“Financial conditions have been eased, supported by accommodative monetary policy and low volatility in financial markets. The strength of the corporate balance sheets also lends support to overall macroeconomic stability.” – RBI Financial Stability Report (FSR), June 2025

Executive Summary

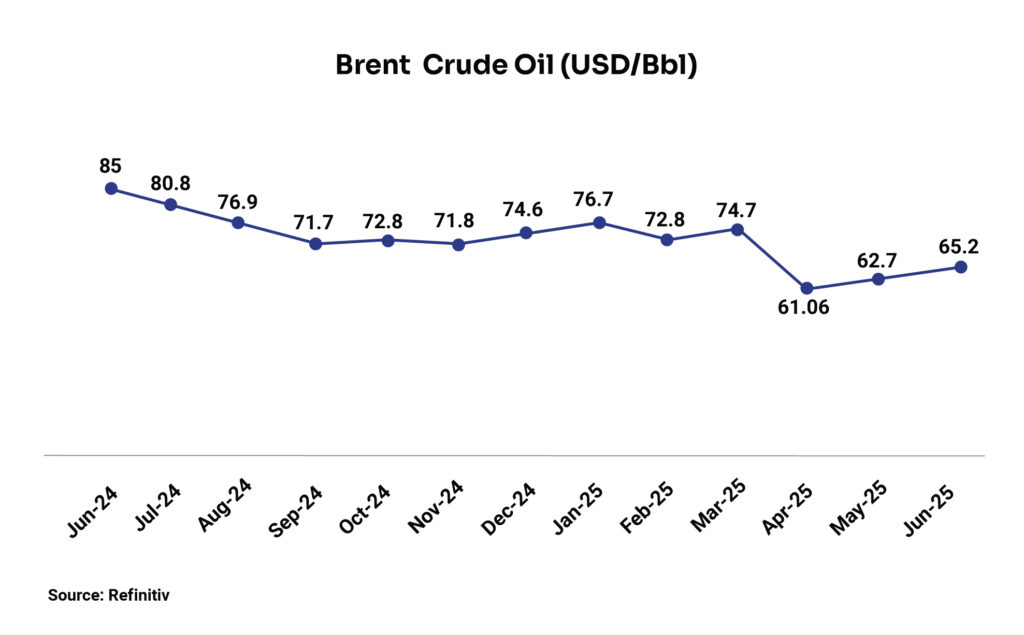

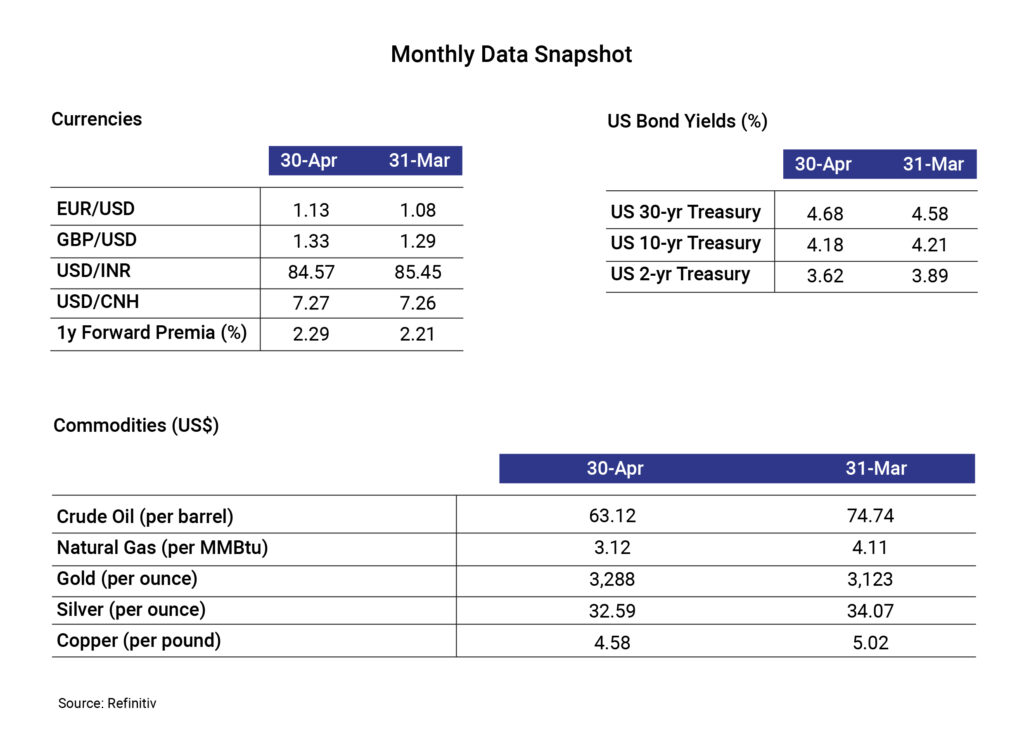

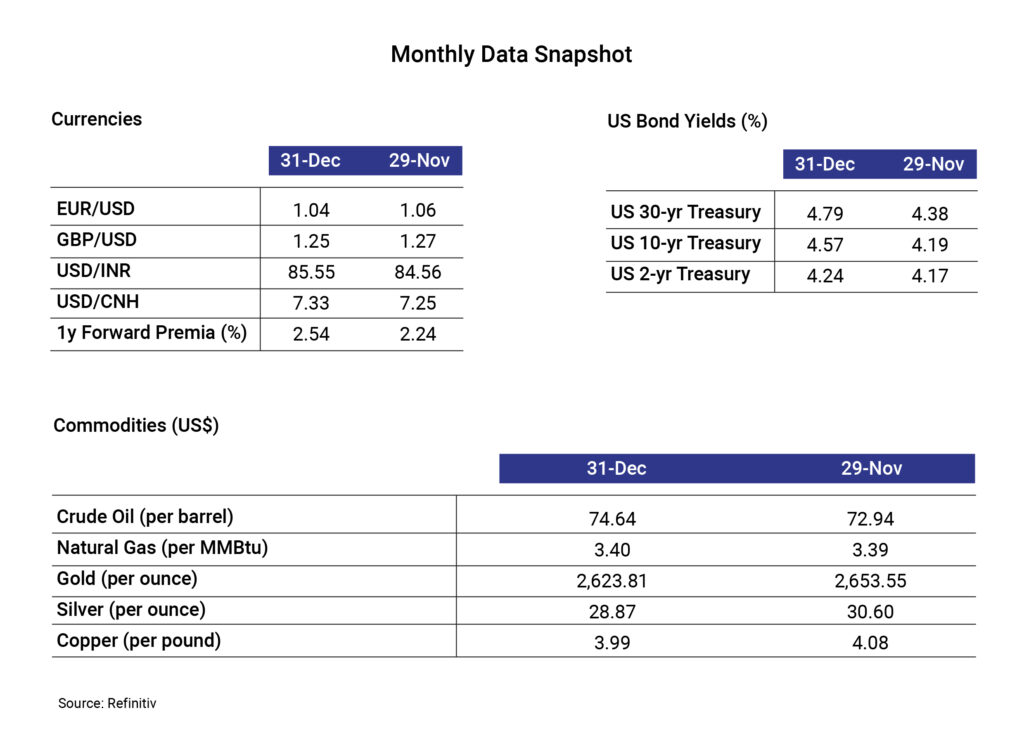

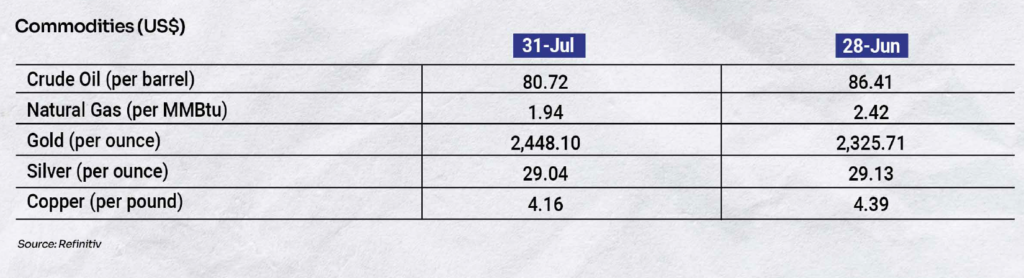

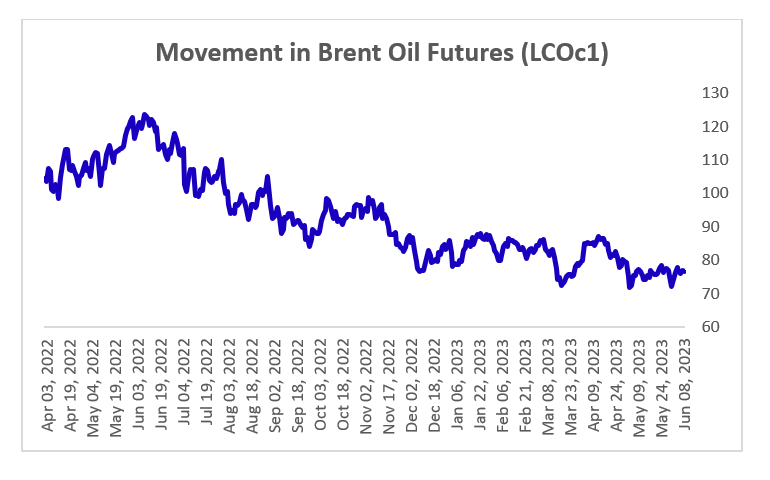

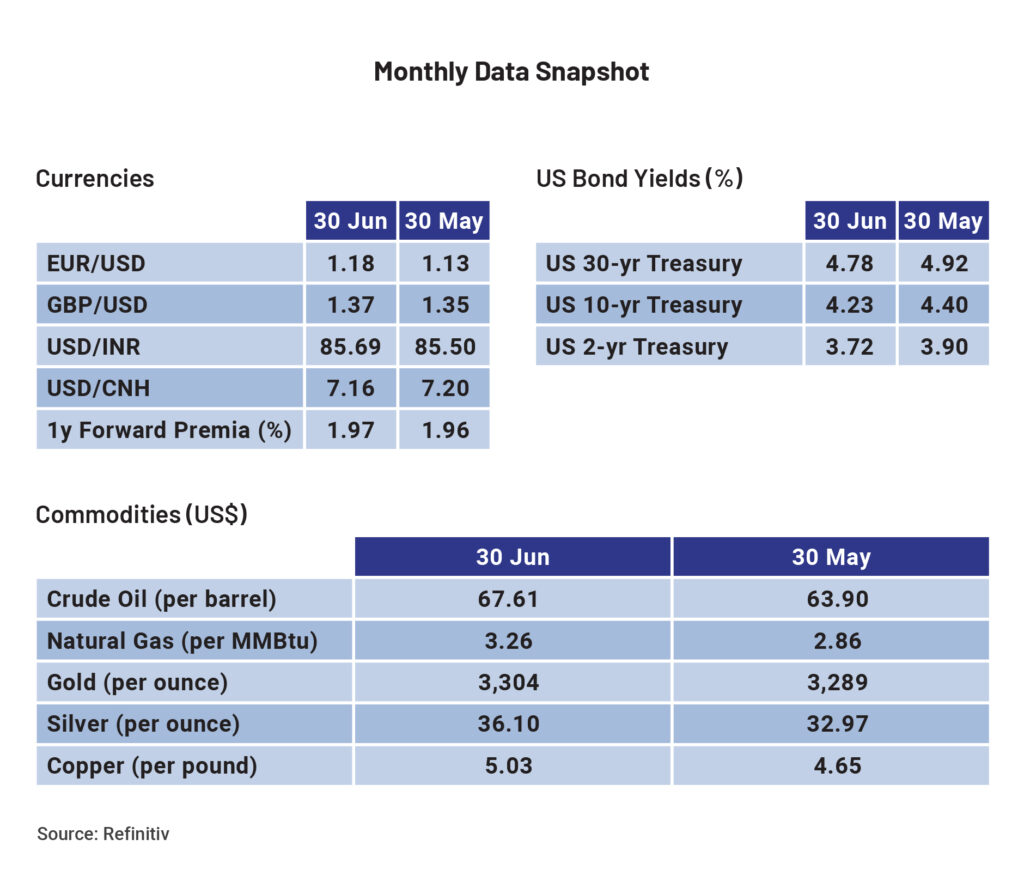

Geo-political tensions in the Middle East were the biggest concern during the month, with significant escalations between Israel and Iran, reminding markets of tensions in the 1980s. With the US striking Iran, global markets took a beating, and crude oil, in particular, saw a sharp spike as the tensions escalated, with Brent reaching about US$80. The de-escalation later through the month, with counterparts reaching an agreement, calmed the markets, with oil giving up most of its move higher.

