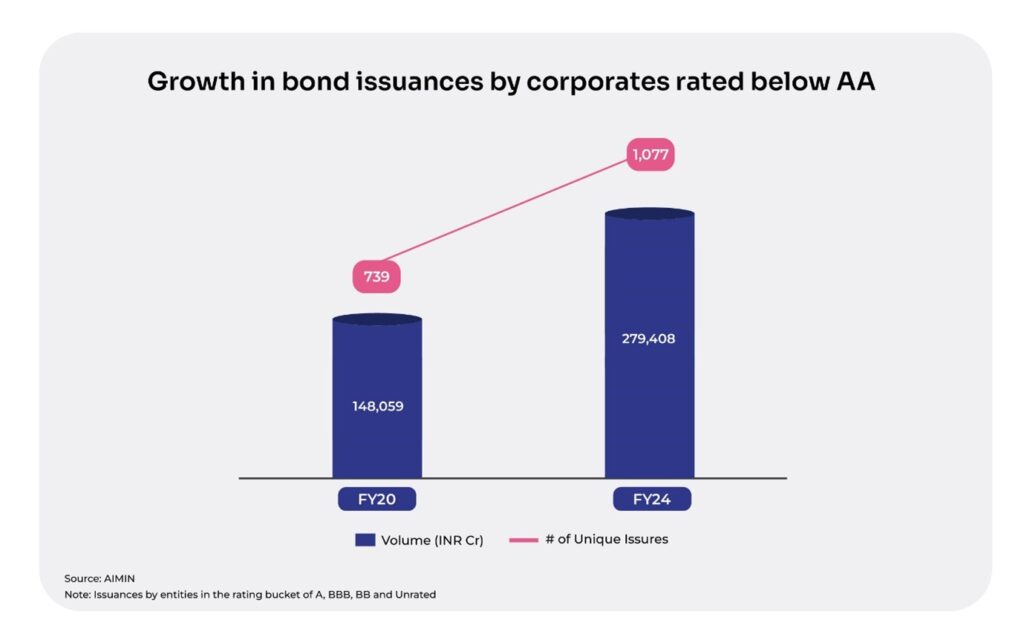

The entities in the Performing Credit space, to which banks generally offer Term Loans, are able to issue debentures into which funds invest. Often, and especially for corporates, an issuance for a fund may be the entity’s maiden capital market issuance and rating exercise. The fund may also be able to provide guidance in navigating the nuances of capital market issuance.