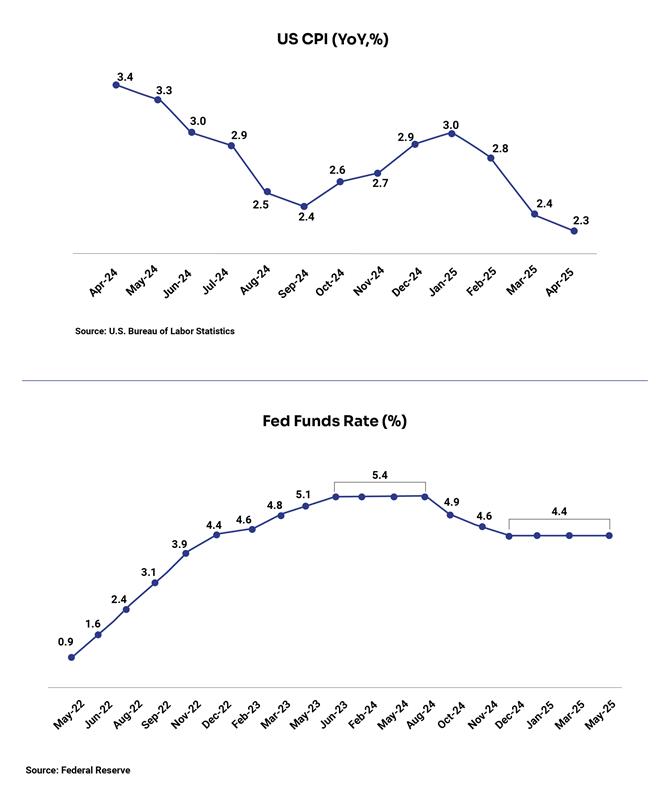

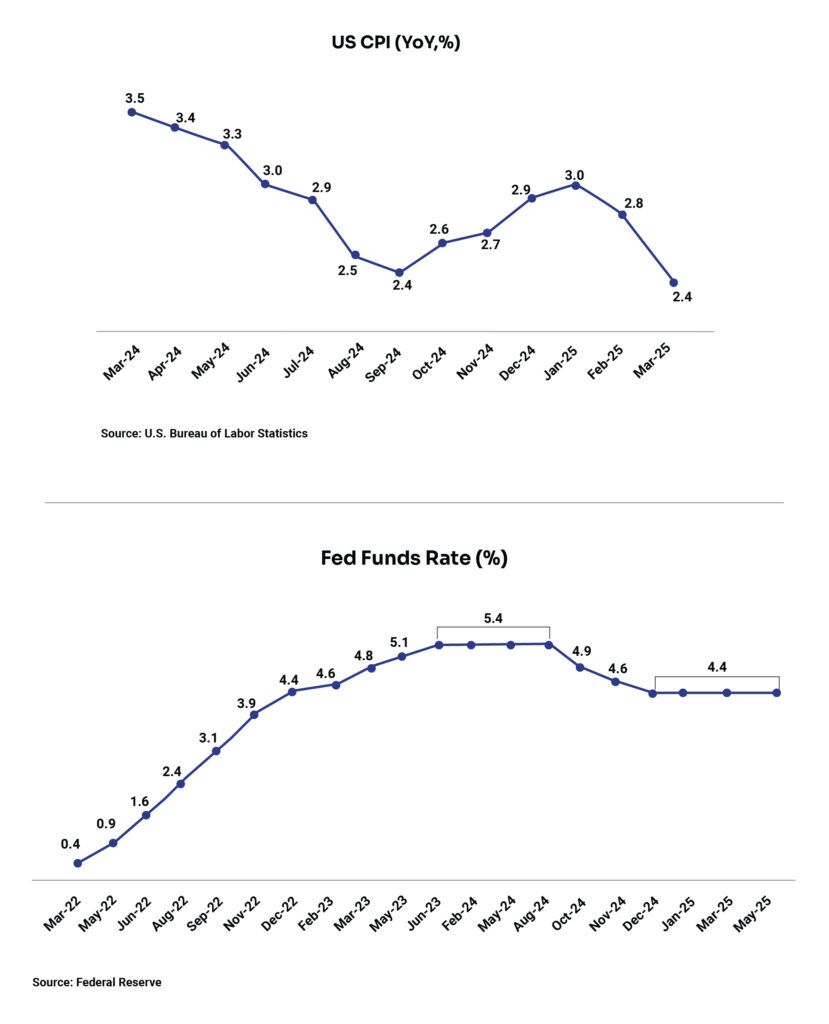

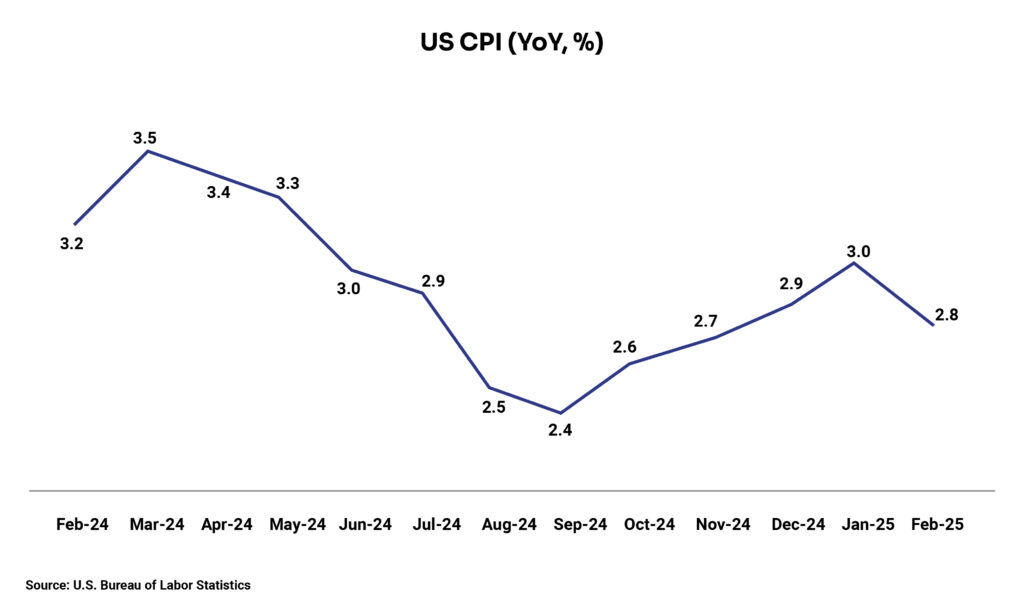

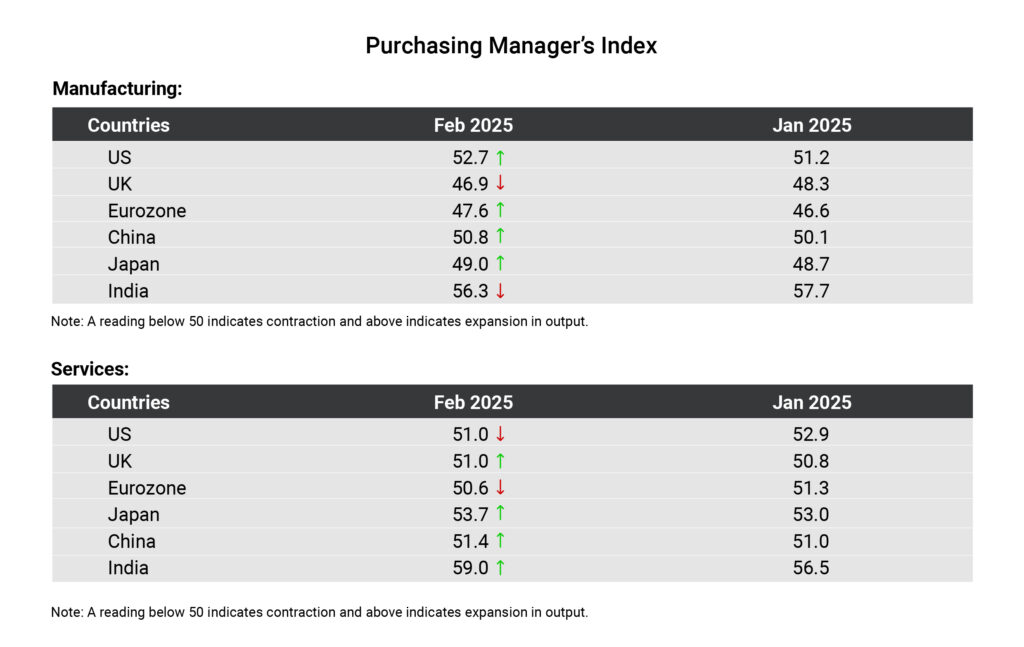

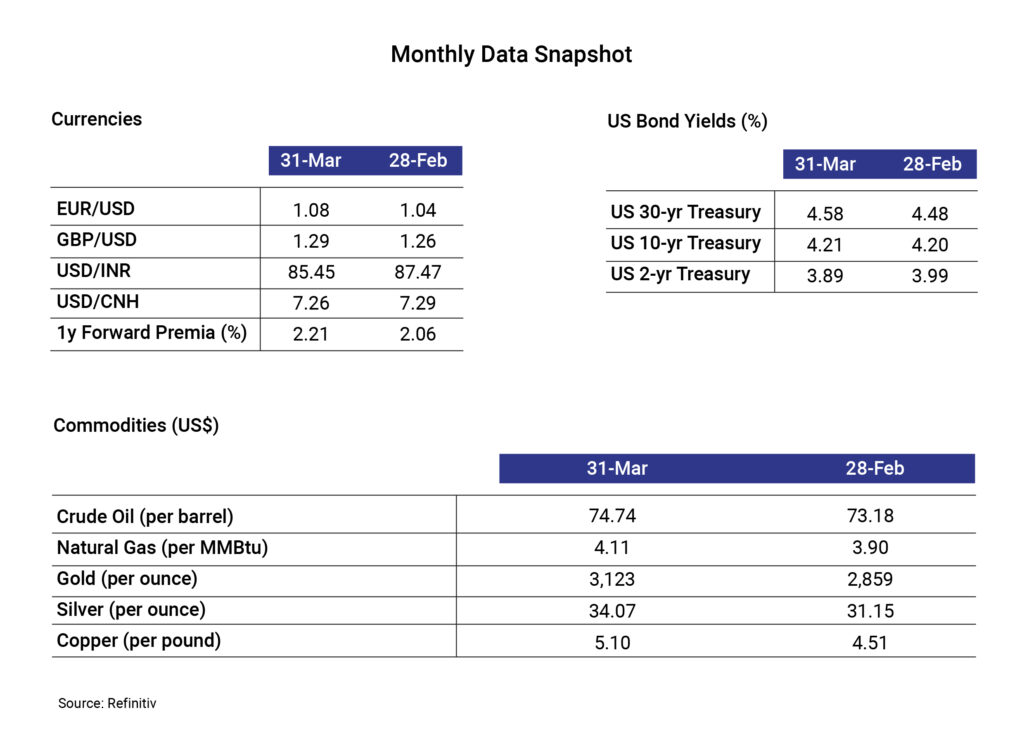

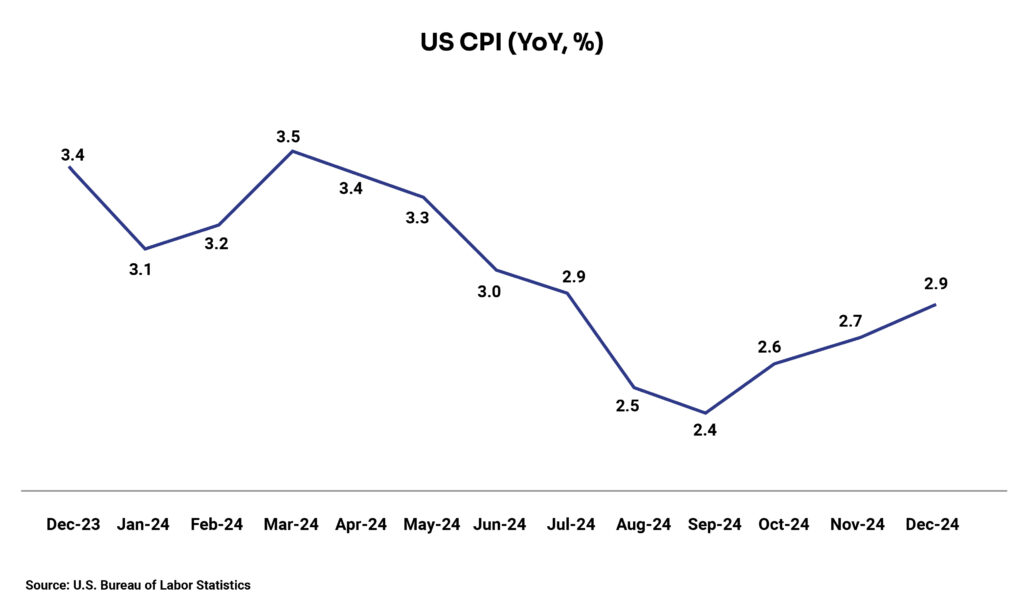

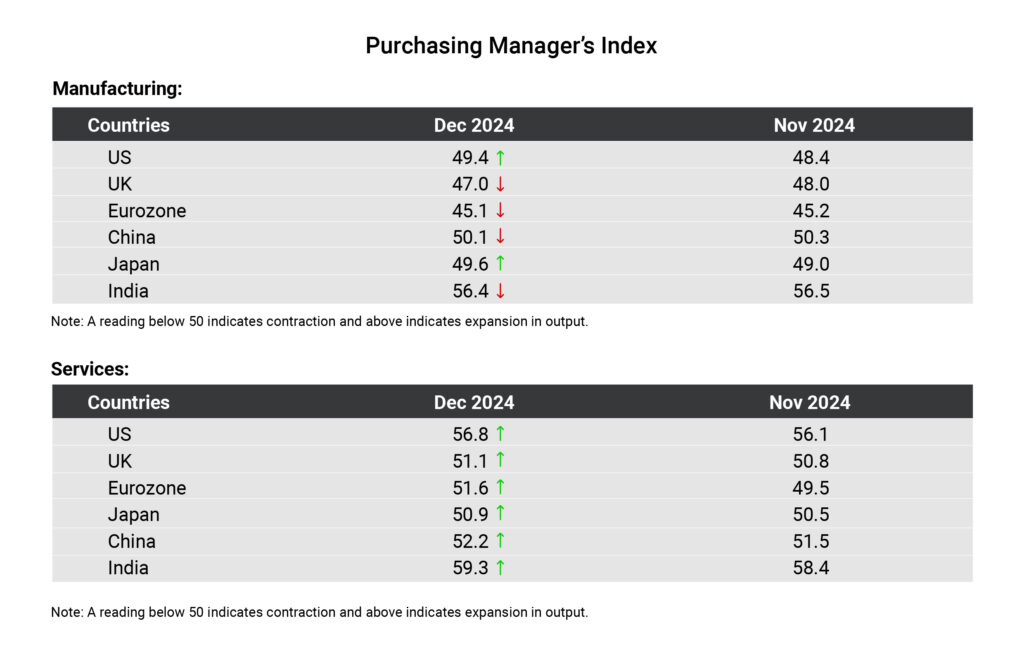

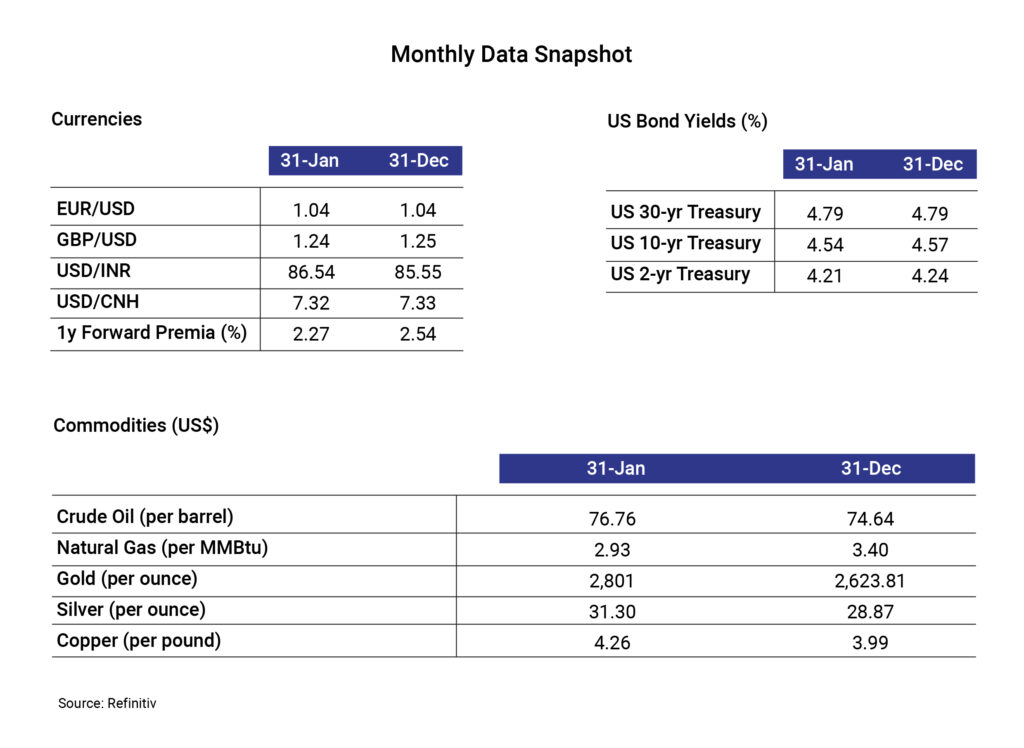

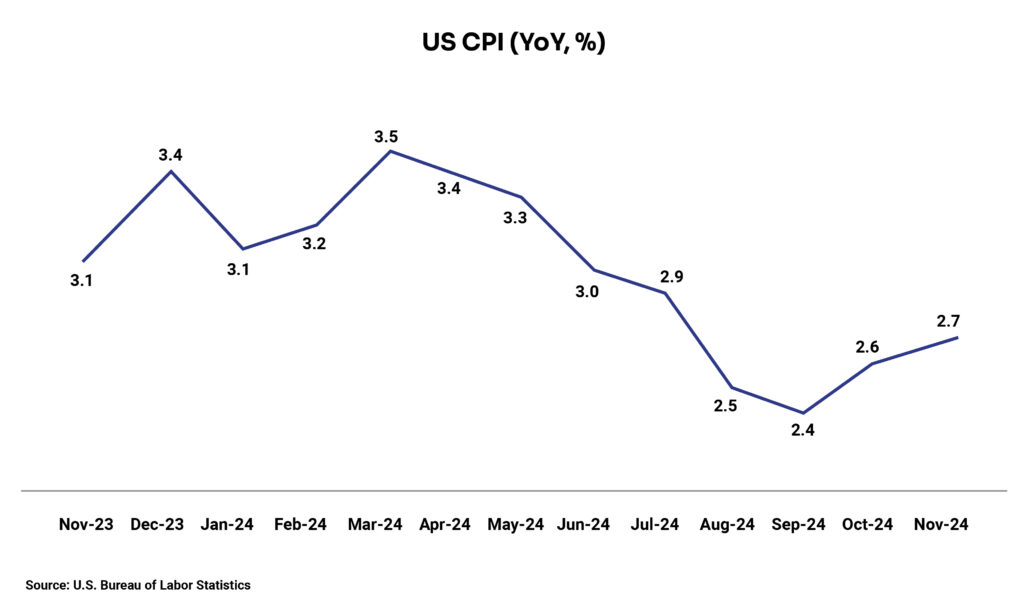

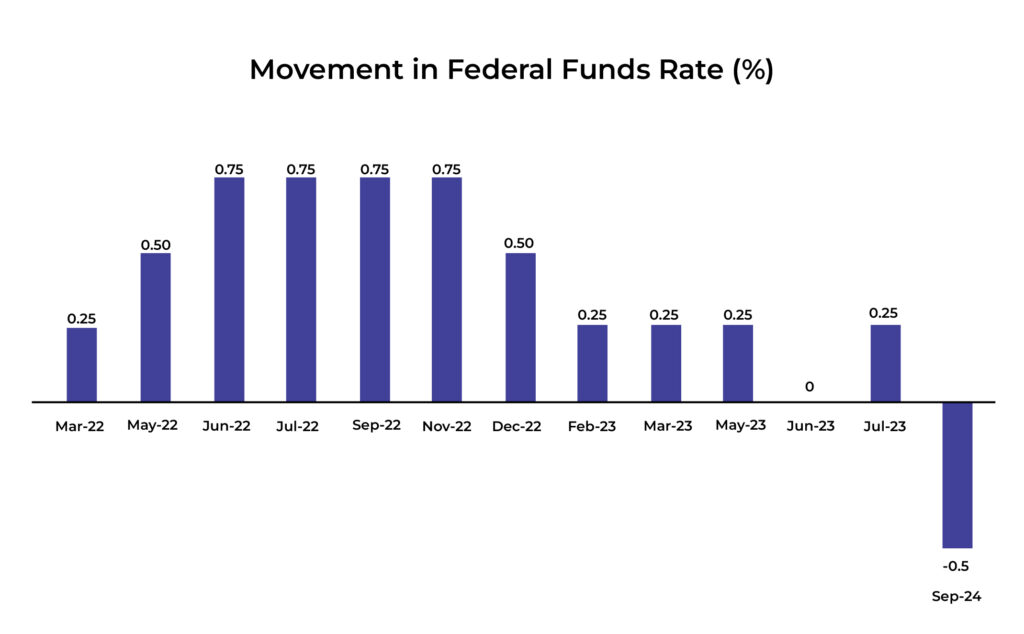

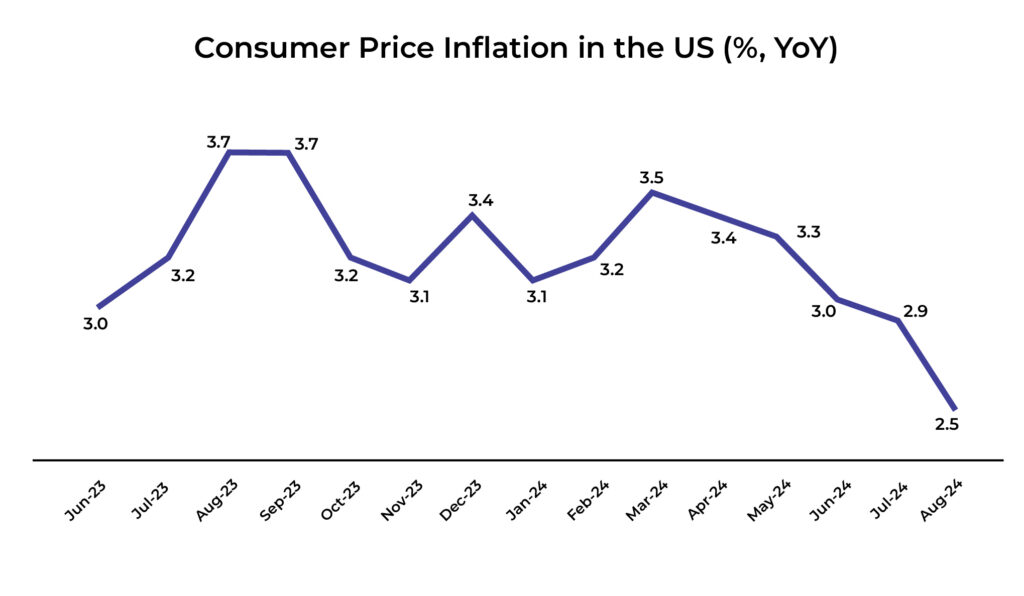

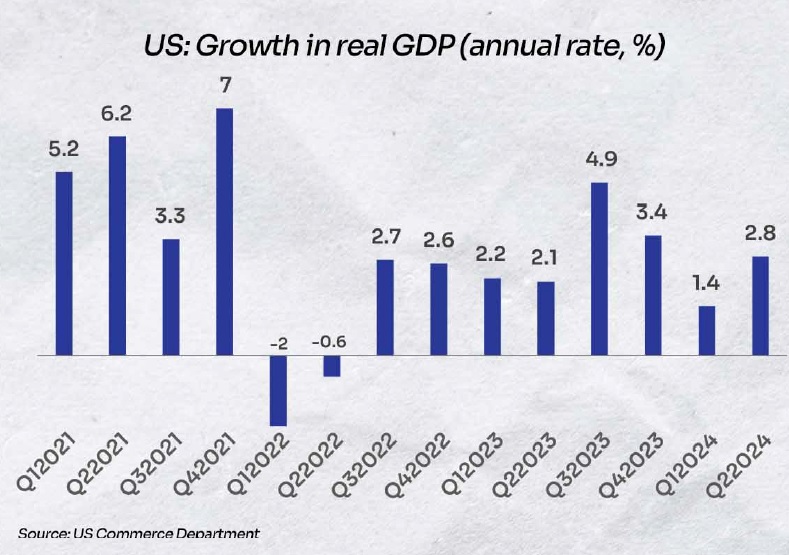

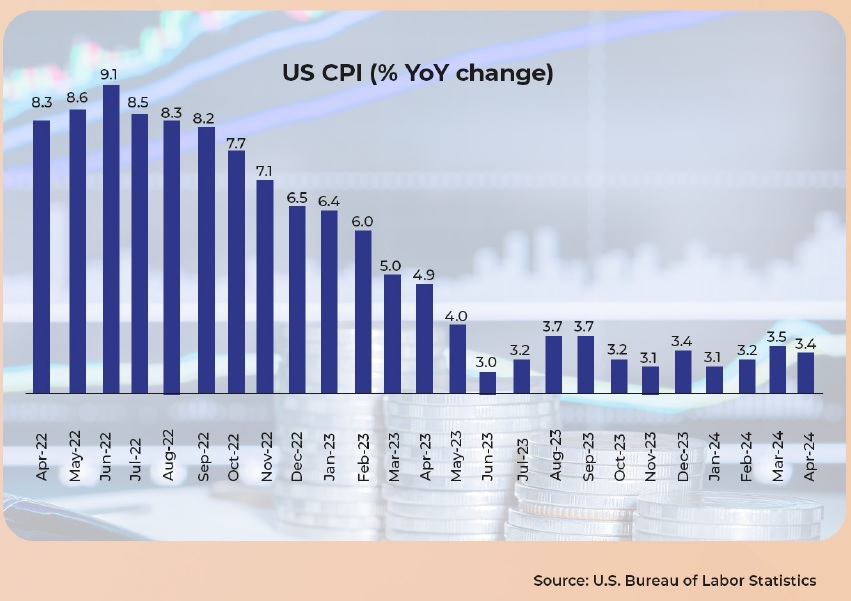

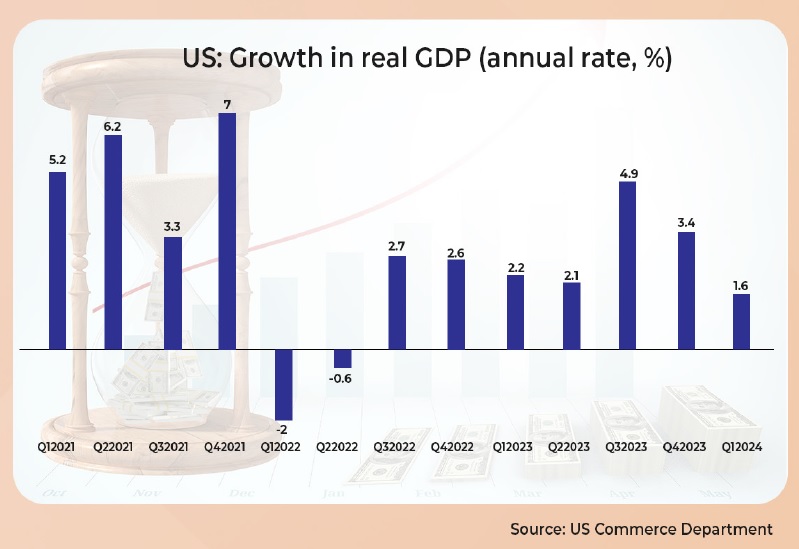

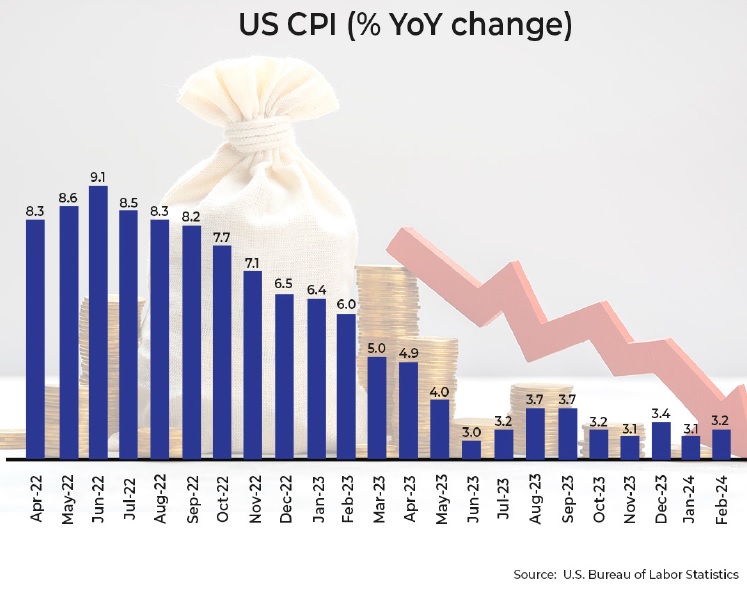

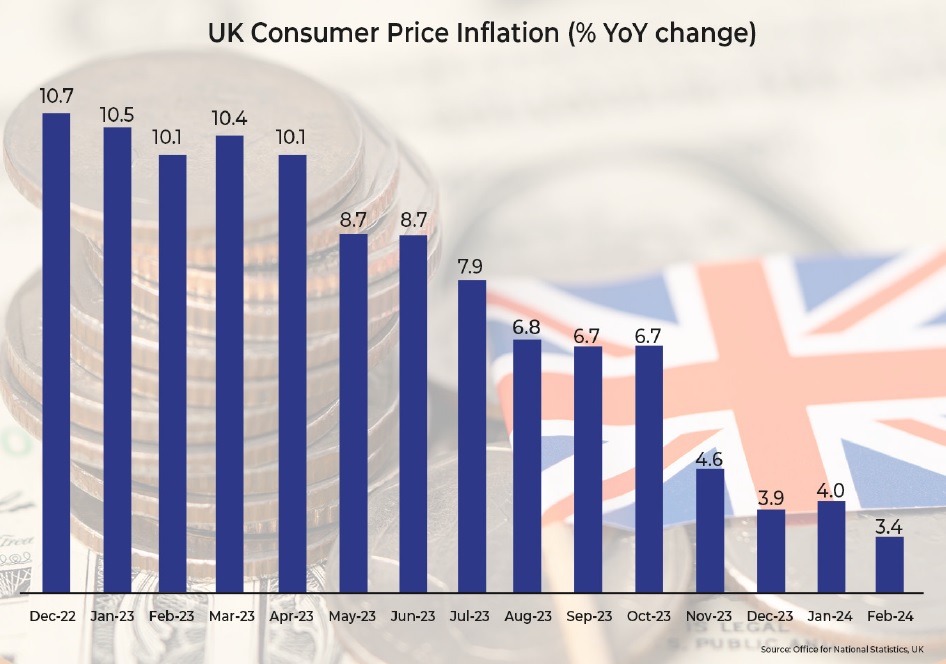

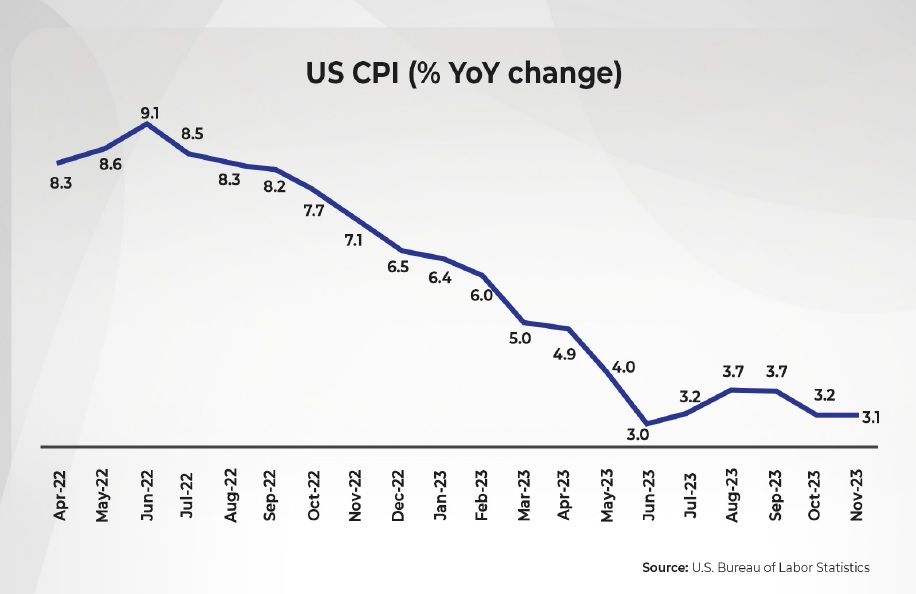

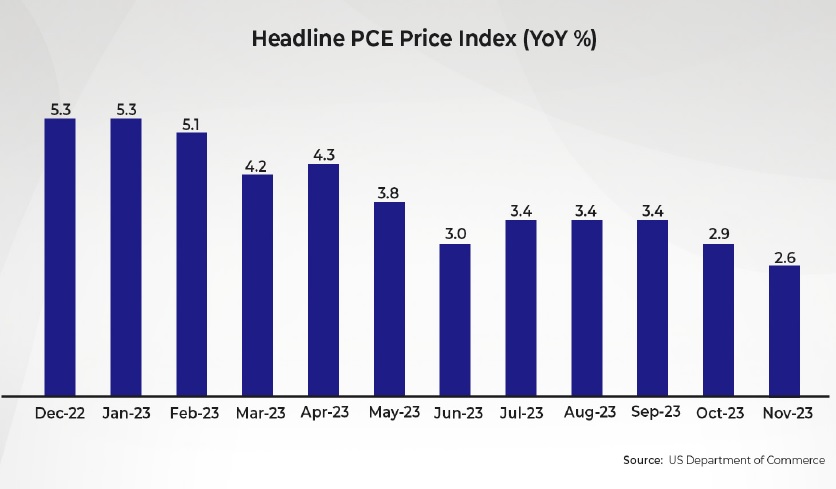

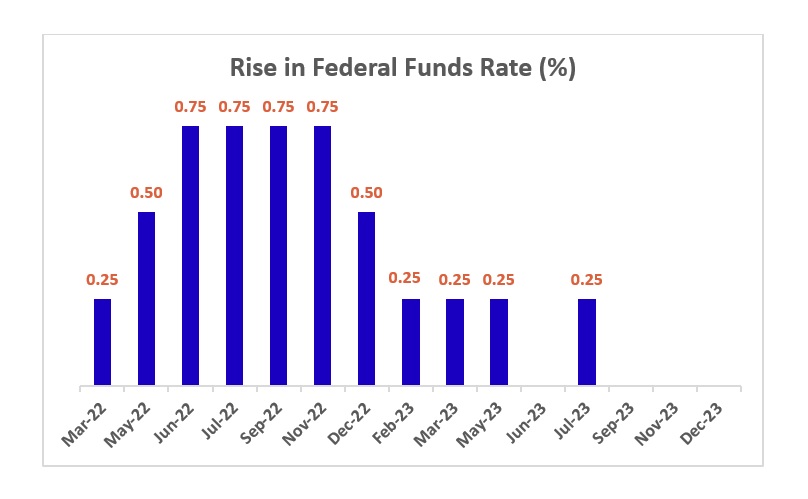

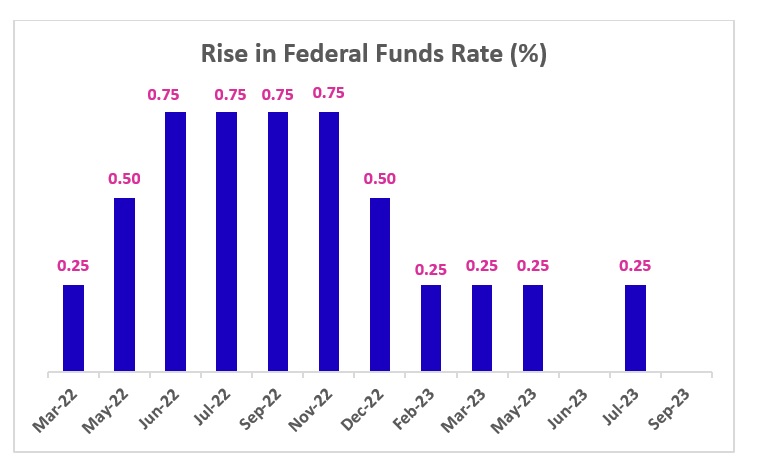

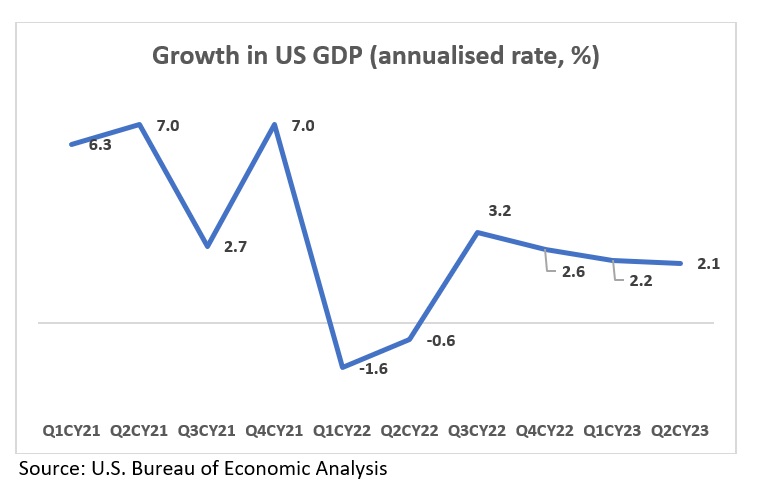

Meanwhile, the US Fed kept the rates on hold as widely expected, with the Summary of Economic Projections leaning towards stagflation, with Personal Consumption Expenditures inflation revised higher. The Fed kept the dot plot to two cuts this year but reduced the subsequent two years by one cut each. The US consumer price inflation came in softer than expected for the month, and so far, the tariff impact on inflation has been muted for the last two months. The US Fed chair indicated that some impact would be inevitable over time. President Trump continued to push for lower rates, and rhetoric around tariffs continued, with early signs of deals with a few nations. Elsewhere, the European Central Bank cut rates by 25 basis points (bps) along expected lines, taking the cumulative cut since mid-2024 to 200 bps, the Swiss National Bank reduced the rates to zero, while the Bank of England kept them on hold.

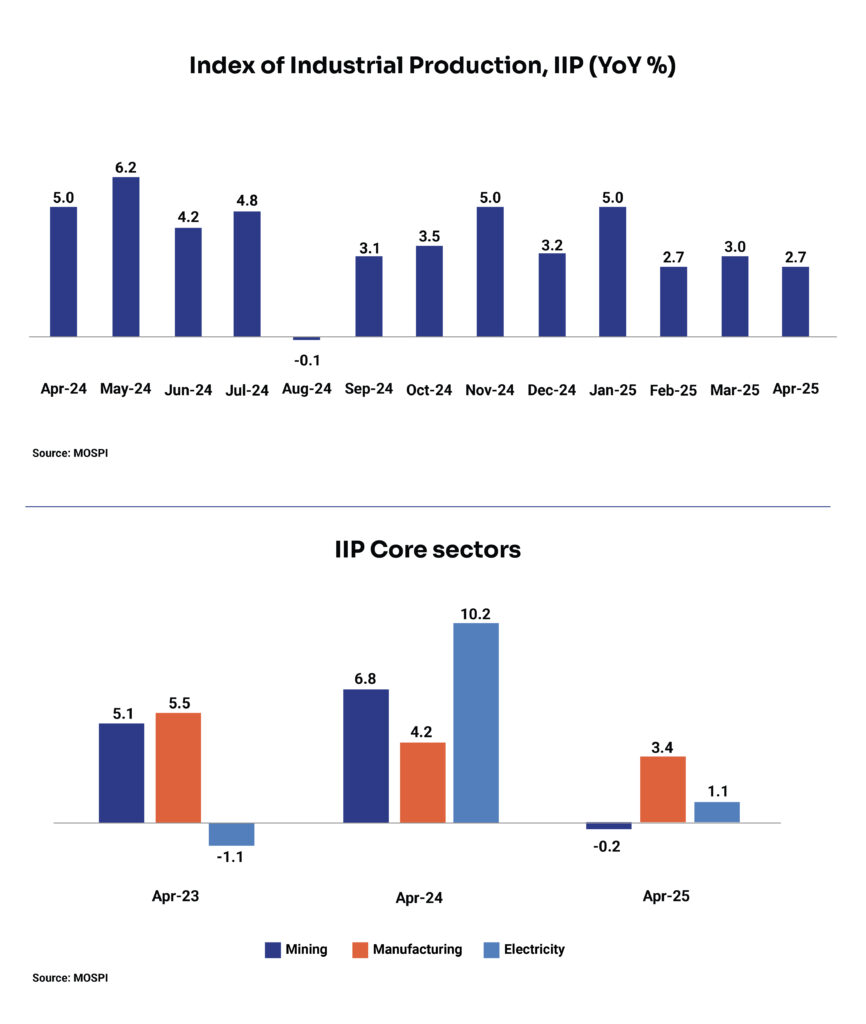

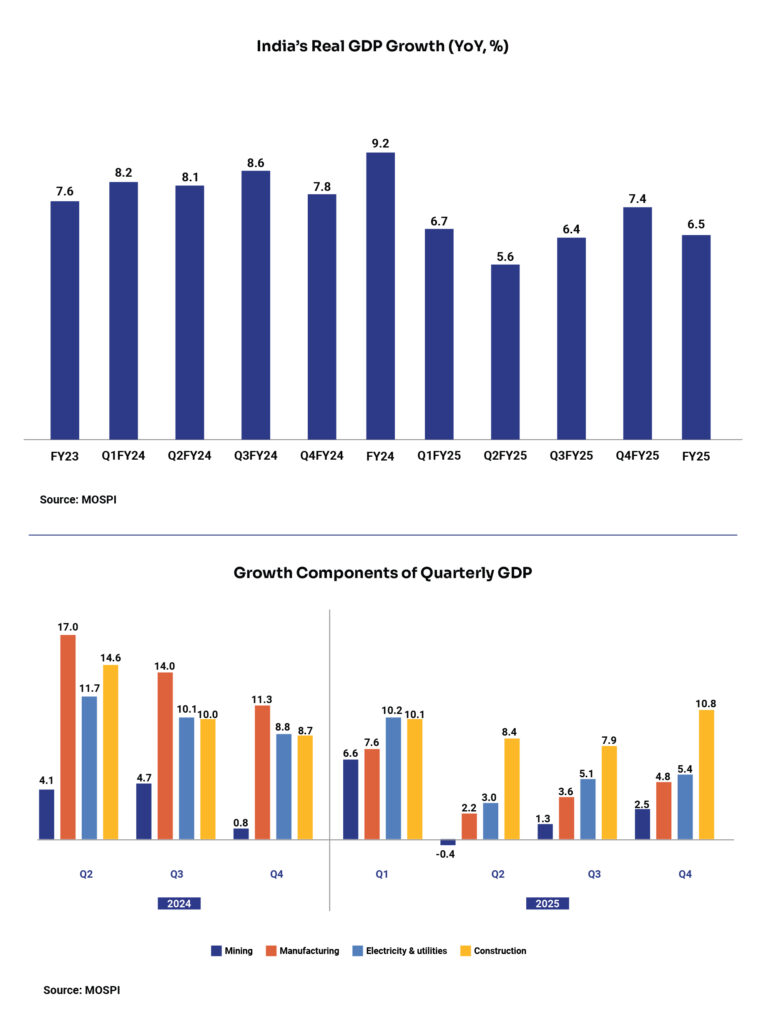

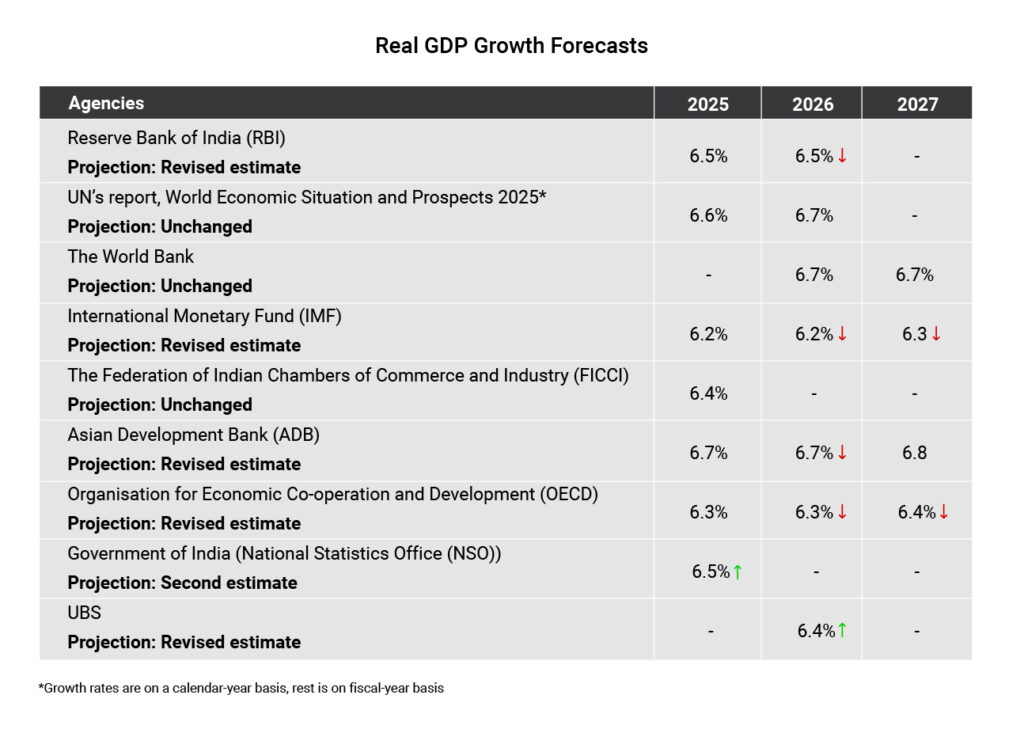

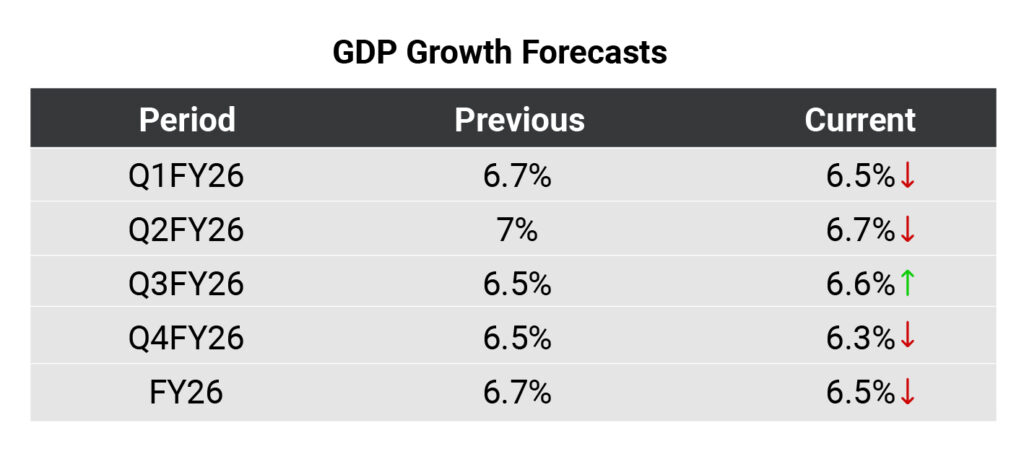

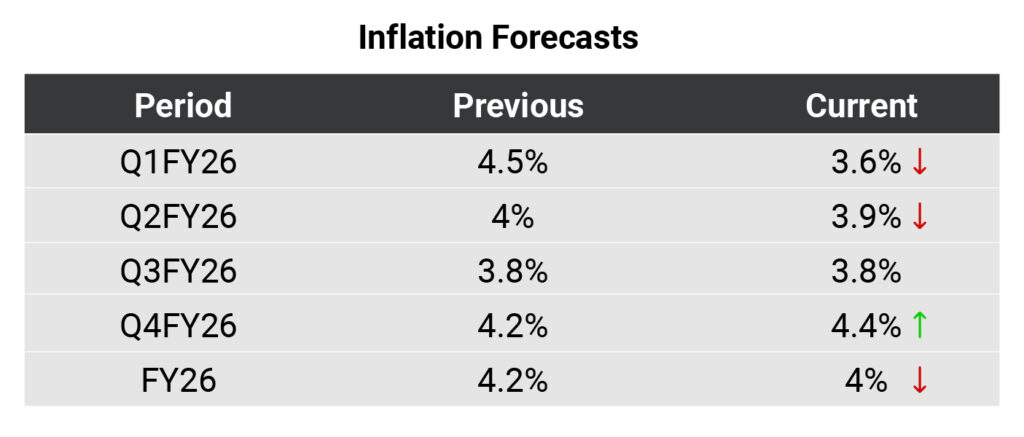

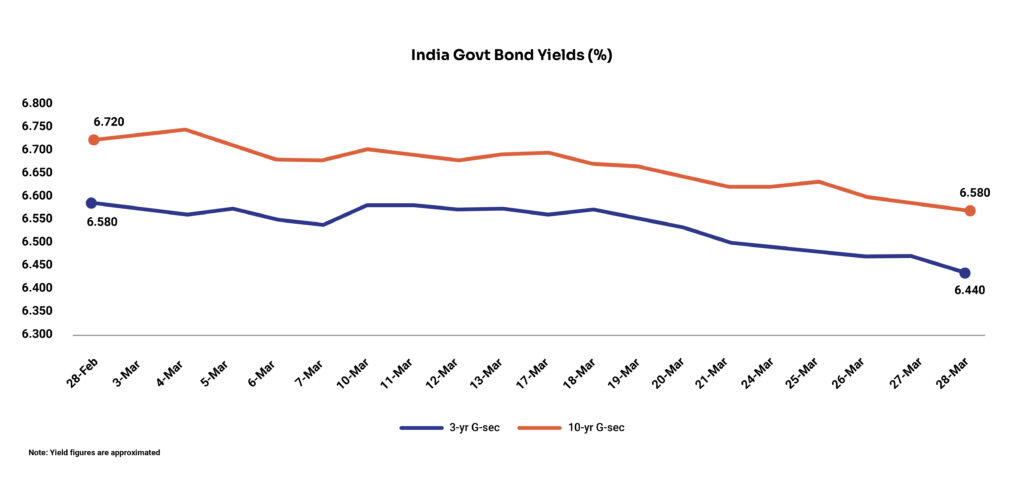

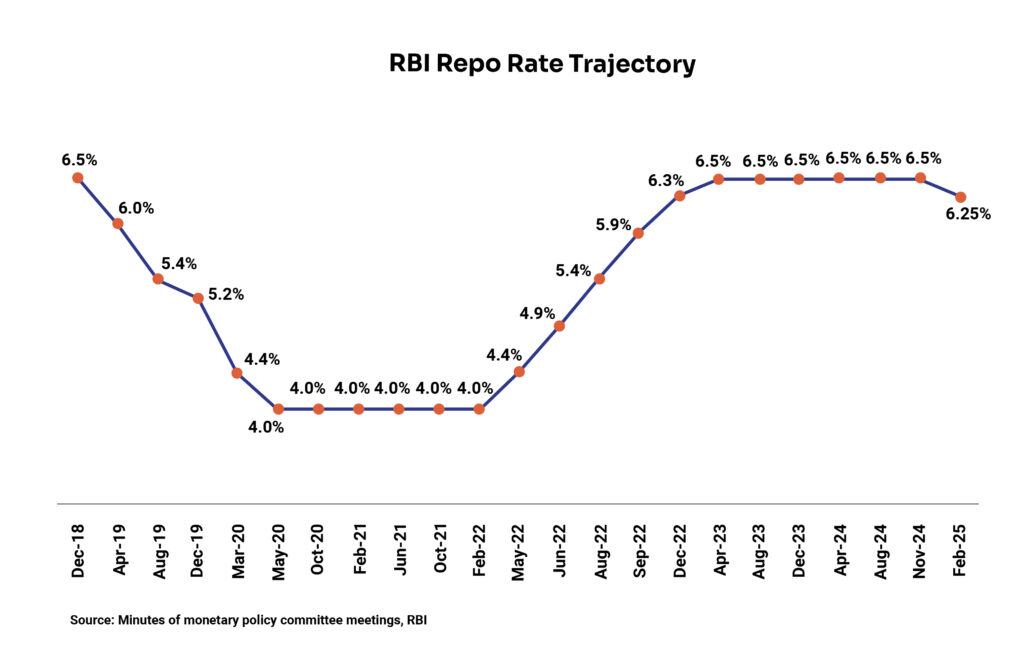

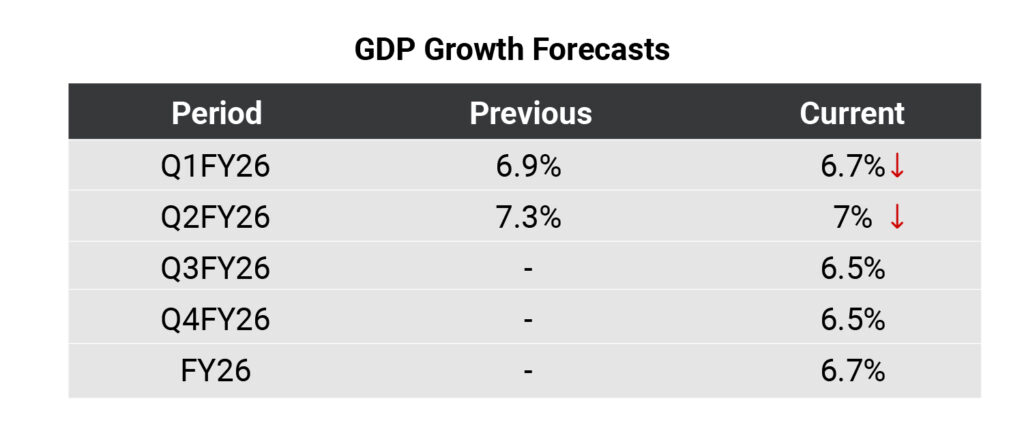

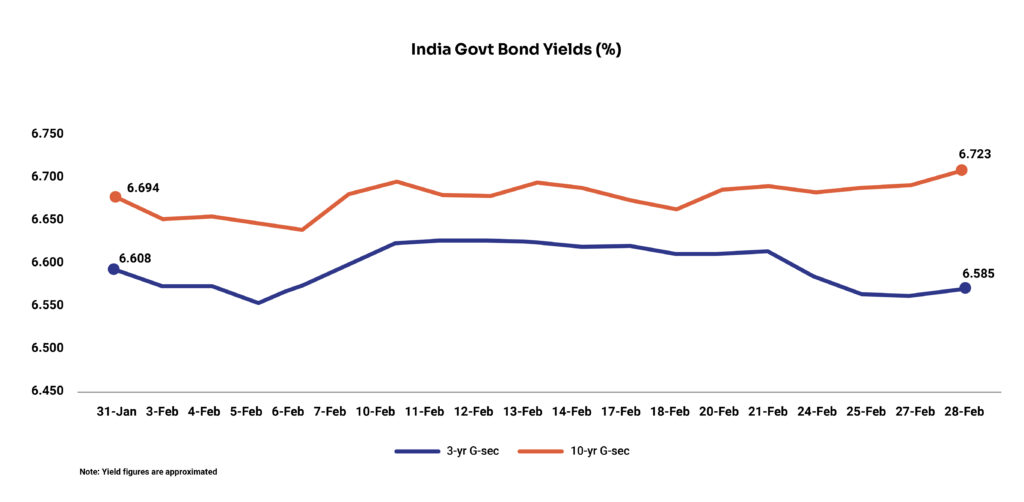

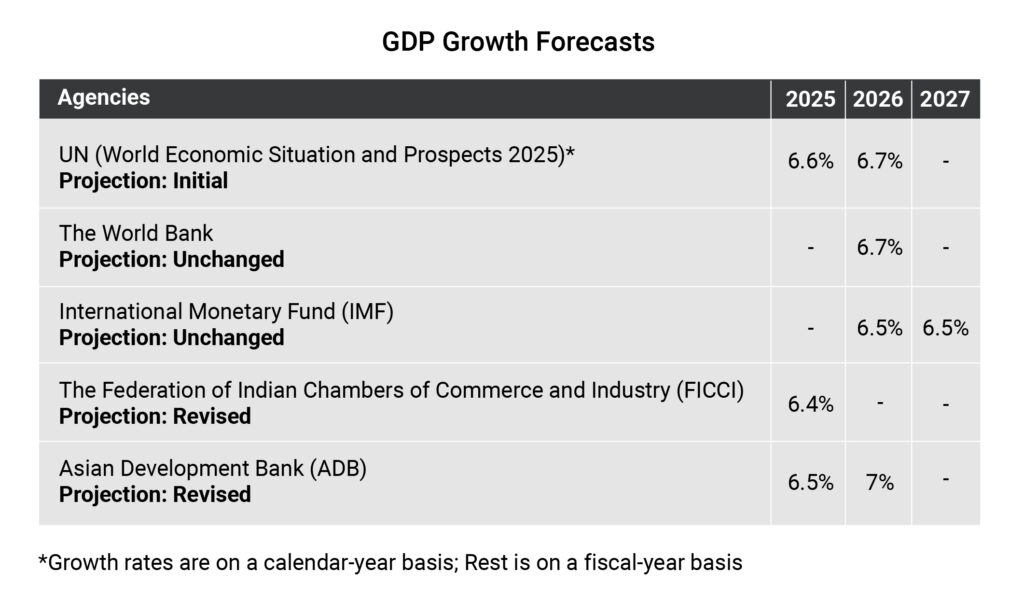

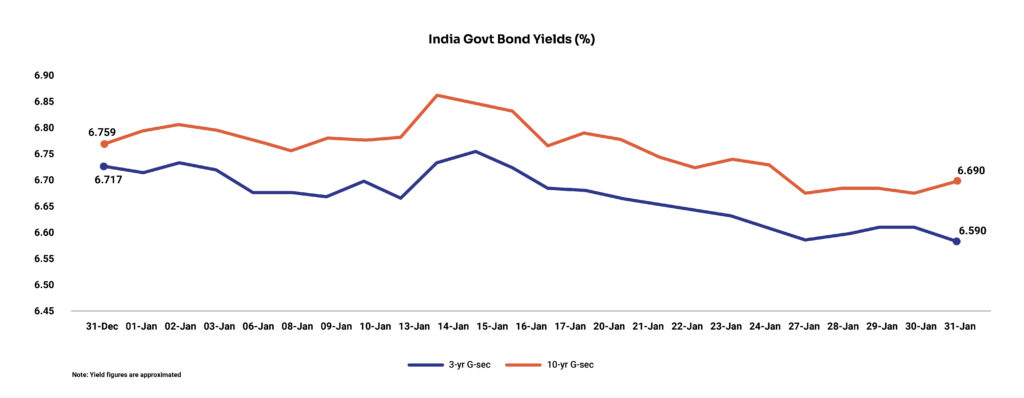

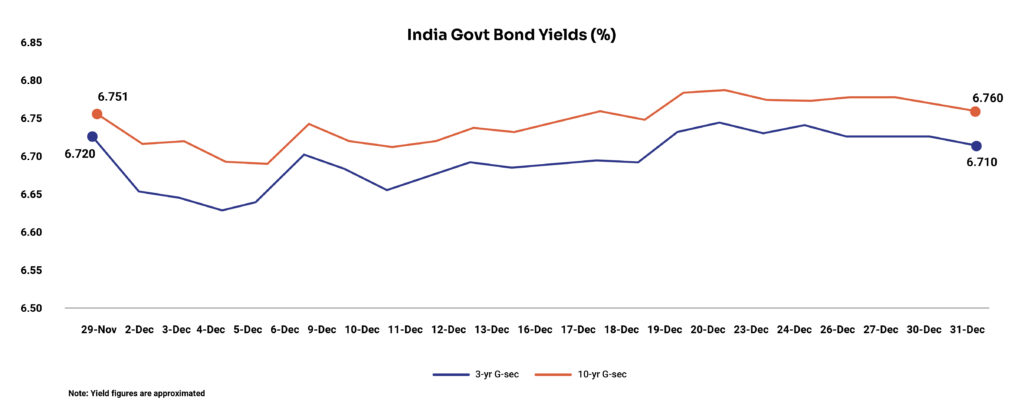

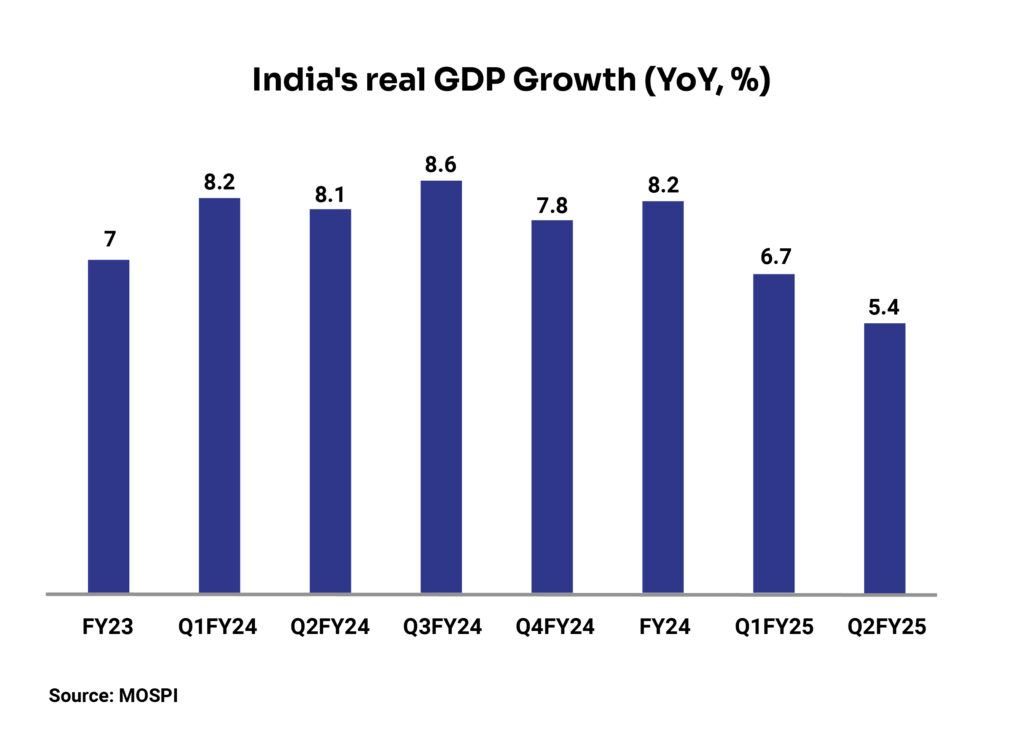

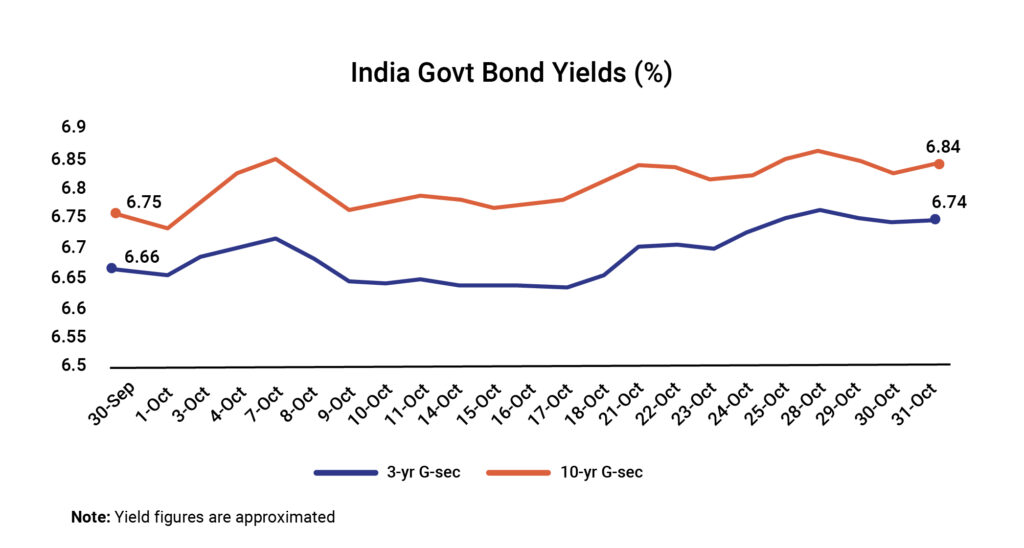

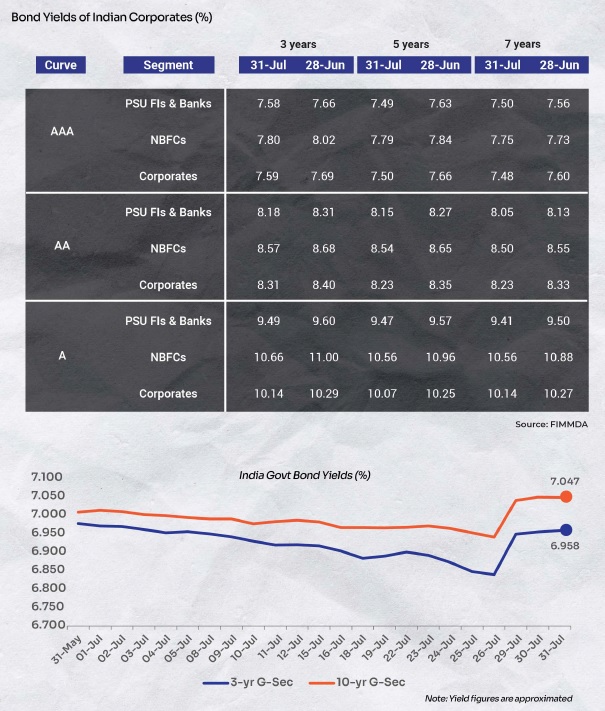

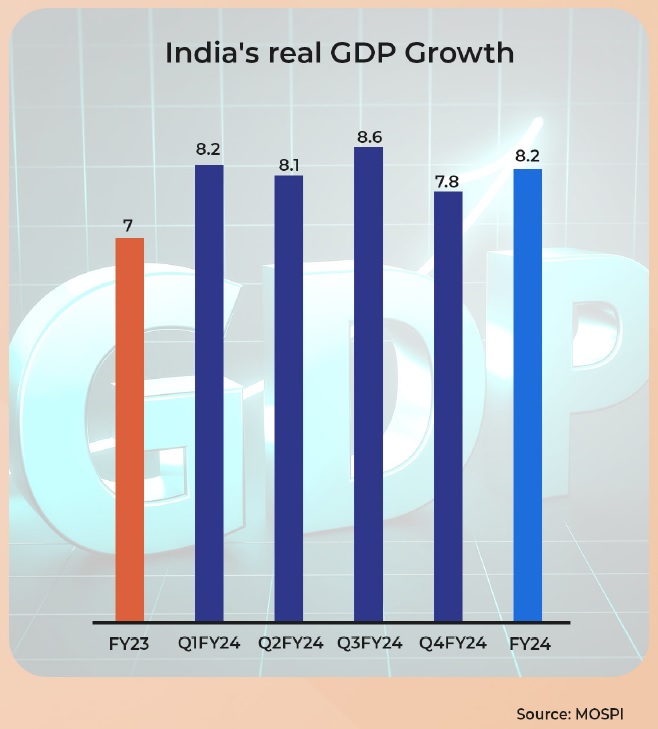

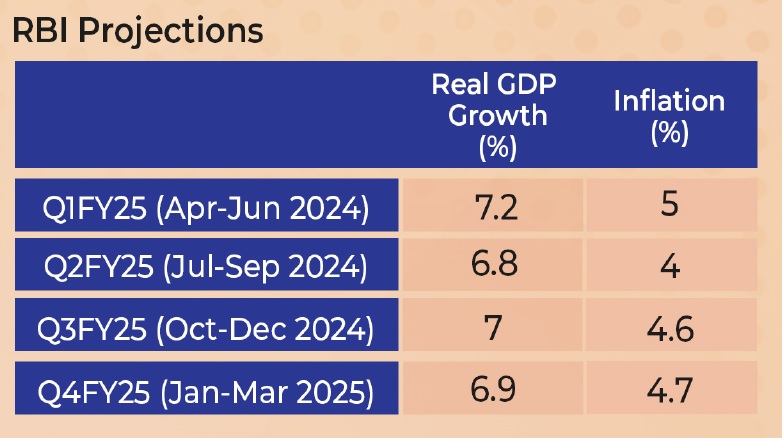

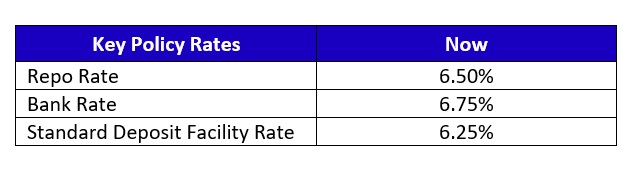

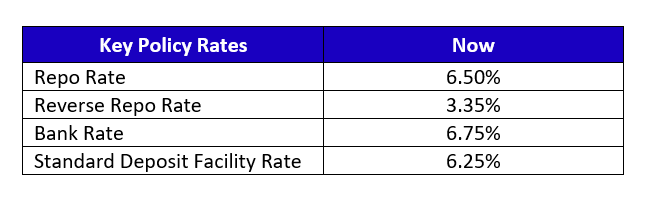

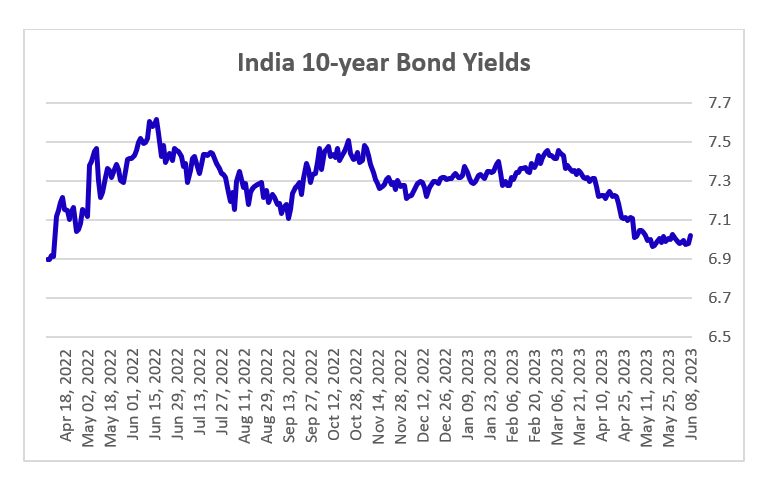

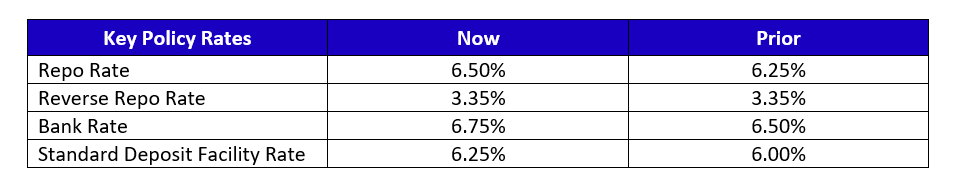

On the domestic front, a surprise policy outcome by the RBI, where they front-loaded cuts by reducing repo rates by 50 bps with a 5-1 majority, against the broader consensus estimate of 25 bps. The Monetary Policy Committee (MPC) also cut the cash reserve ratio (CRR) by 100 bps to 3%, infusing about INR 2.5 lakh crore liquidity in a staggered manner, thereby focusing on monetary transmission to boost growth. Finally, the MPC changed the stance to neutral, indicating that the future decision will be data-driven and the bar to reduce further will be high. Barring any significant data surprises, we believe the MPC stays on an extended pause from here. RBI kept the growth rate forecast unchanged at 6.5% while reducing the inflation forecast to 3.7% for FY26. Markets reacted with a steeper curve, with front-end rallying on the back of a larger-than-expected cut.