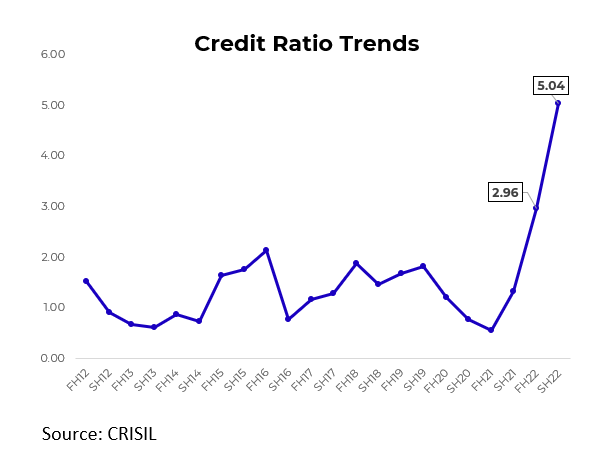

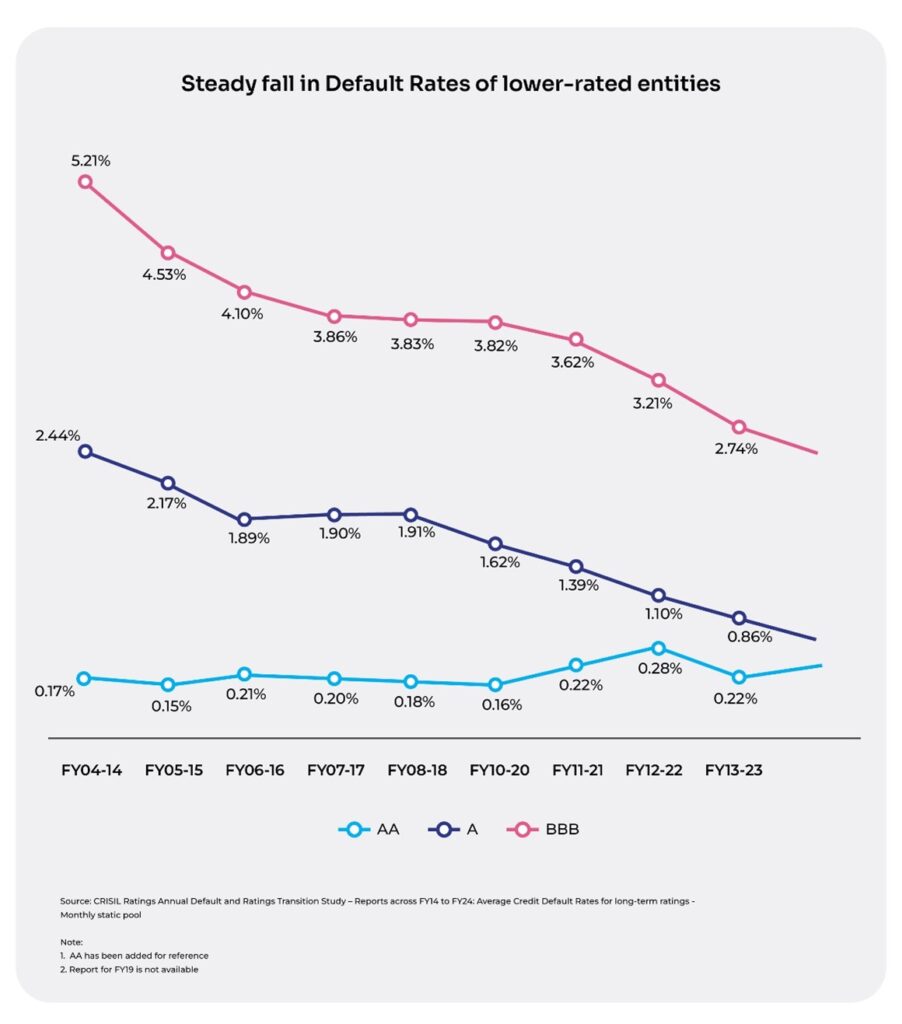

- Enactment of the Insolvency and Bankruptcy Code that has imparted credit discipline among such corporates.

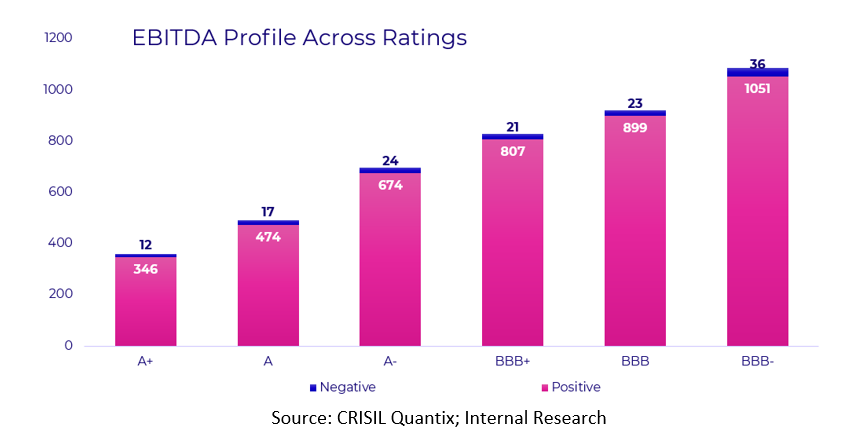

- Improved scale and profitability of the entities due to the growth and digital advancement of the Indian economy.

- Industry-wide consolidation.

- Lower volatility in operating parameters.