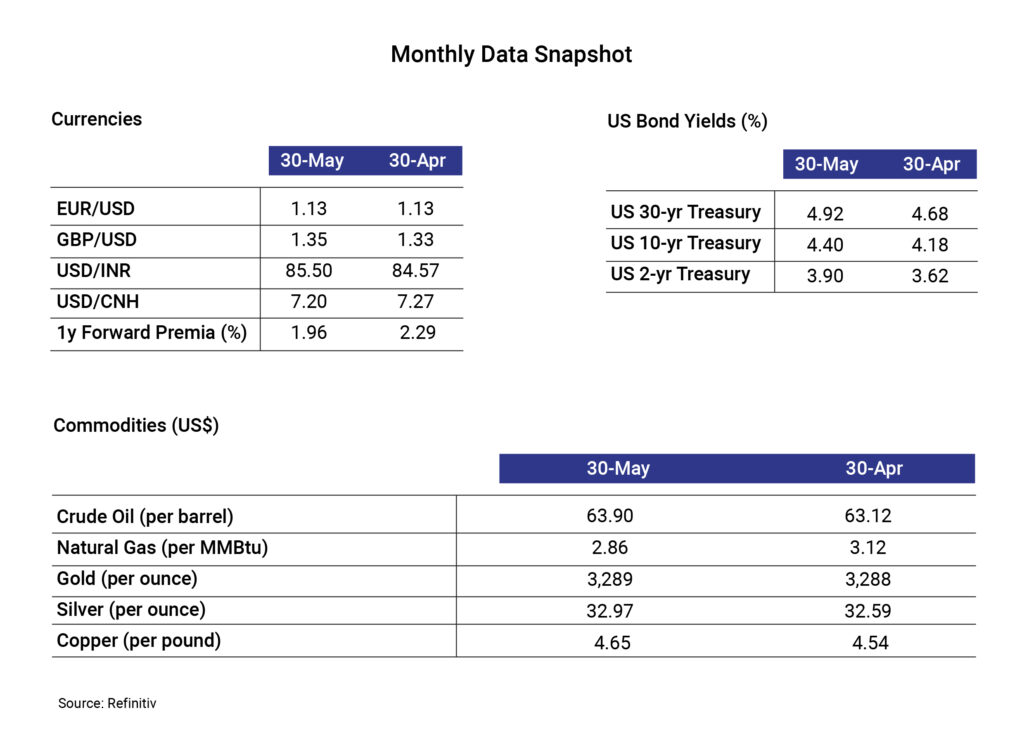

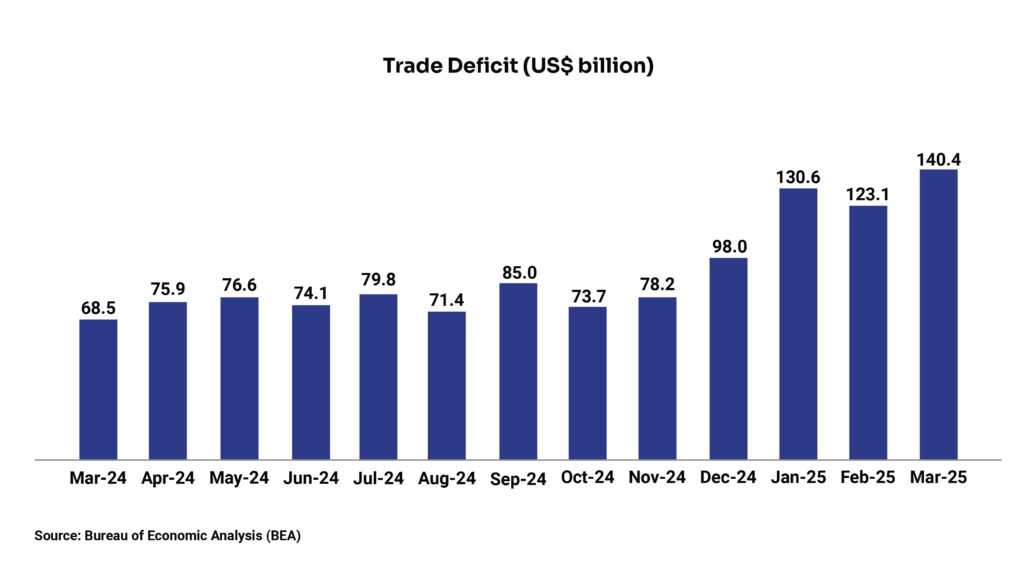

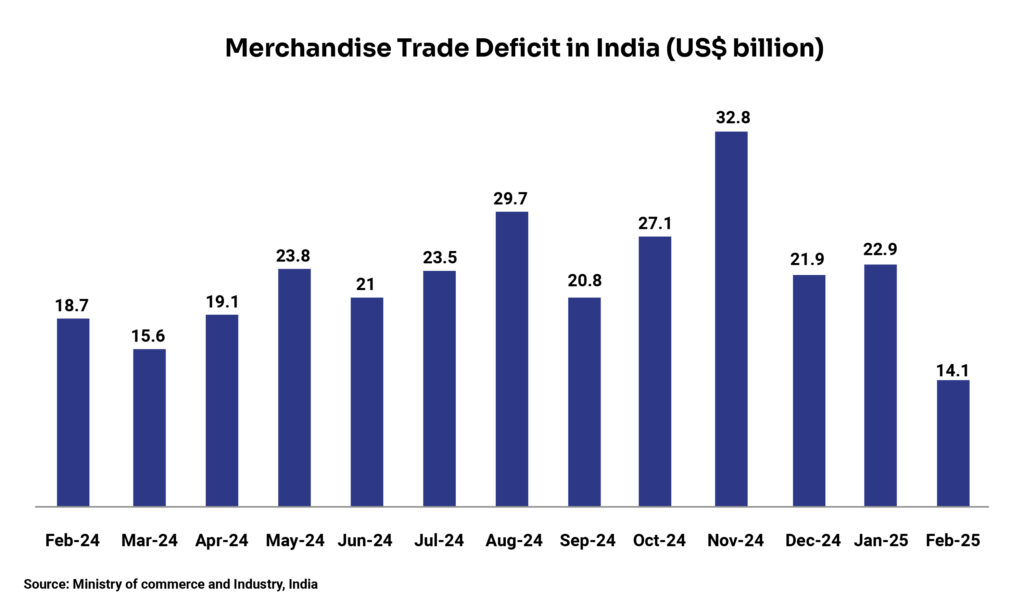

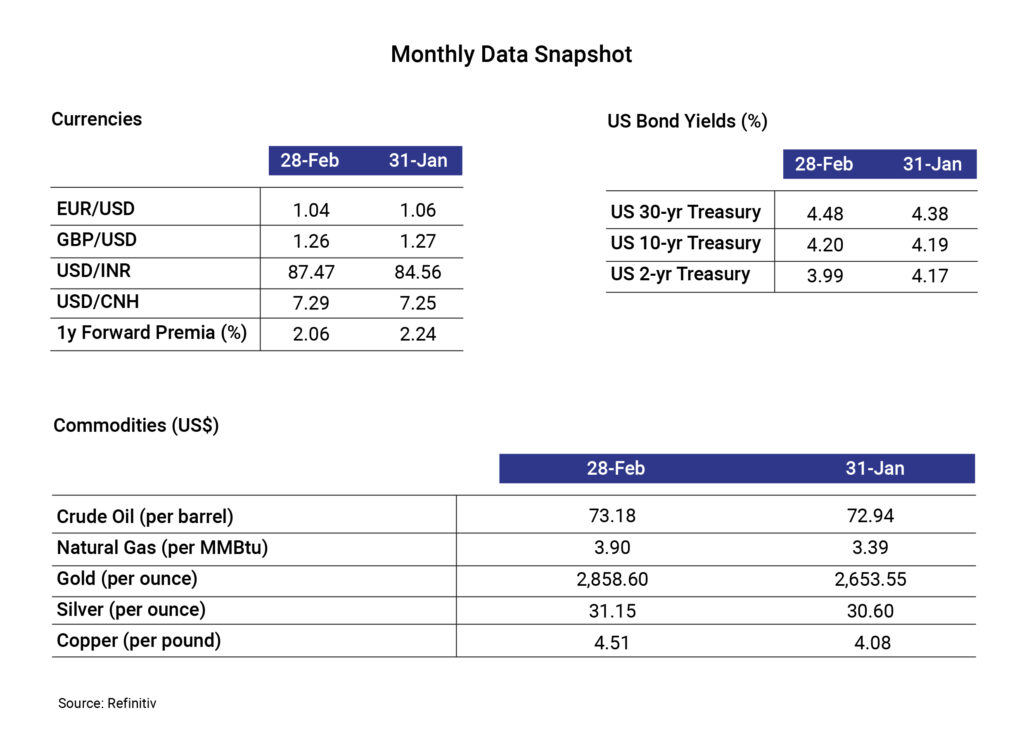

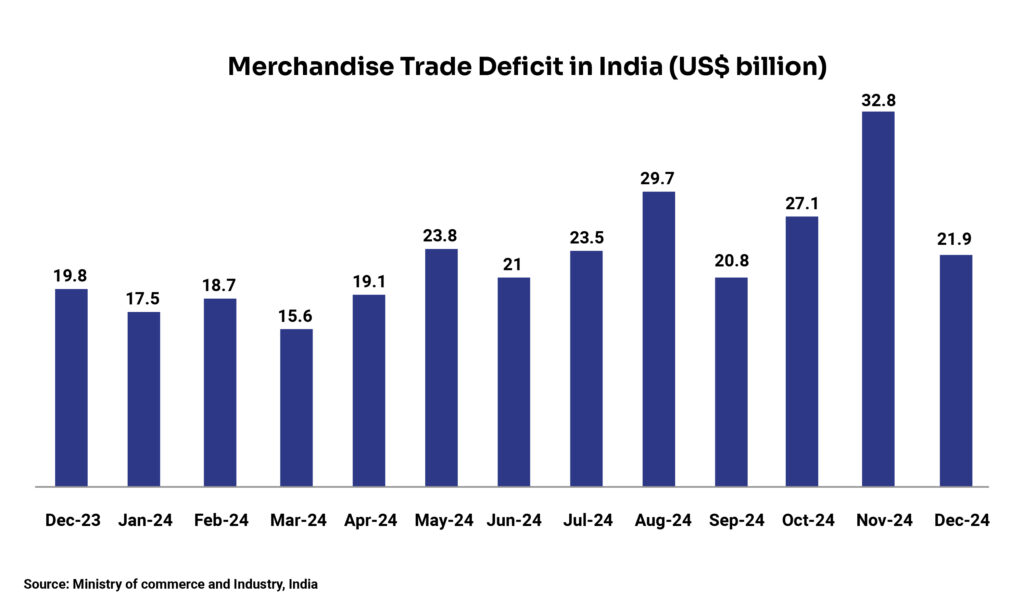

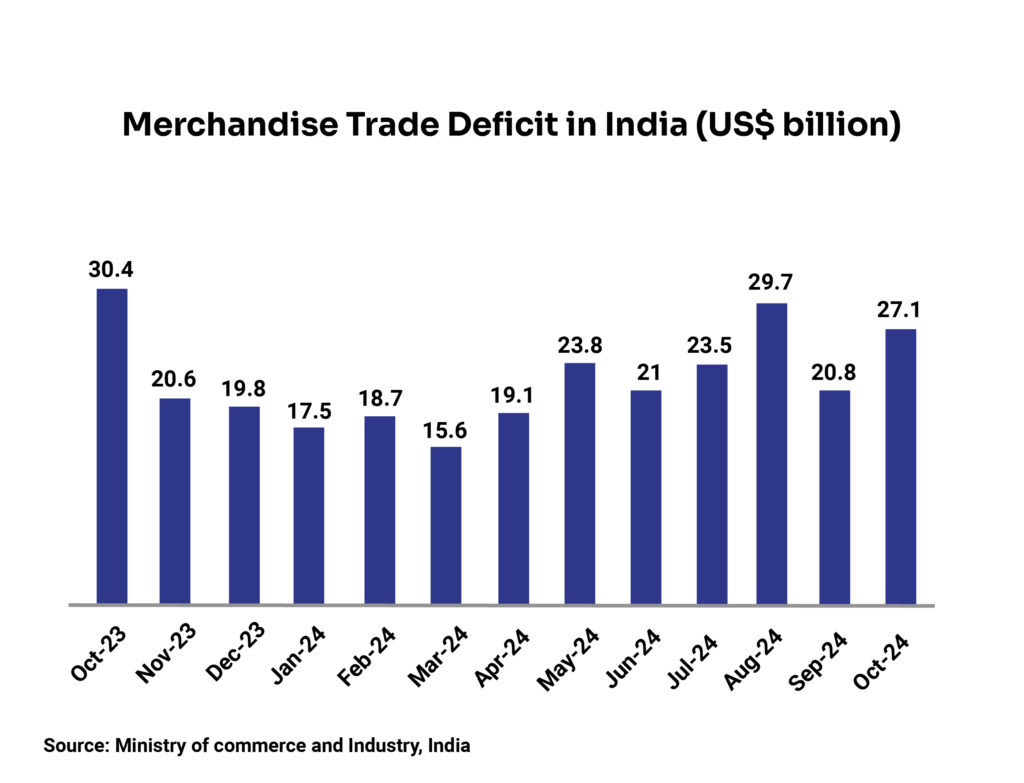

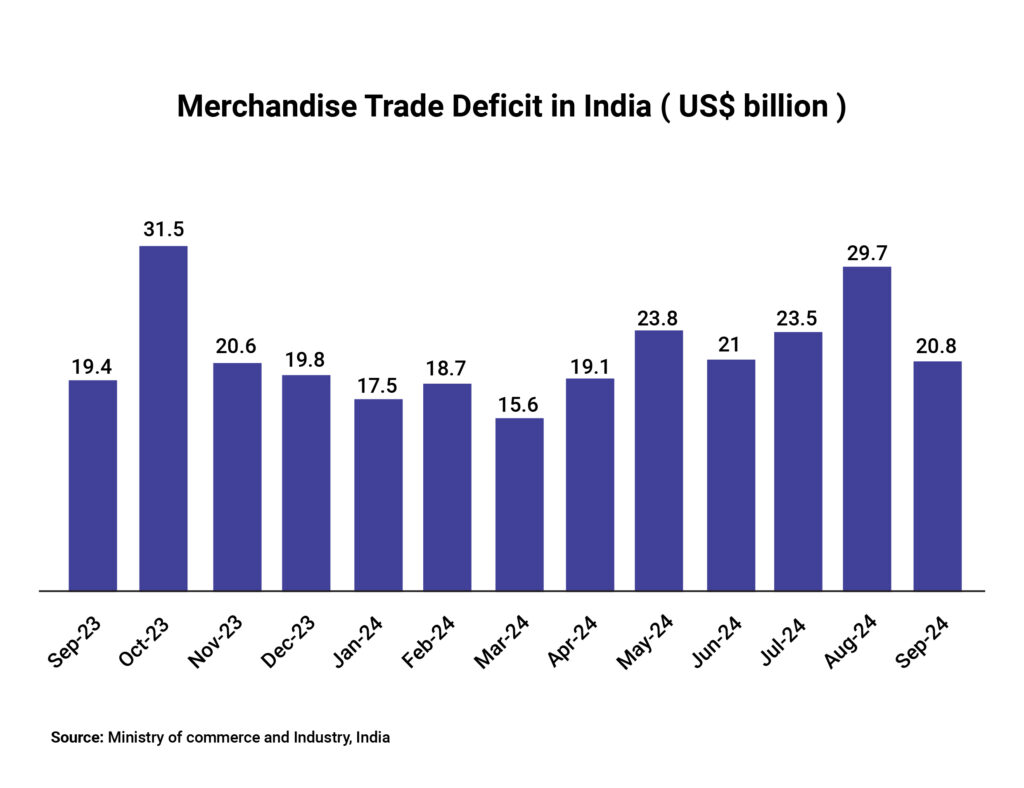

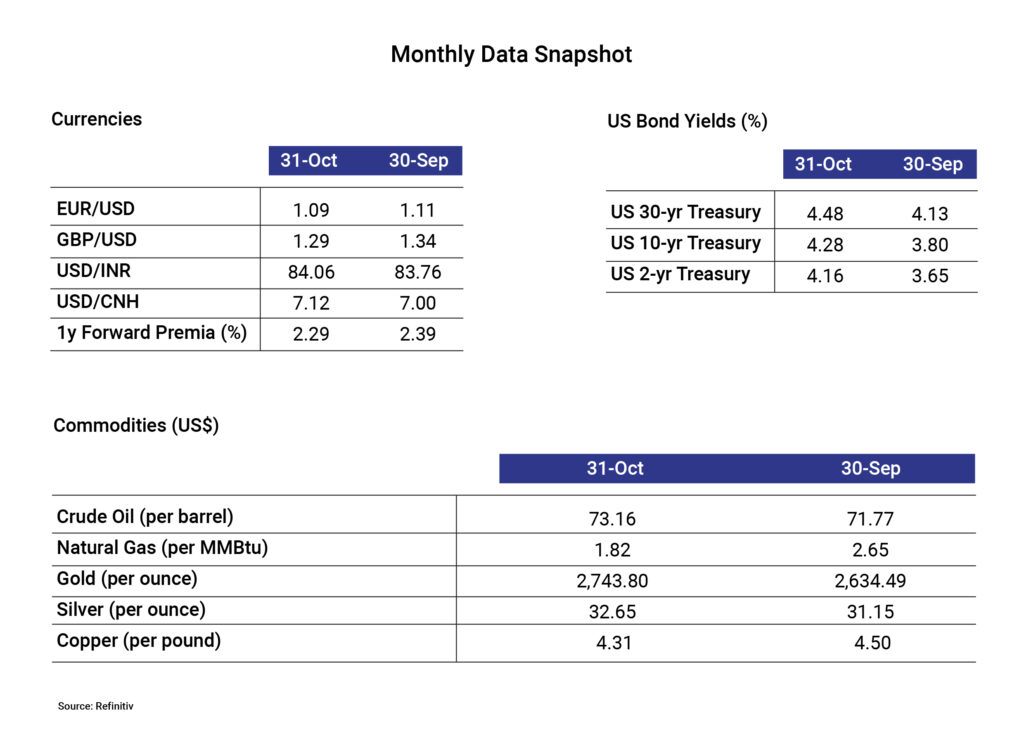

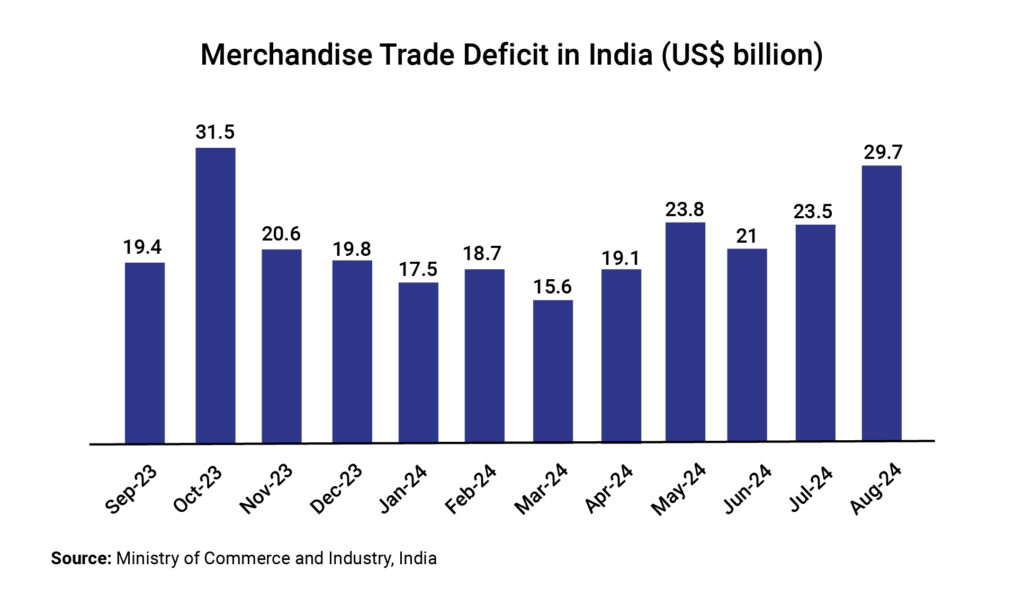

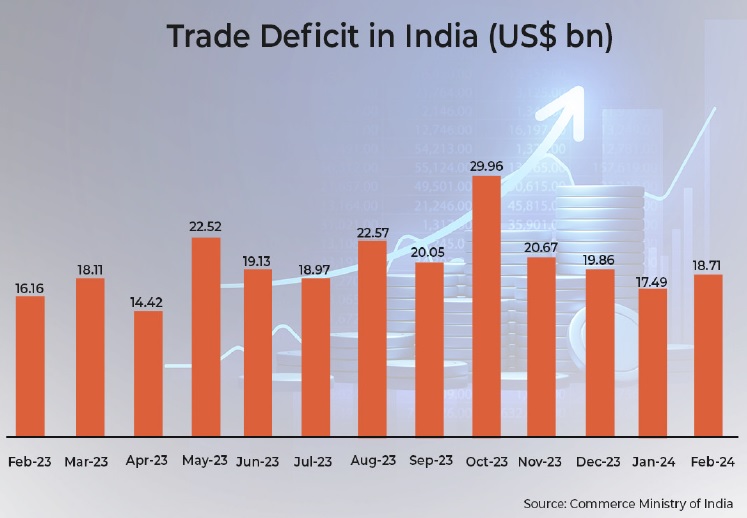

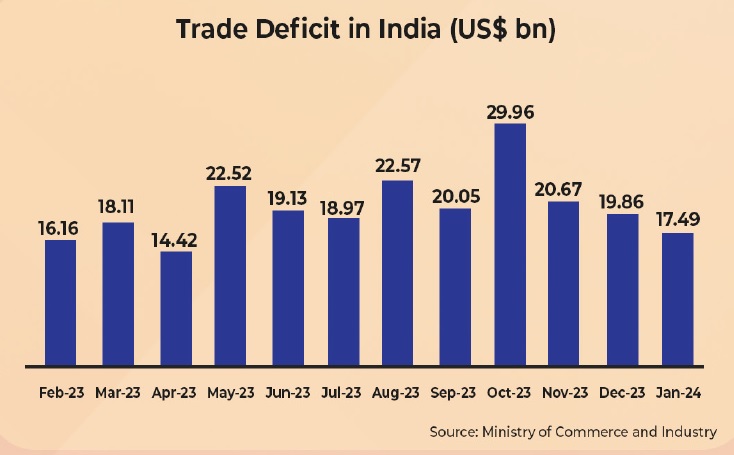

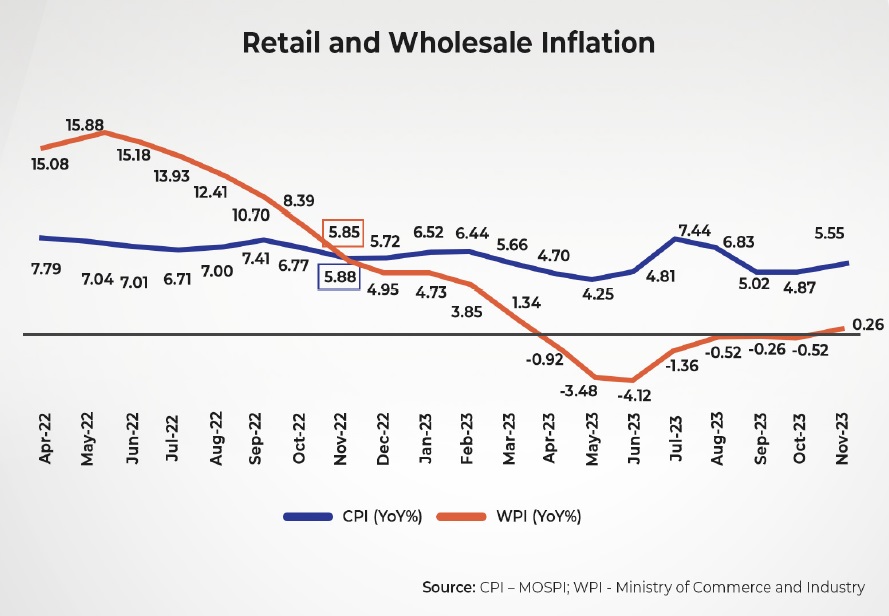

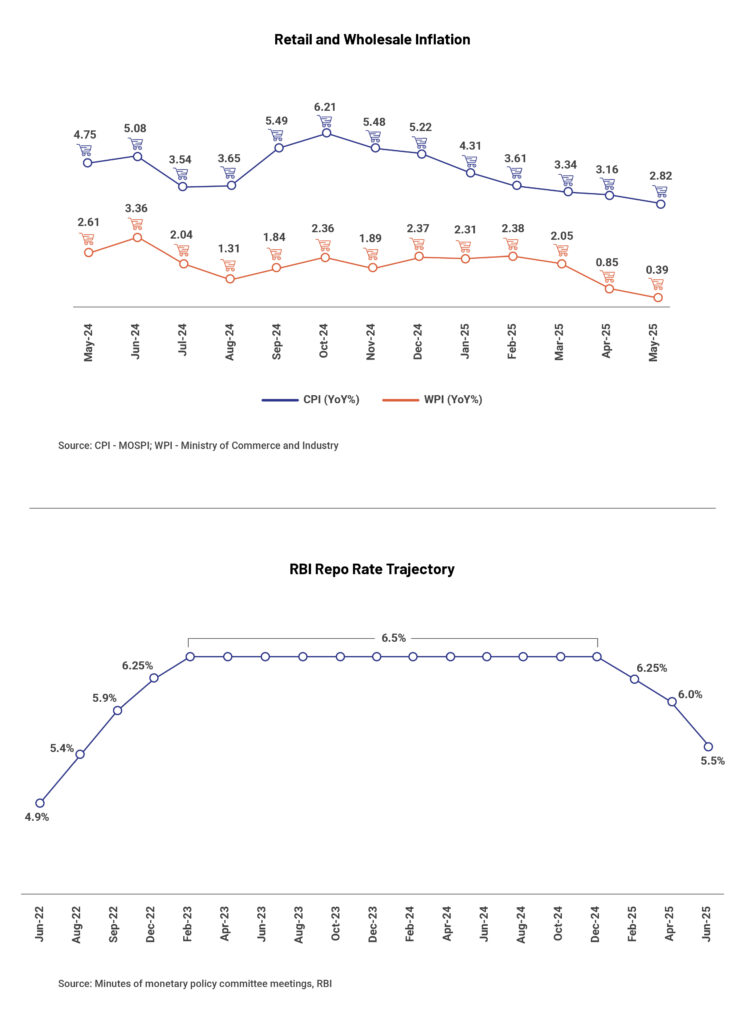

Among other data points, inflation surprisingly eased to a six-year low of 2.82% led mainly by food prices. The trade deficit also narrowed to US$21.9bn in May from US$26.4bn in April, led by a contraction in imports. On the currency front, INR took a beating on the back of geo-political tensions and subsequent oil spike during the month, but stabilized on de-escalation, with foreign exchange reserves restoring to around $700bn.

Retail inflation slips below 3% to a 6-year low; RBI announces the steepest repo rate cut in CY25

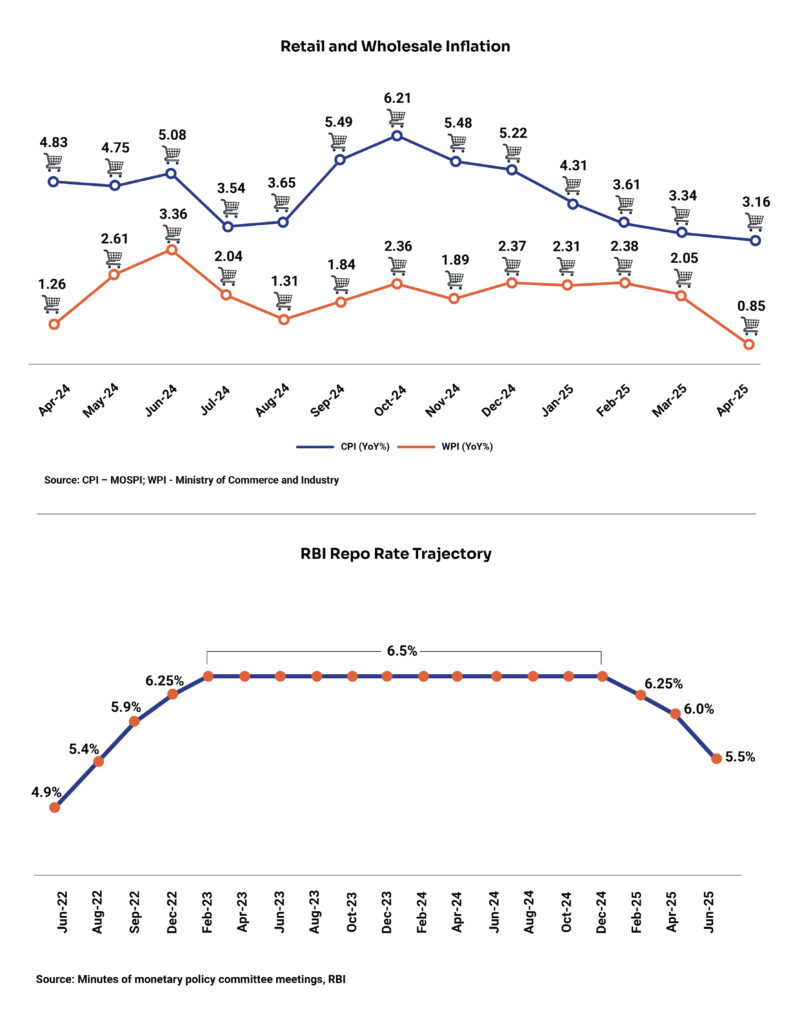

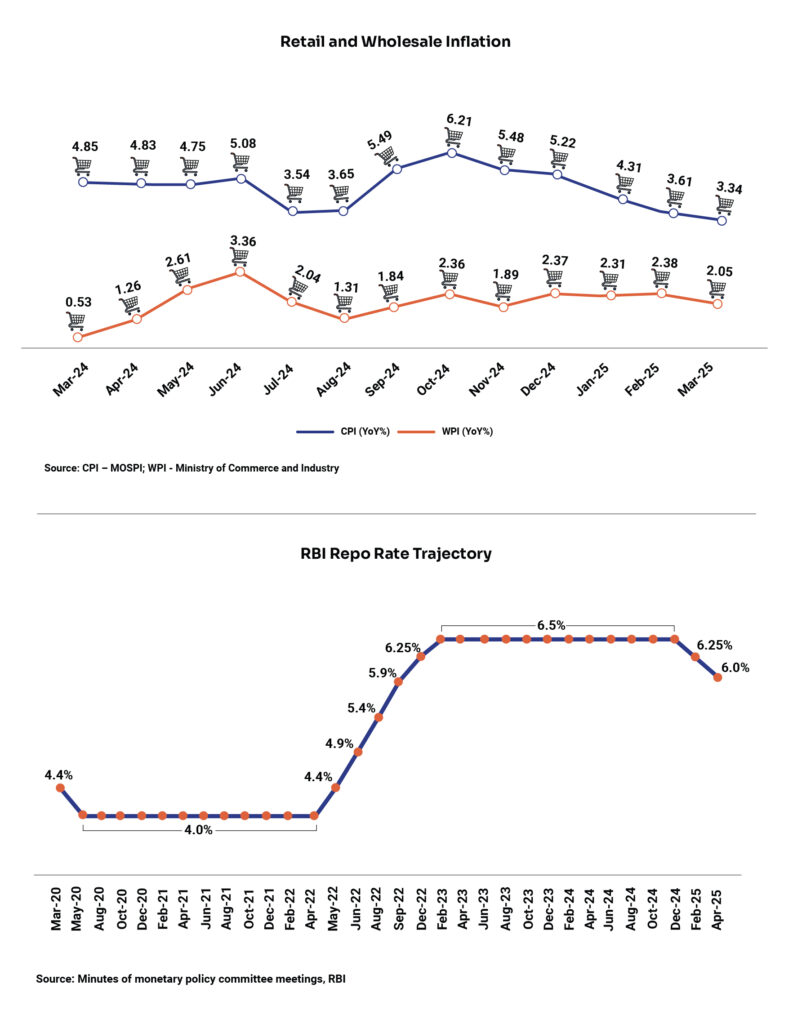

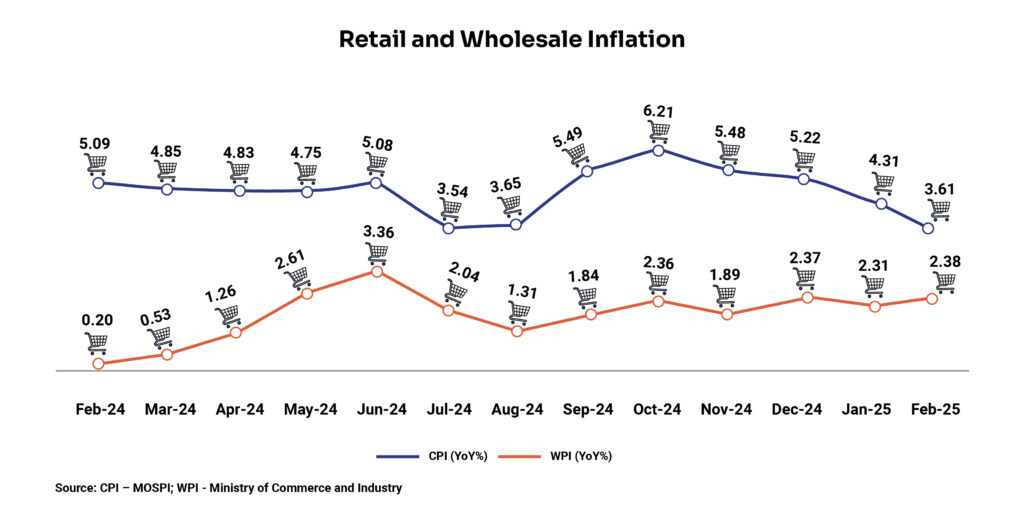

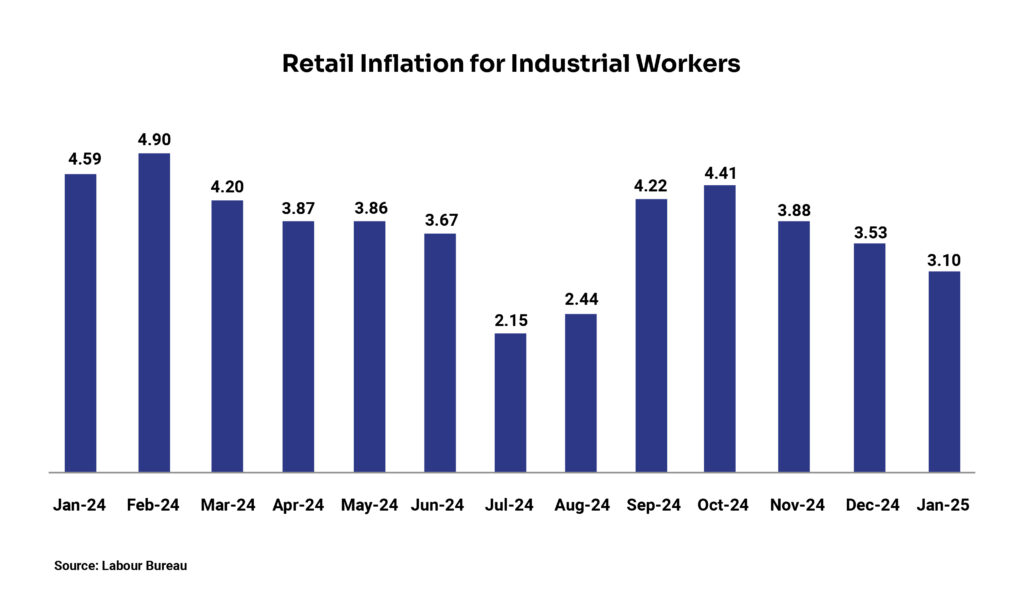

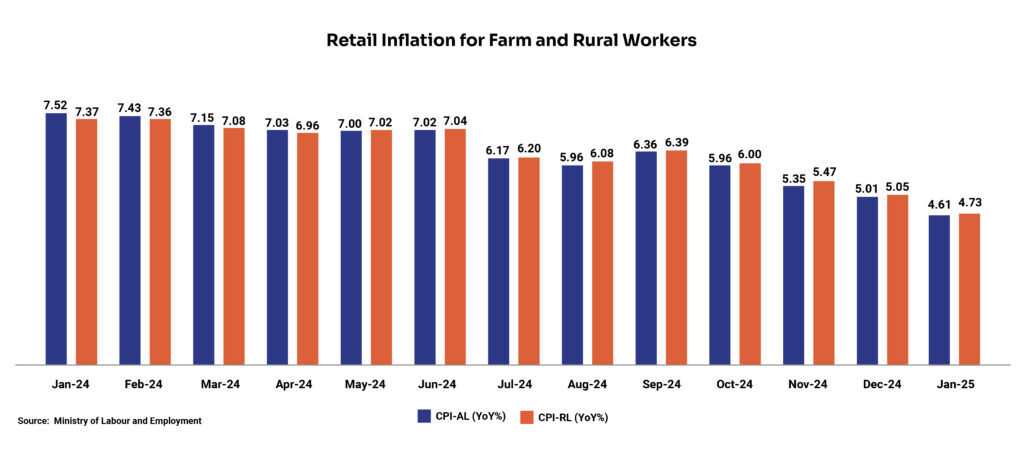

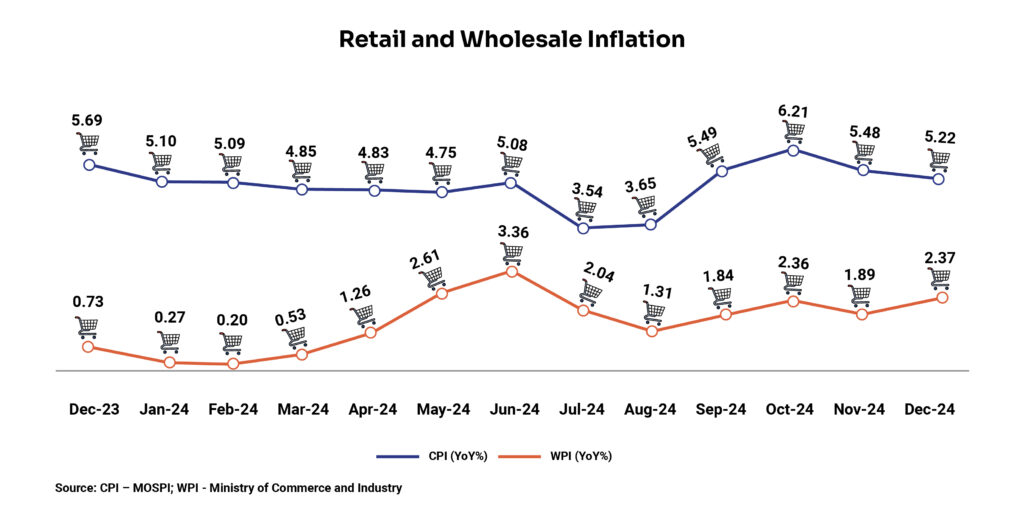

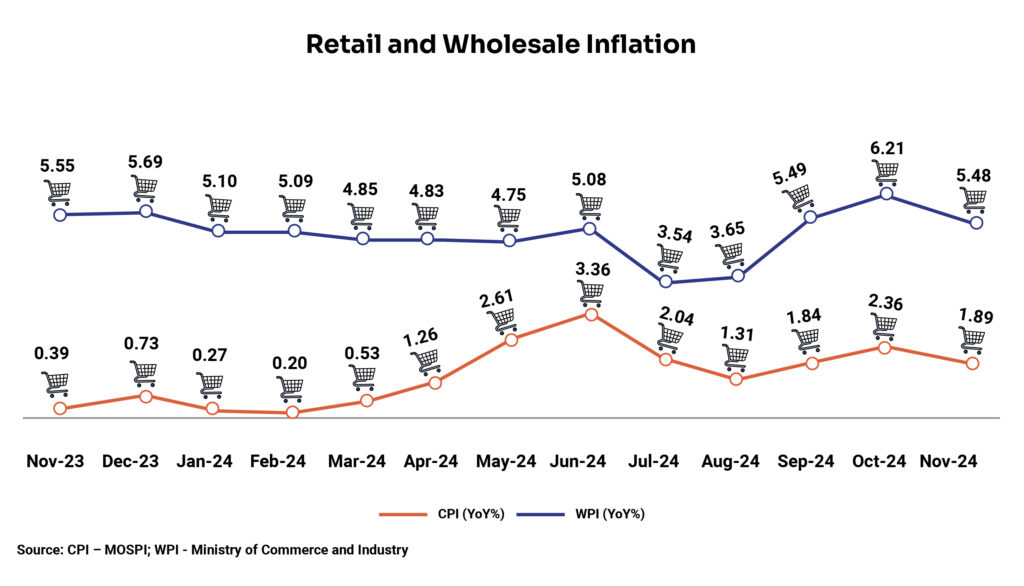

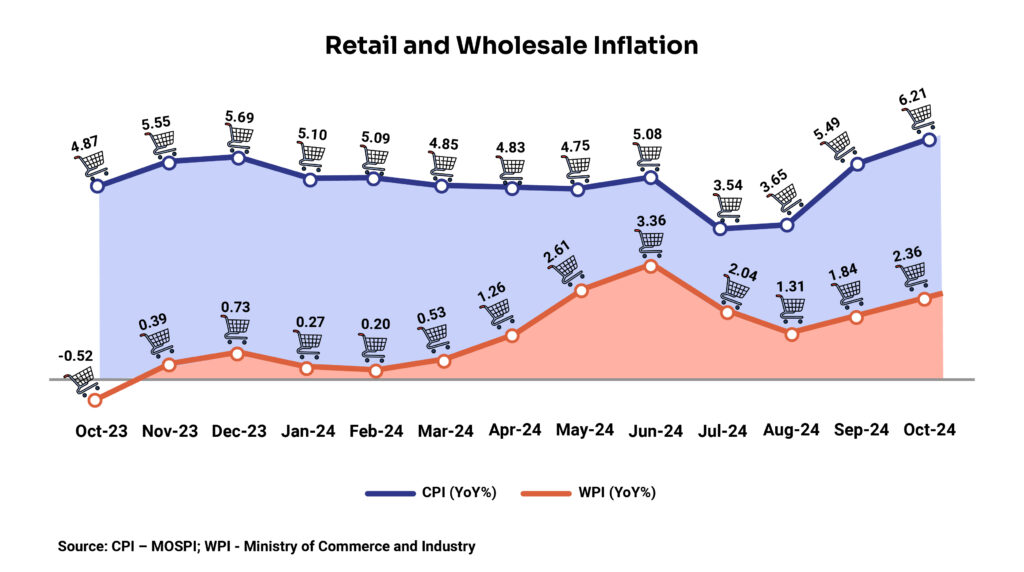

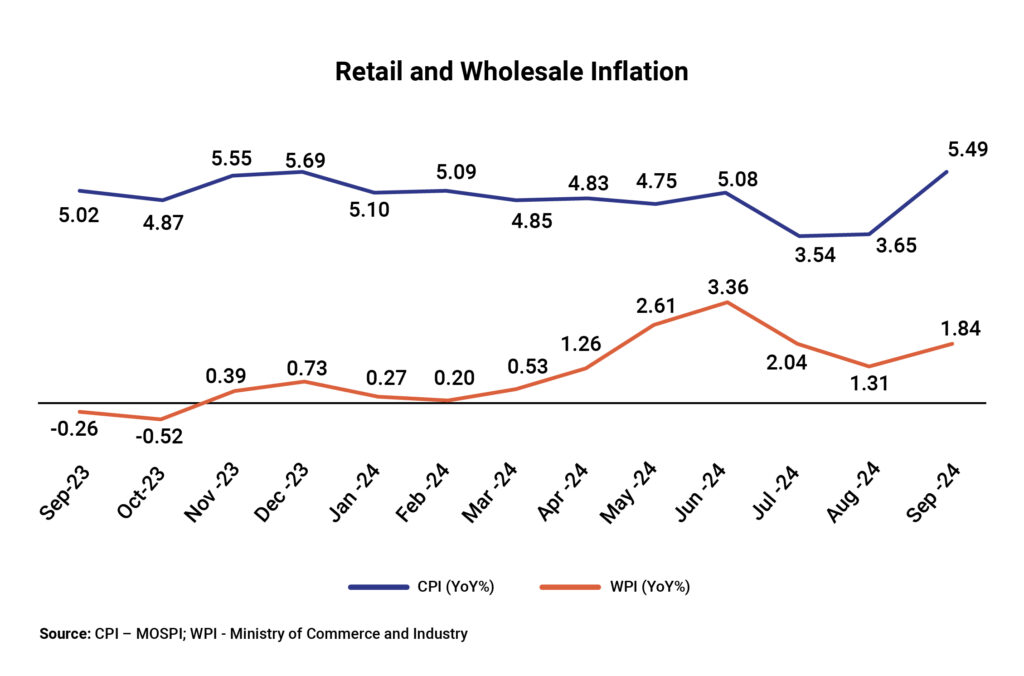

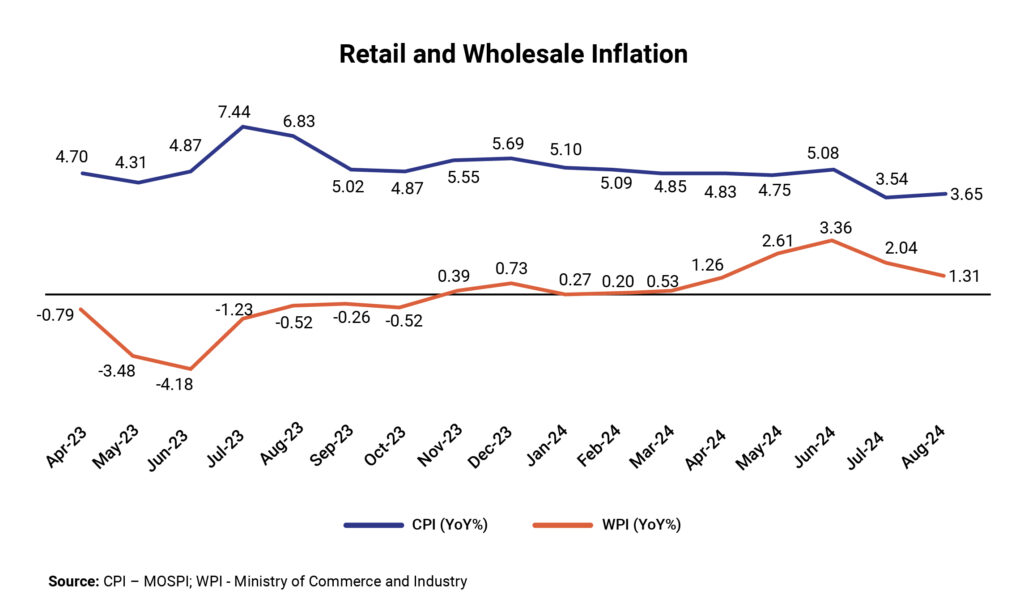

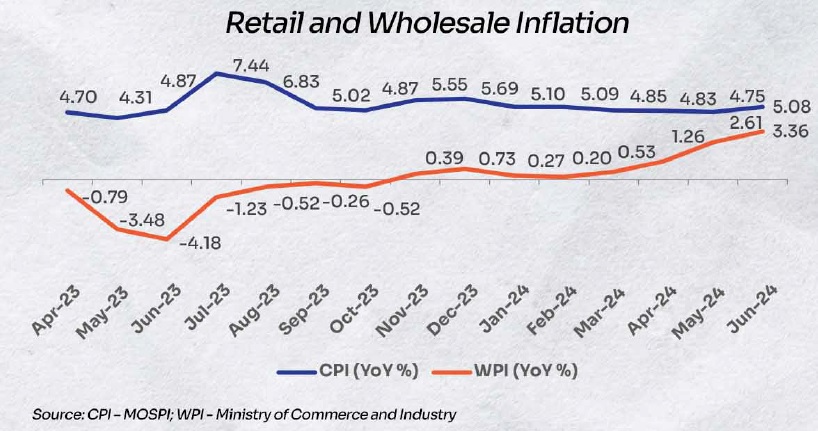

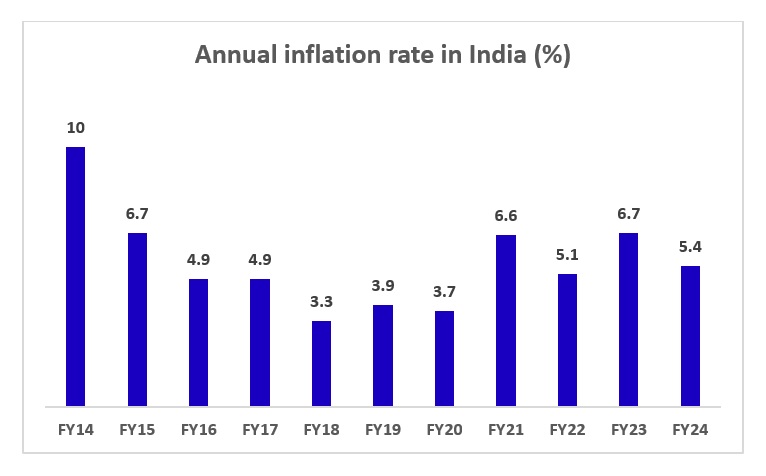

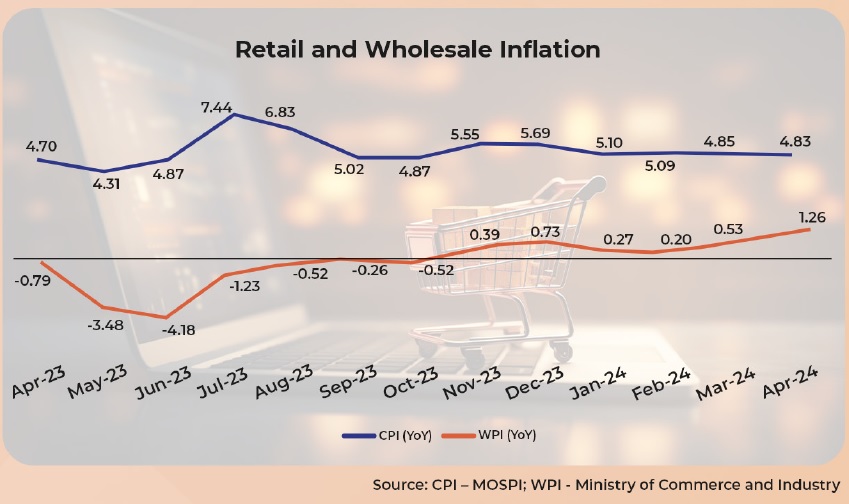

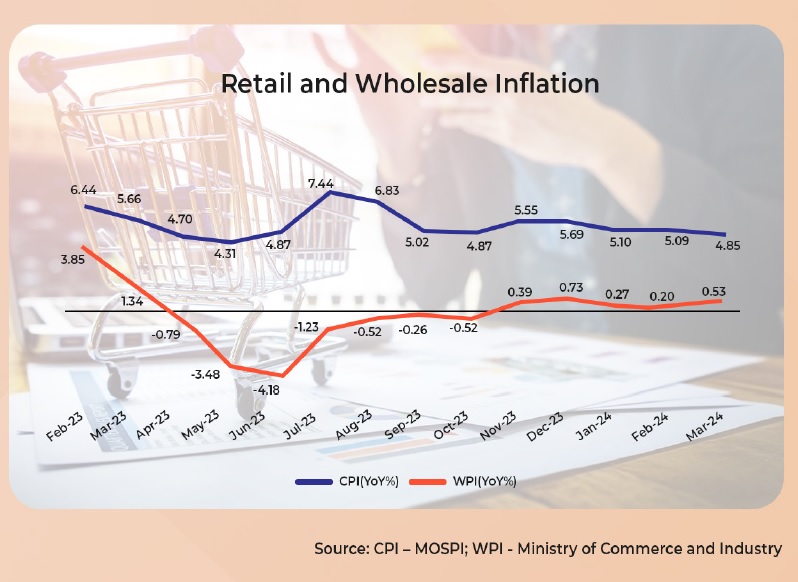

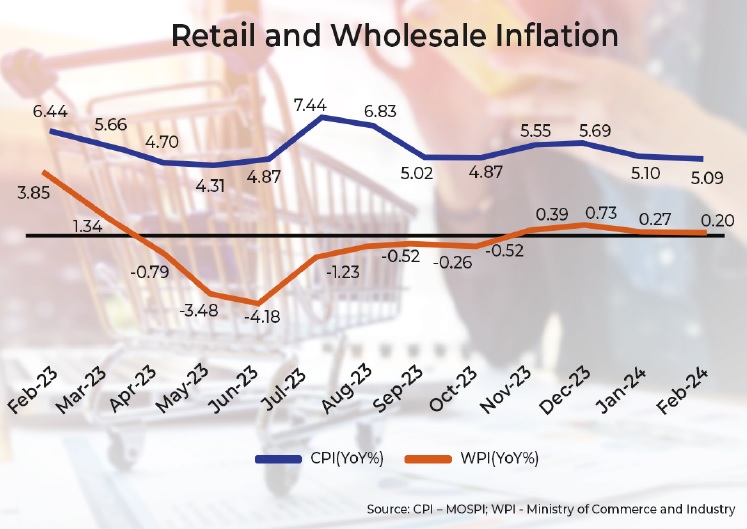

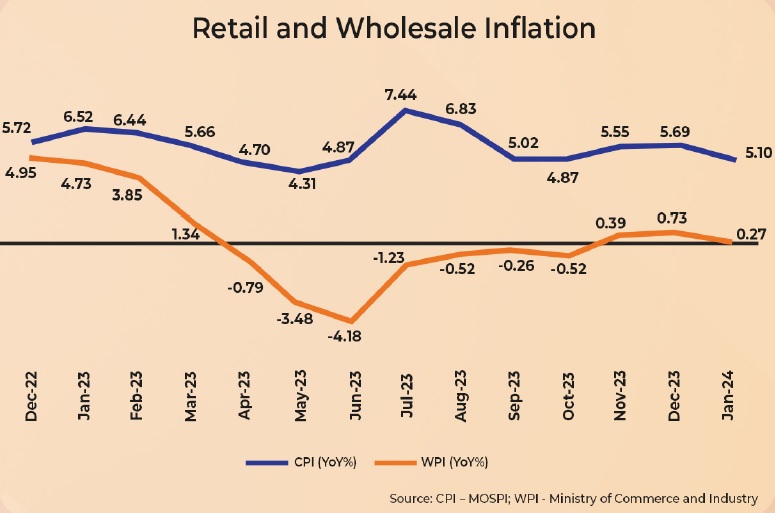

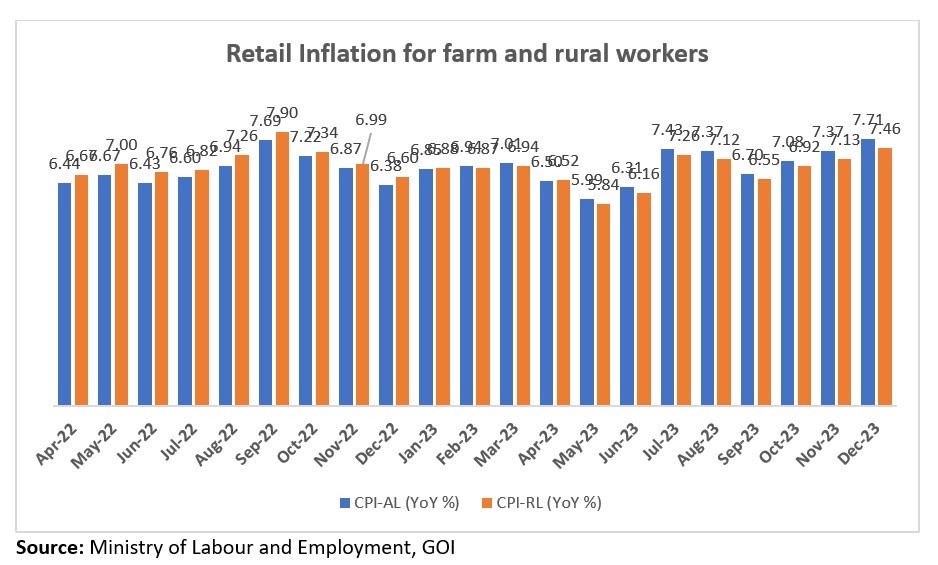

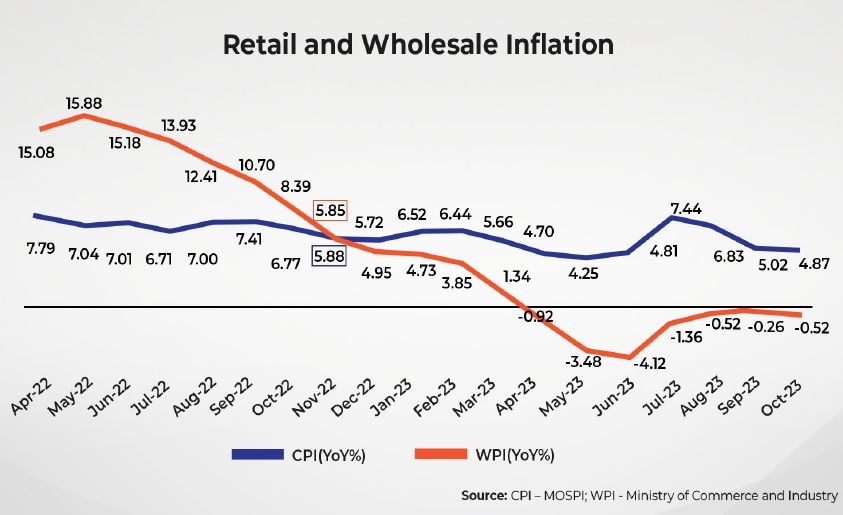

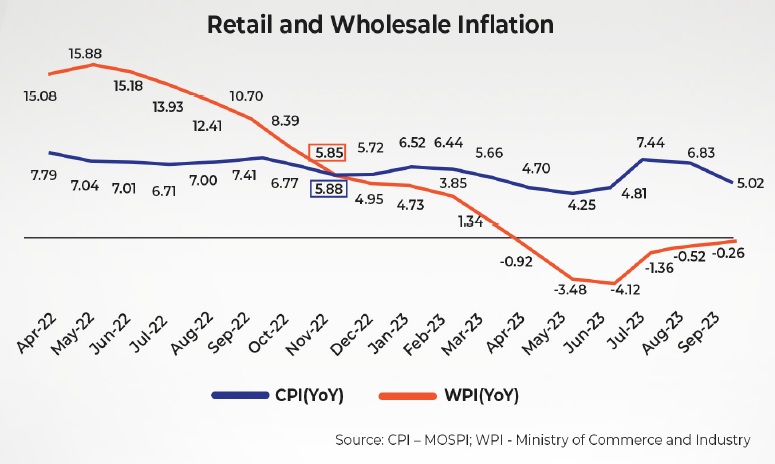

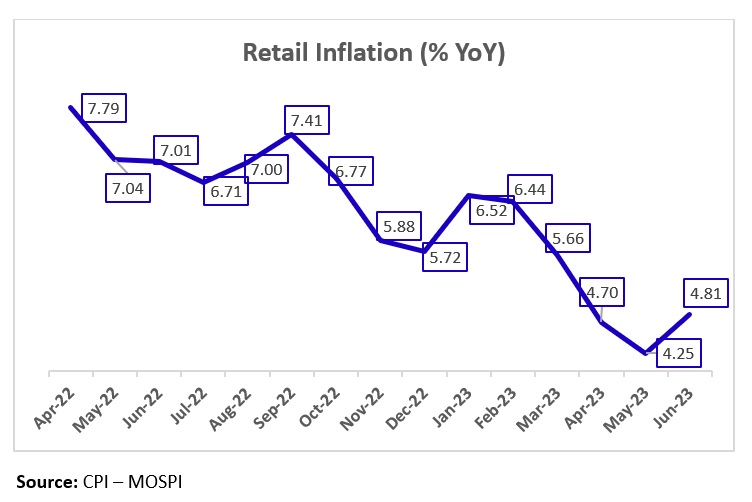

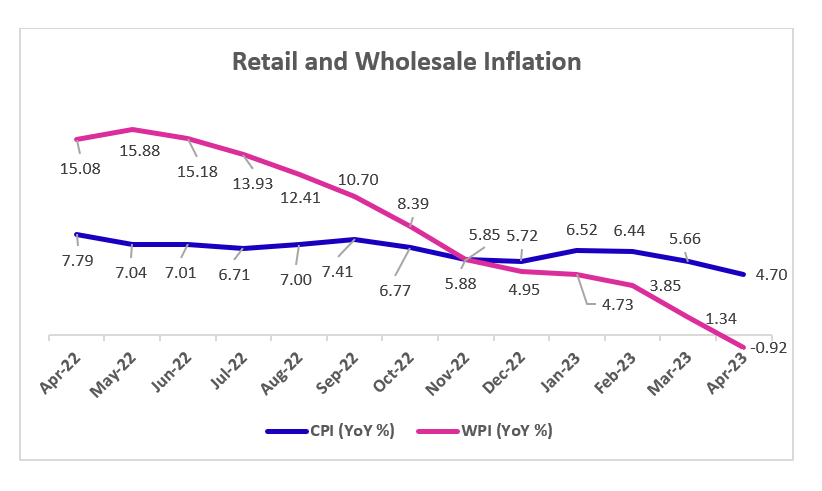

India’s retail inflation, which is measured by the consumer price index (CPI), eased to over 6-year low of 2.82% YoY in May (lowest since February 2019) reflecting 34 bps MoM fall from 3.16% in April. The fall is attributed to food inflation, which dropped to a near 4-year low of 0.99% YoY in May. Within the food basket, vegetables inflation fell 13.7% YoY, the lowest in over 2 years followed by pulses which moderated to 8.2% YoY during the month. However, core inflation, which excludes volatile food and energy prices and is seen as a reliable indicator of domestic demand, slightly inched up to 4.2% YoY in May from 4.1% YoY in April.

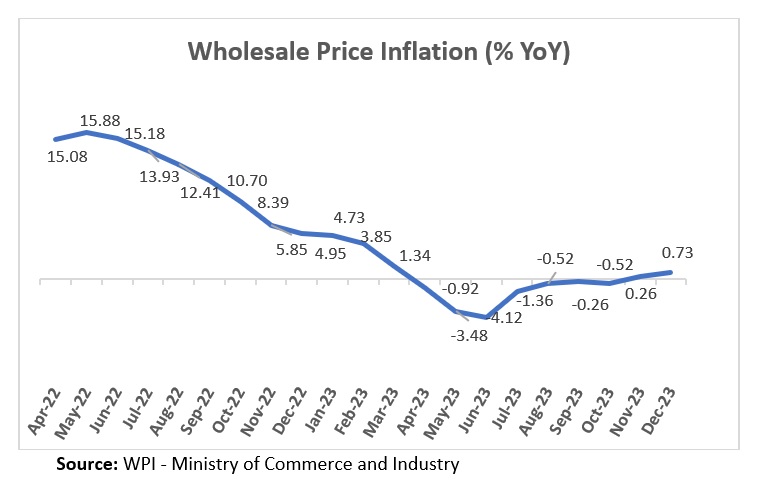

The wholesale inflation continued its downward trajectory, falling to a 14-month low of 0.39% YoY in May. The decline is led by lower food and fuel prices. Core inflation moderated to 0.8% YoY in May from 1.57% in April.