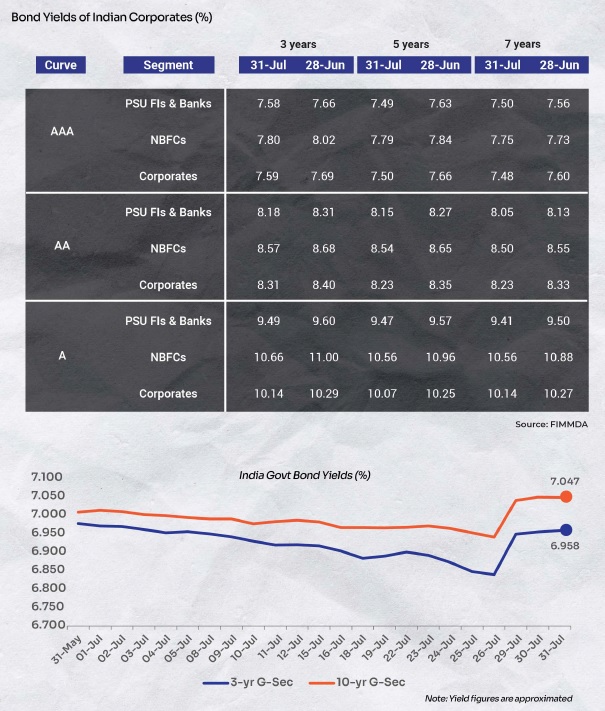

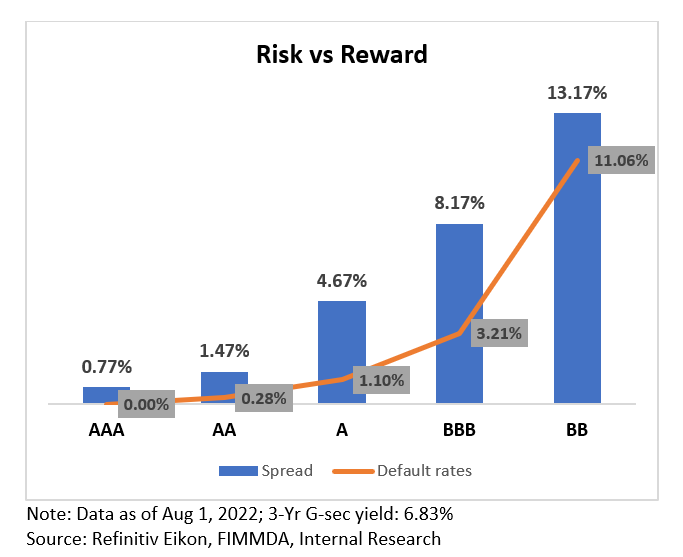

In the public debt market, it has become difficult for investors to generate real returns. However, it makes sense to cautiously move into the private credit market given the immense potential in the space to earn superior returns. Recent regulatory steps like the enactment of the Insolvency and Bankruptcy Code and the introduction of the Account Aggregator framework brought confidence in the market and enabled transparency and scope for efficient decision-making about borrowing entities.