Inflation in manufactured products, the largest component in the overall basket, eased to a 7-month low of 2.04% YoY in May followed by inflation for primary articles which contracted to a 23-month low of 2.02% YoY during the month. The decline is driven by a fall in prices of vegetables, pulses, potatoes, onions and protein-rich items such as eggs, meat, and fish. Within the primary articles index, prices for minerals declined sharply to 0.44% in May versus 9.69% in April. The fuel & power category recorded a deflation of 2.27% YoY in May driven by a decline in prices of mineral oil. In contrast, prices of electricity and coal increased during the month.

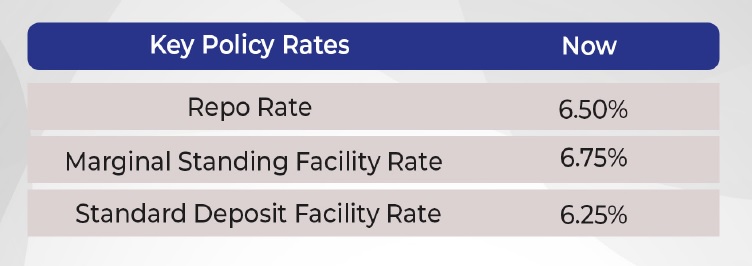

Amid the steady decline in inflation, RBI has reduced the repo rate by 50 basis points (bps), the third consecutive rate cut in CY25, to 5.5%. This rate cut has been the sharpest since the 75-bps reduction during Covid-19 in March 2020. With limited room for further rate cuts, the RBI has changed its monetary policy stance from accommodative to neutral. While external challenges like geopolitical tensions and trade policy shifts remain, RBI has retained India’s growth projection for FY26 at 6.5%.

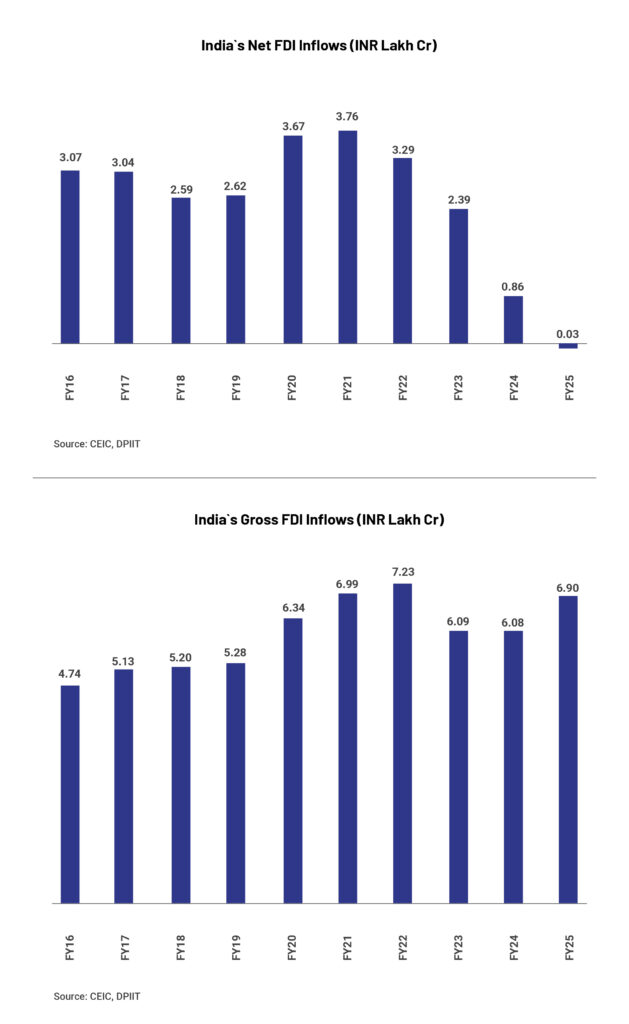

India’s net foreign direct investment inflows hit record low in FY25

Net foreign direct investment (FDI) inflows into India plummeted 96.5% YoY to an all-time low of US$353 million (~INR 3026 crore) in FY25 from US$10 billion (~INR 86,000 crore) in FY24. The decline in net FDI inflow – calculated by subtracting repatriation and net FDI outflow from gross FDI inflow – happened despite a strong uptick in gross FDI inflow. The decline can be linked to large scale exits by foreign entities trigged by IPOs of large-scale companies such as Hyundai Motor India and Swiggy, among others.

Net FDI outflow grew 75% YoY to US$29.2 billion (INR 2.49 lakh crore) in FY25. Singapore, US, UAE, Mauritius, and the Netherlands together accounted for over 50% of the outflow. Repatriations and disinvestment rose by 15.7% to US$51.5 billion (INR 4.4 lakh crore) in FY25. Economists believe that the moderation in net FDI inflows is not a sign of weakness but is evidence of a mature market enabling the foreign players to enter and exit smoothly.

Gross inward FDI stood at a 4-year high of US$81 billion (INR 6.9 lakh crore) in FY25, as per RBI data. Sectors such as manufacturing, financial services, electricity and energy, and communication services together accounted for ~60% of the inflows. This highlights that India still holds the potential of an attractive investment destination. Furthermore, improving the ease of doing business and strengthening regulatory policies can aid in attracting foreign investment in India.

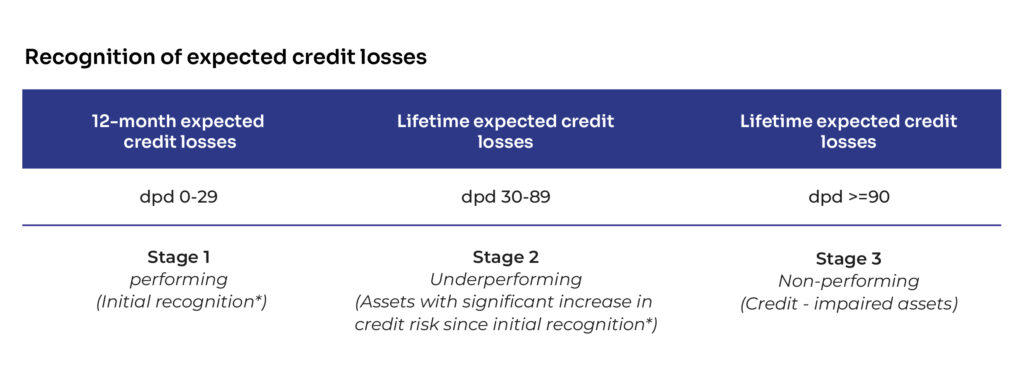

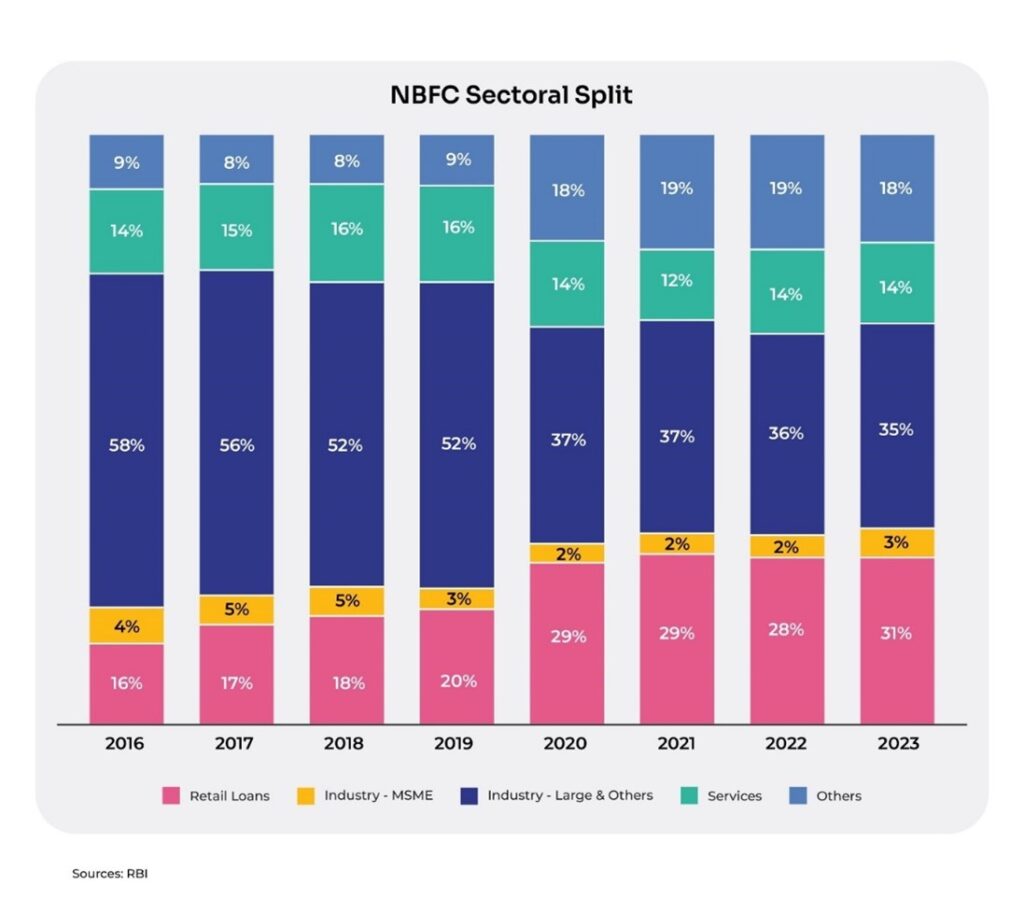

RBI Financial Stability Report Bank indicates resilient credit growth among NBFCs

The Reserve Bank of India’s bi-annual Financial Stability Report indicated deceleration in credit growth but improvement in asset quality in the banking sector at the last financial year end. For NBFCs, credit growth improved while asset quality remained improved in the same period. However, the central bank flagged concerns in the financial markets due to volatility in government bond markets, driven by dynamic policy and geopolitical environment.

The credit growth of scheduled commercial banks (SCBs) decelerated to the lowest level (11%) in three years as of March 2025 due to a moderation in growth in agriculture, services, and personal loans over the last few quarters. The credit growth of public sector banks outpaced that of private sector banks as of March 2025 after more than a decade. The credit growth of NBFCs (Upper and Middle Layers) accelerated to 20.7% as of March 2025 from 16% as of September 2024 due to the conversion of a housing finance company (HFC) to an upper-layer NBFC and the merger of a middle-layer NBFC with an upper-layer NBFC.

Both SCBs and NBFCs continued to depict improvement in their asset quality, with the GNPA ratio declining to multi-decadal lows of 2.3% and 3%, respectively. For SCBs, the decline is attributed to stable asset quality in personal loans across major sub-segments and sustained improvements in asset quality across all sub-sectors in industrial loans, while agriculture remained the highest contributor to the GNPA ratio.

For NBFCs, the sustained improvement in asset quality is attributed to a decline in the GNPA ratio of government-owned NBFCs (to 1.4%) (accounts for 59% of advances by NBFC middle layer) and stable asset quality of privately-owned NBFCs (5.2%, which is the same as in September 2024). Sector-wise, asset quality improved in all except agriculture.

Notably, the stress in the retail loan book is visible among NBFCs compared to SCBs, and the former have significantly increased their share in unsecured personal loans and microfinance segments in recent years. SCBs reported a GNPA ratio of 1.2% in their retail loan book while NBFCs recorded a ratio of 3.1% in the same segment in the comparable period.