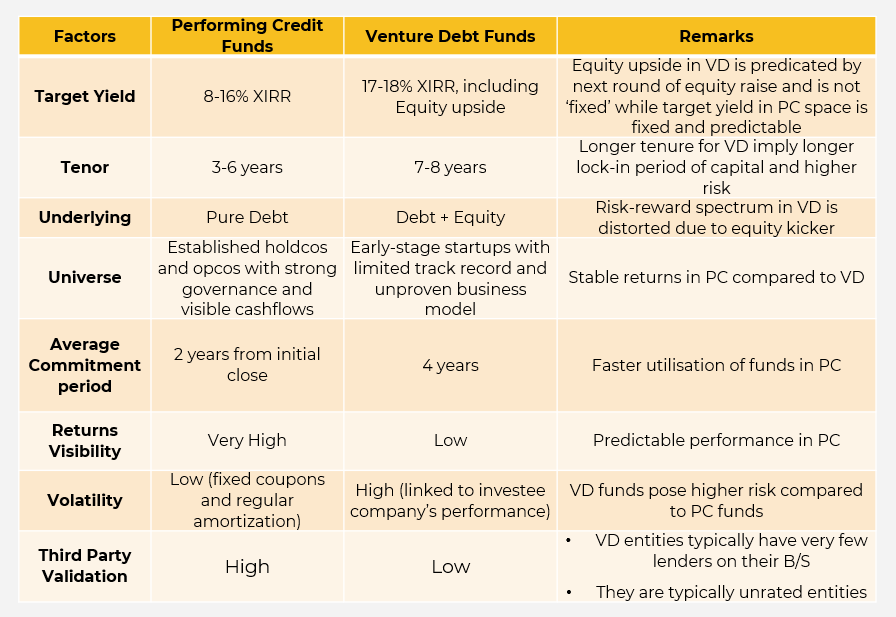

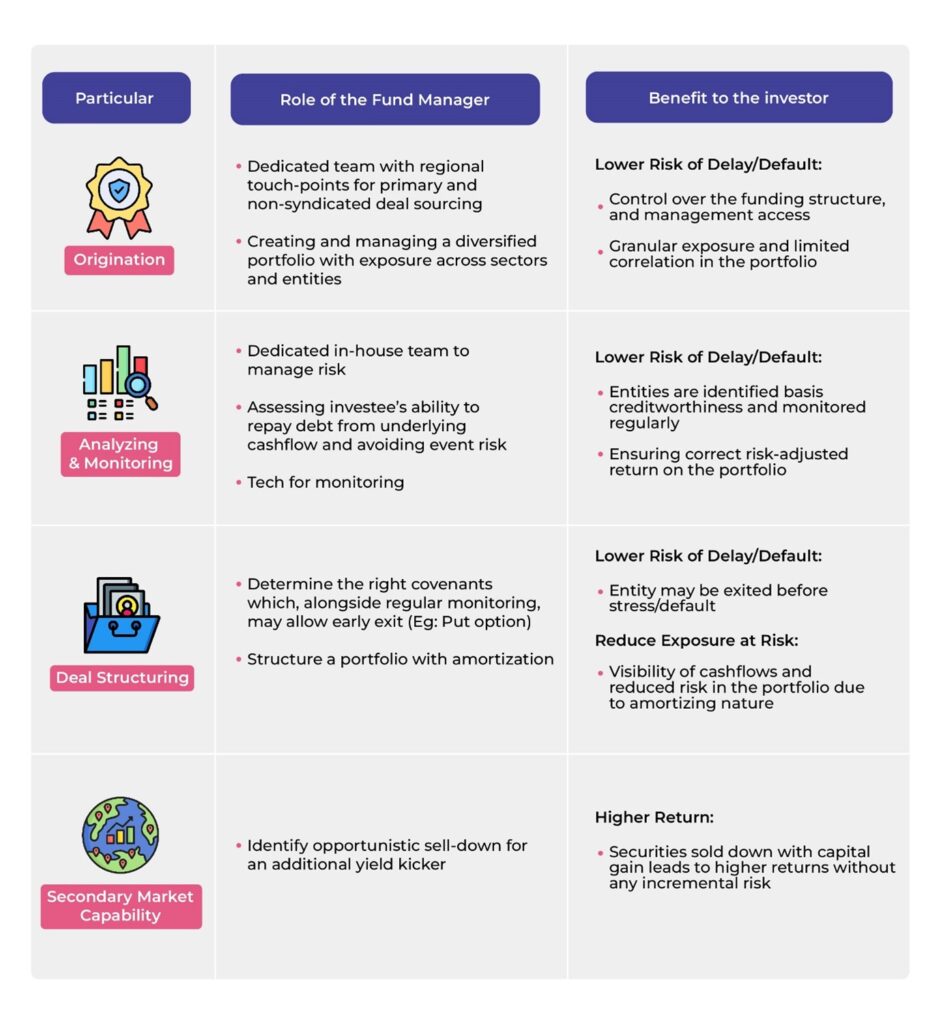

Further, choosing a highly professional fund manager is extremely useful while investing in the space as such risks can be mitigated ensuring stability and predictability of returns. Below are the factors investors should consider before investing in Private Credit funds:

Disclaimer: The information provided in this article is for general informational purposes only and is not an investment, financial, legal or tax advice. While every effort has been made to ensure the accuracy and reliability of the content, the author or publisher does not guarantee the completeness, accuracy, or timeliness of the information. Readers are advised to verify any information before making decisions based on it. The opinions expressed are solely those of the author and do not necessarily reflect the views or opinions of any organization or entity mentioned