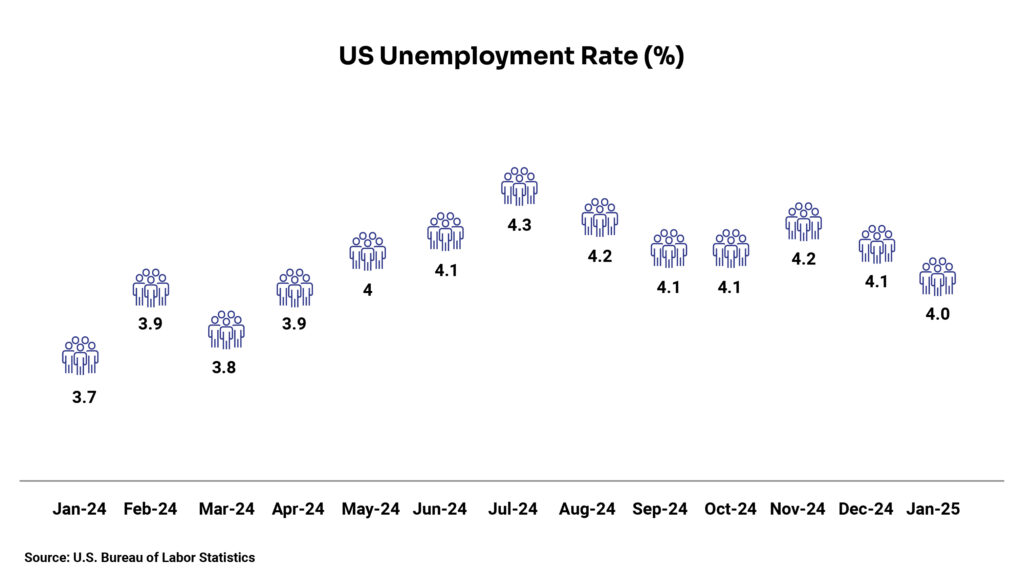

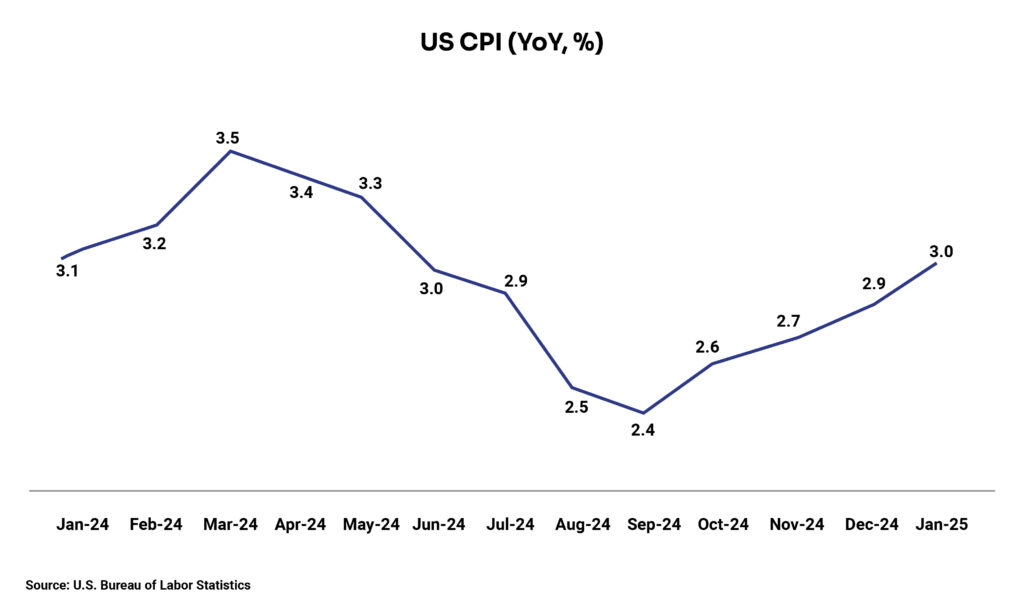

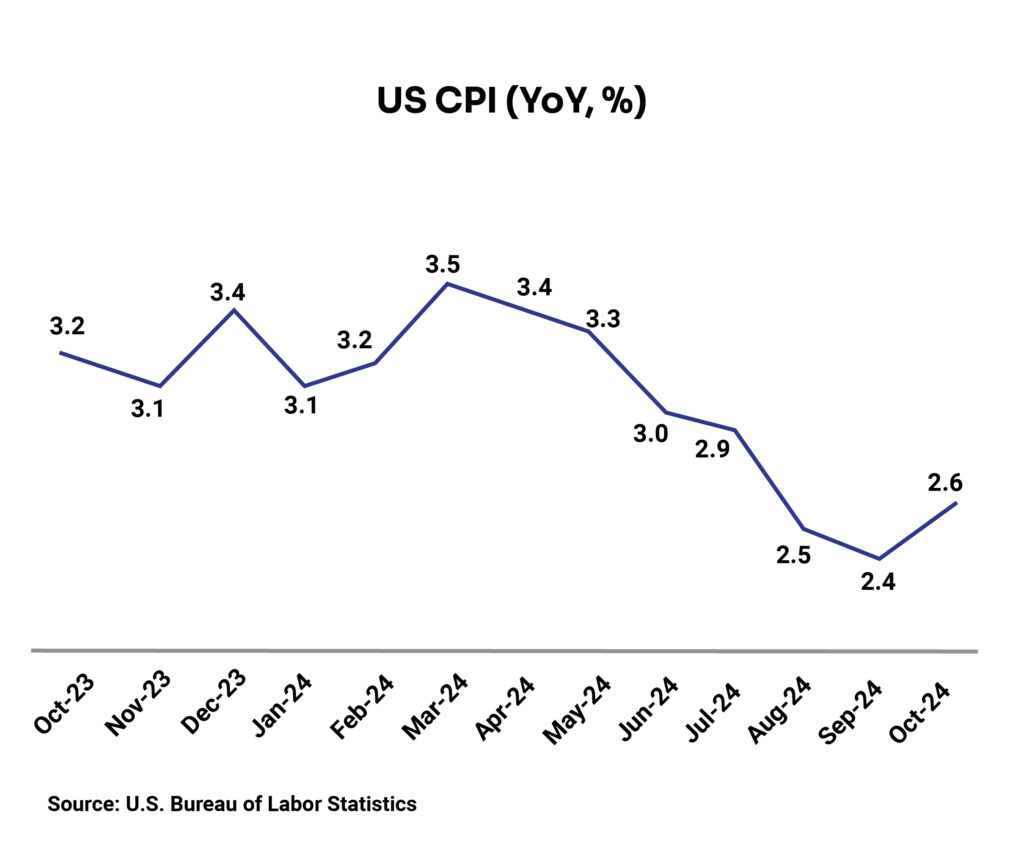

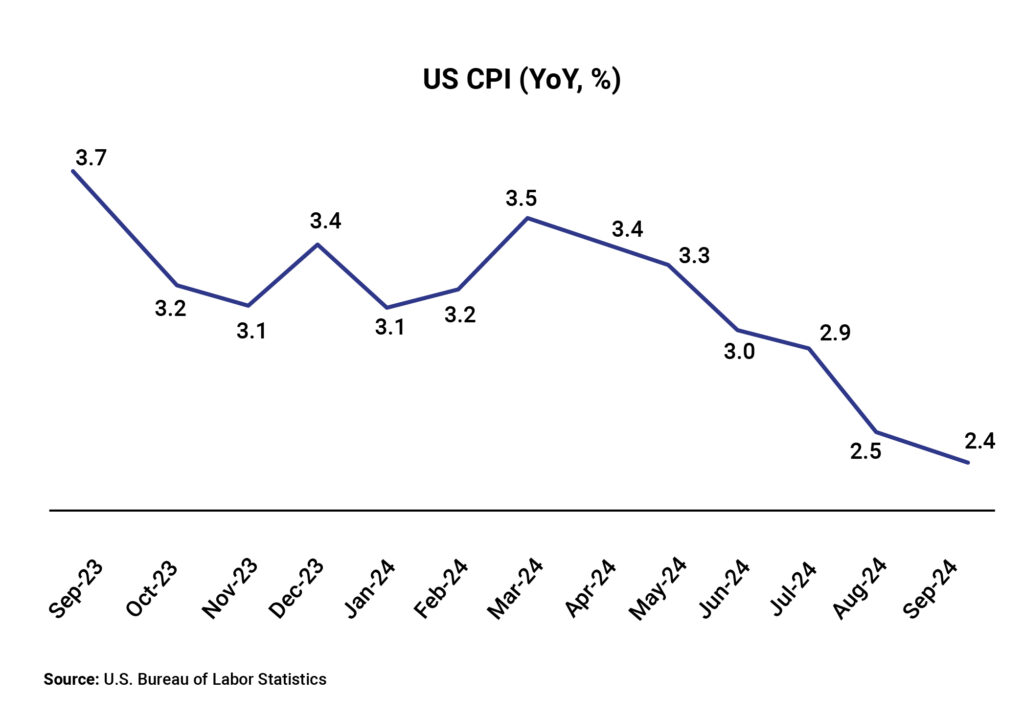

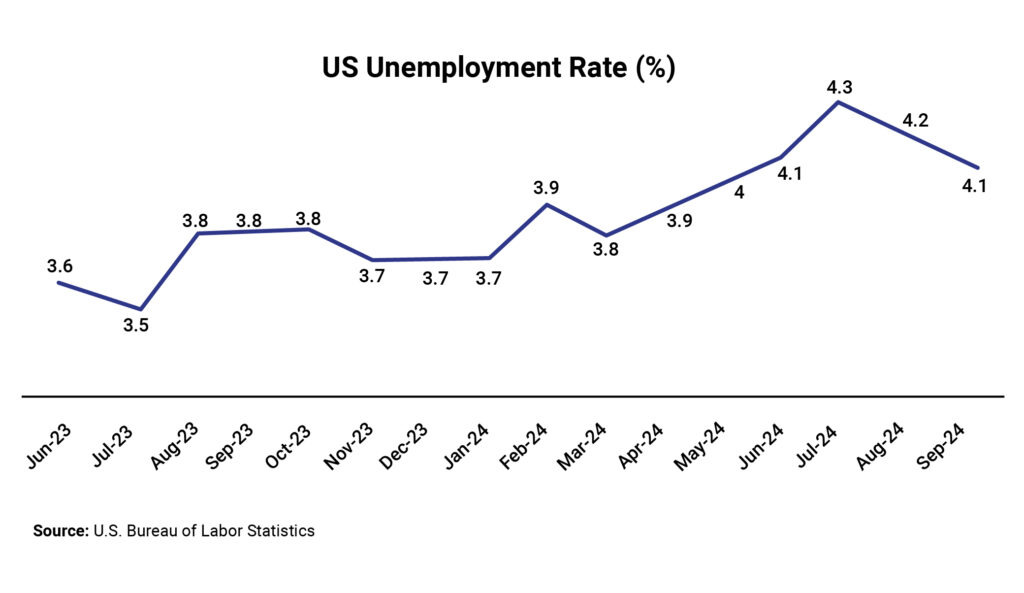

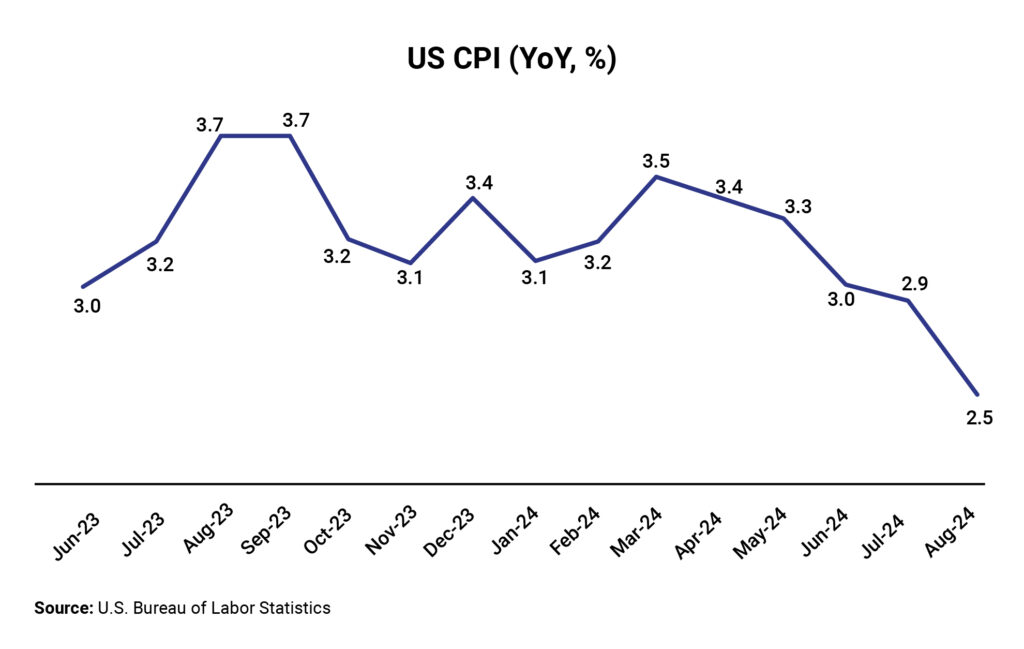

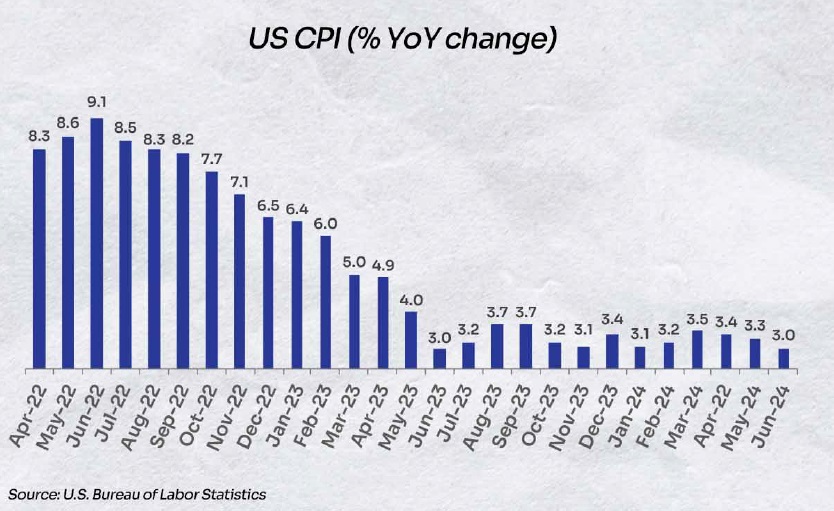

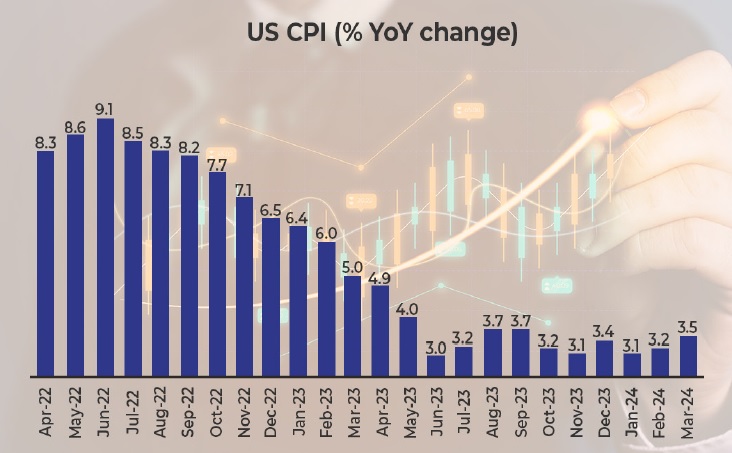

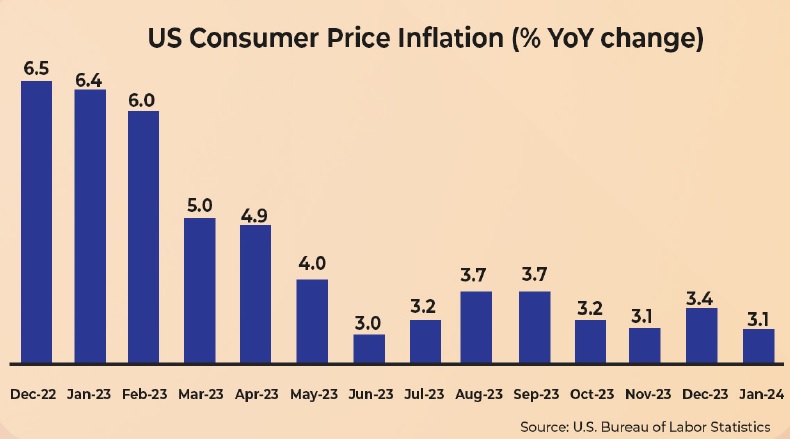

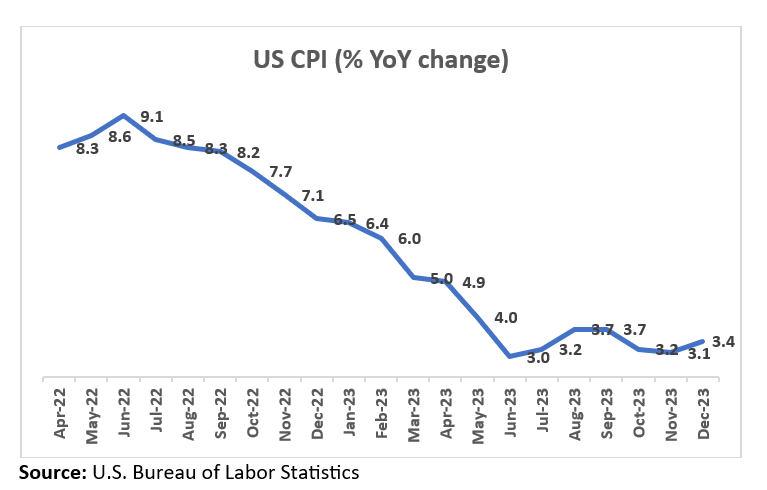

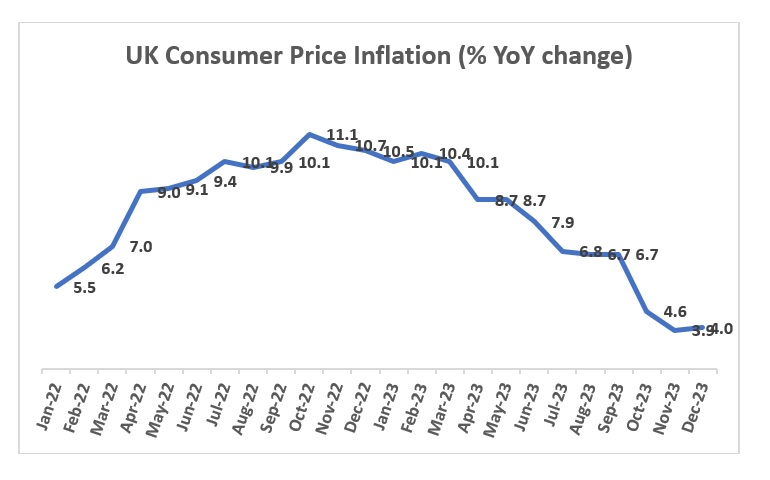

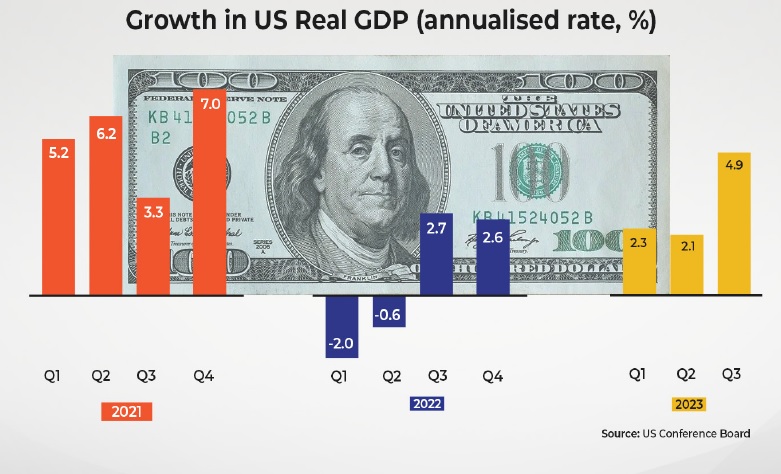

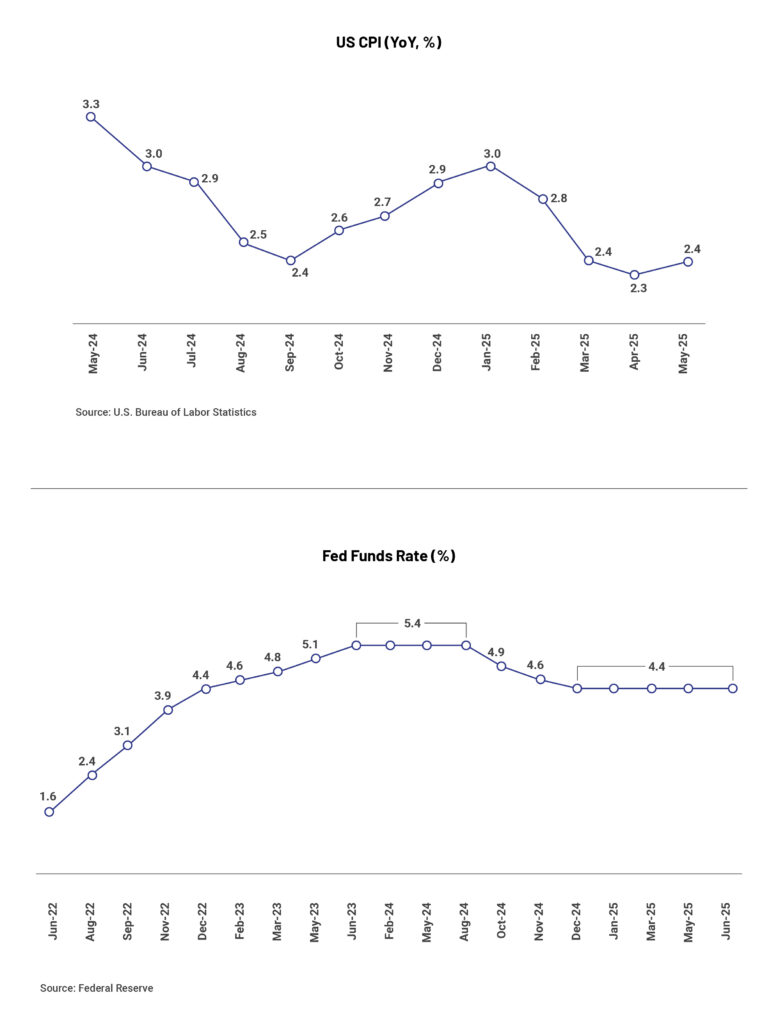

US inflation accelerates for the 1st time in 4 months, US Fed awaits further cuts

Consumer price inflation in the US accelerated for the first time in four months to 2.4% in May from 2.3% in April, which was the lowest level since 2021, However, the inflation came in below the consensus estimates of 2.5%. The acceleration is mainly driven by rise in prices of food (2.9% versus 2.8% in April), transportation services (2.8% versus 2.5%), used cars and trucks (1.8% versus 15%), and new vehicles (0.4% versus 0.3%). The core inflation, which excludes volatile food and energy and is considered a better gauge of long-term trends by the US Fed, came in at 2.8%, slightly below the consensus estimates of 2.9%.

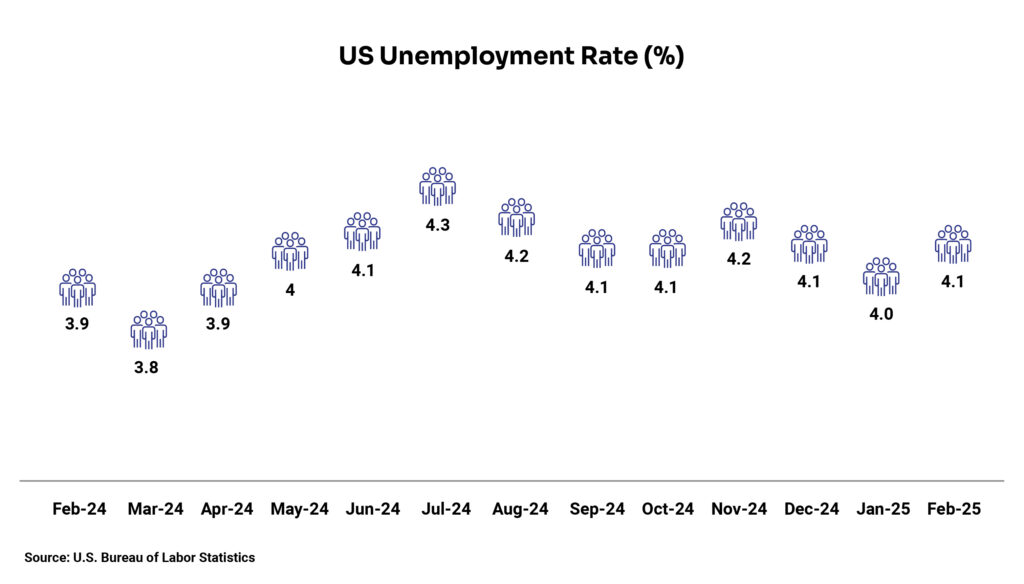

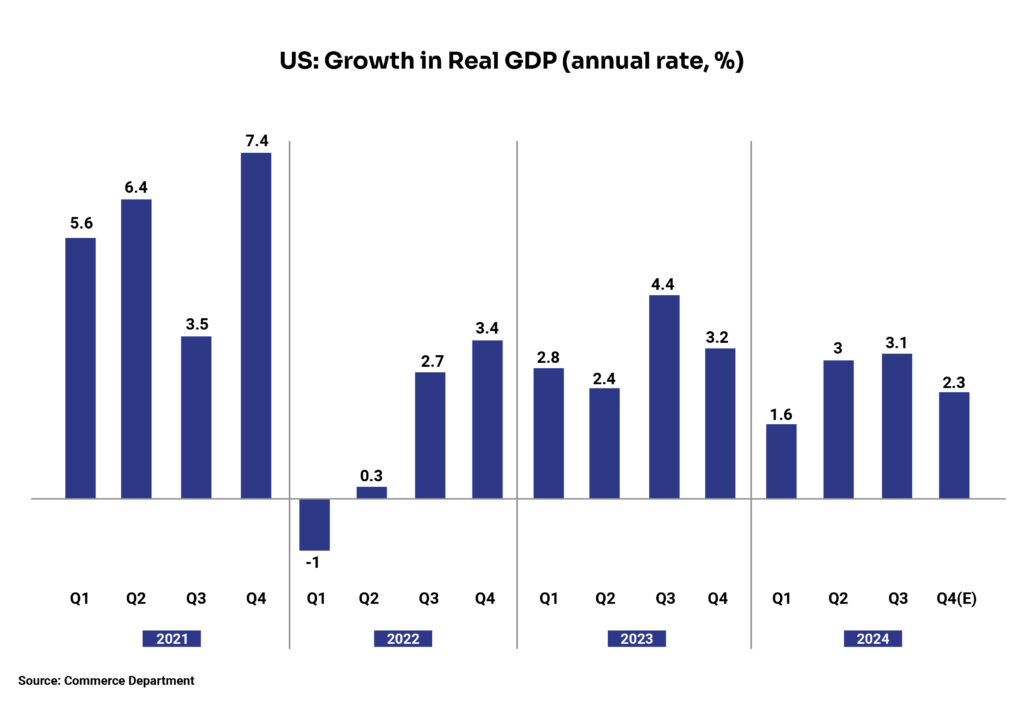

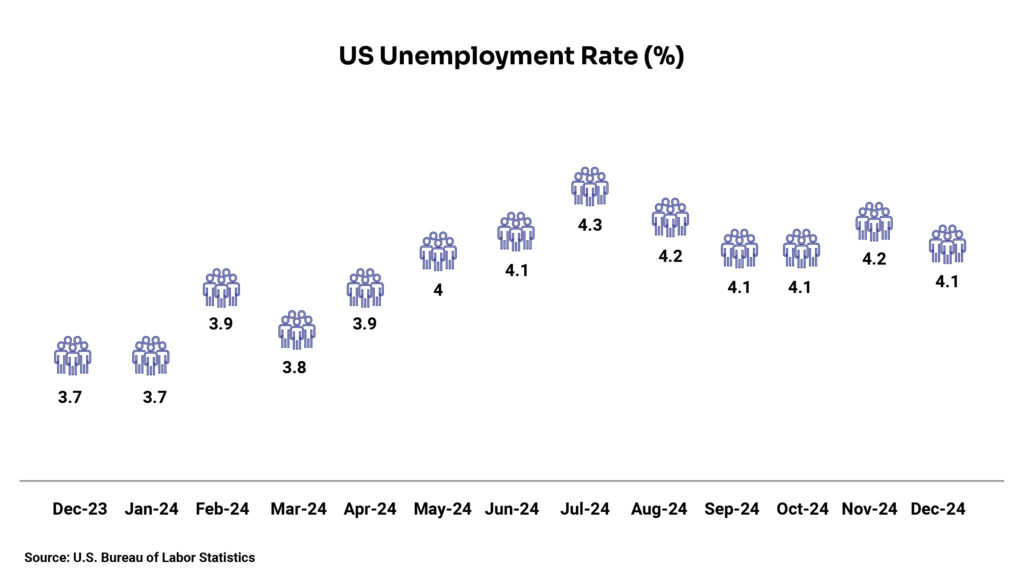

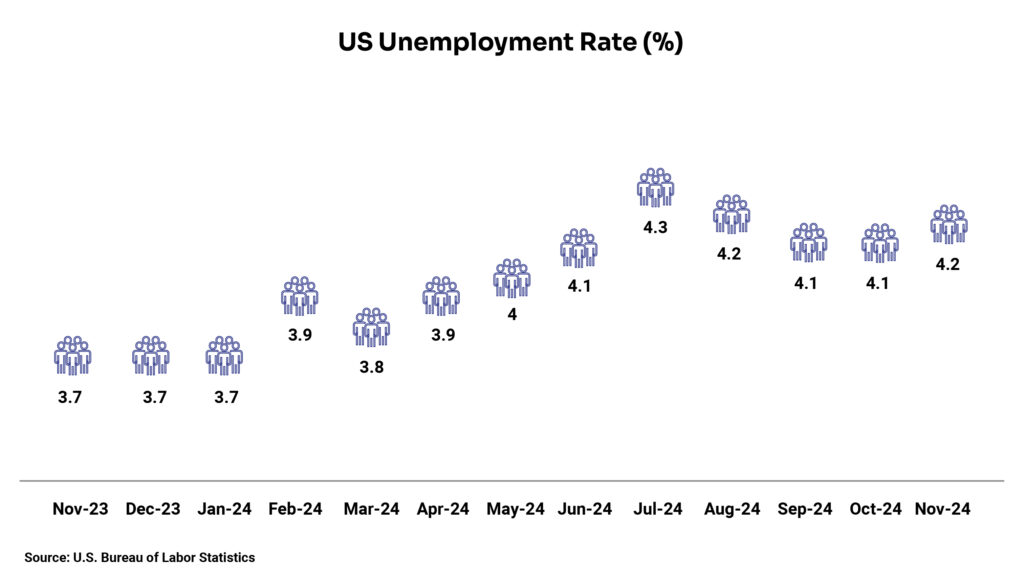

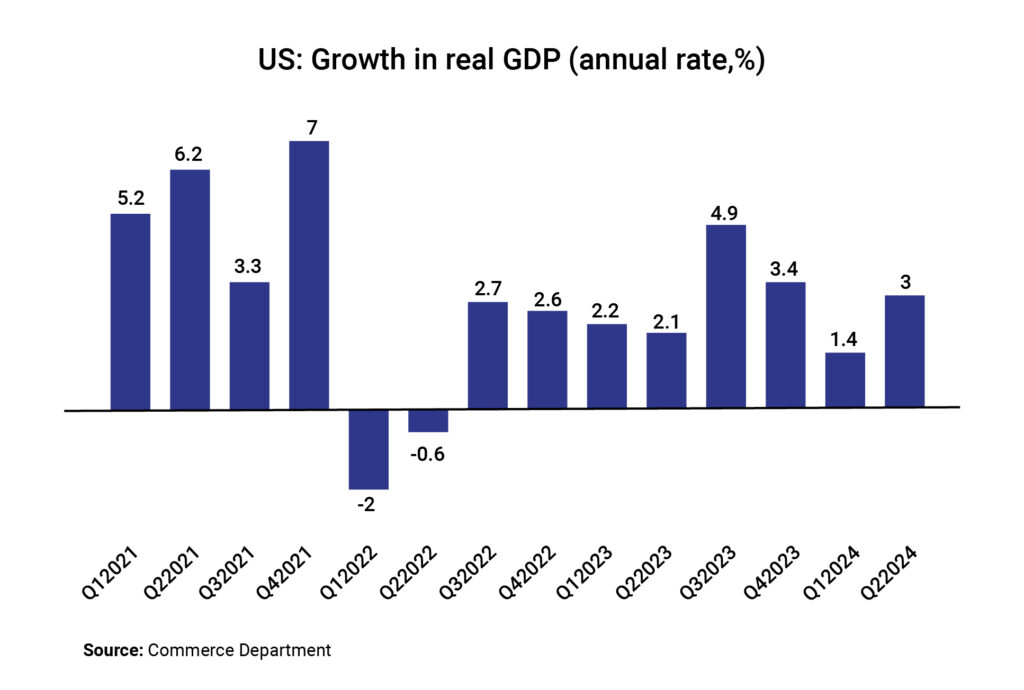

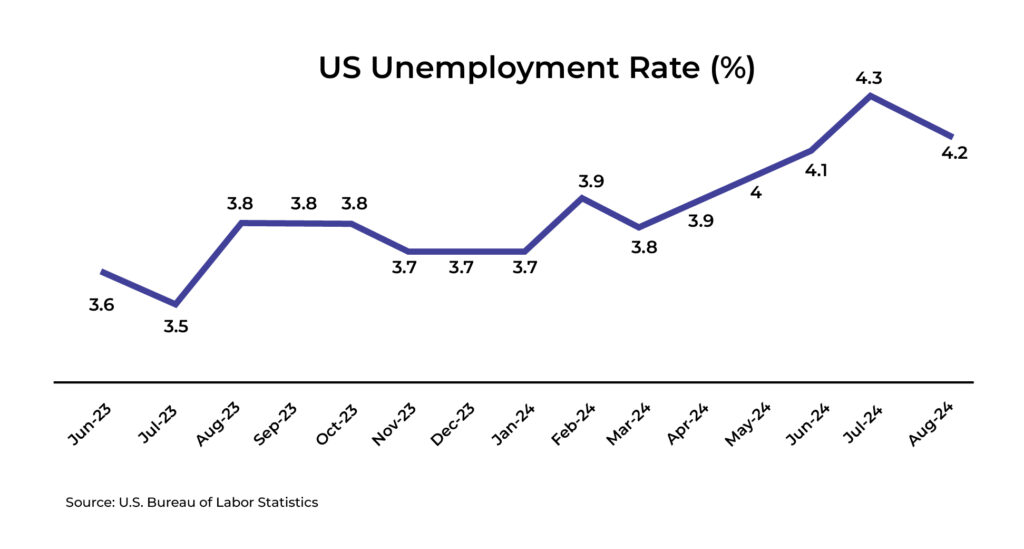

The US Federal Reserve held the repo rate steady at the 4.25%-4.5% range during its May meeting citing upside inflation risk and increase in unemployment. The Fed Chair Jerome Powell said, “that their existing policy is “in a good place” and can allow them to respond swiftly as economic conditions evolve.” As per market estimates, the US fed is likely expected to cut the rates in the later half of the year, although uncertainty remains.

US dollar is on its worst journey since 1973

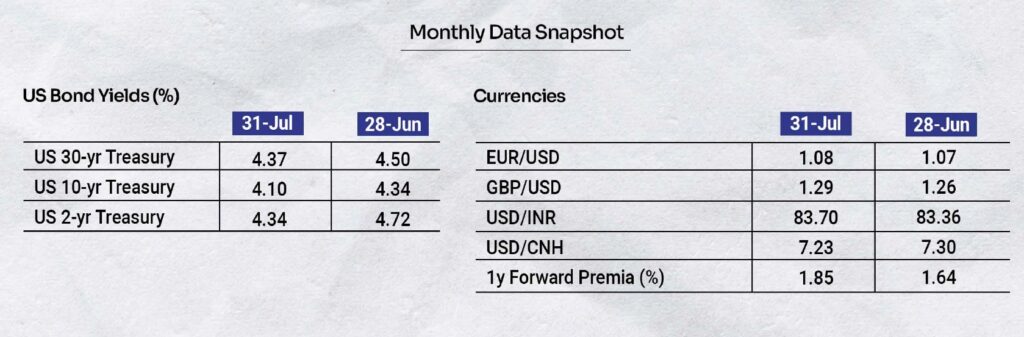

The US dollar has plummeted over 10% since the beginning of this year to June-end, marking its worst first-half performance since 1973. The ICE dollar index, which tracks the greenback against a group of six major global counterparts including the euro, yen, and pound, is hovering around 97, depicting a 13% fall from its 52-week high.

Despite a resilience in US stock markets, the prolonged fall in US dollar and declining long-term treasury yields indicates growing investor concerns about the ongoing tariff war and rising debt in the US, mainly after the “big, beautiful” tax bill that is expected to add US$3.2 trillion to the overall US debt, as per recent reports. The bill is designed to extend Trump’s 2017 tax cuts, curb healthcare and social welfare spending, and significantly increase public borrowing. Further, rising expectations of further interest cuts in the US following President Trump’s push for lower borrowing costs amid his criticism of the Federal Reserve chair led to conflicting signals on monetary and trade policy to the financial market. There is a growing concern that the dollar’s fall might eventually affect the US equities.

Disclaimer:

The details mentioned above are for information purposes only. The information provided is the basis of our understanding of the applicable laws and is not legal, tax, financial advice, or opinion and the same subject to change from time to time without intimation to the reader. The reader should independently seek advice from their lawyers/tax advisors in this regard. All liability with respect to actions taken or not taken based on the contents of this site are hereby expressly disclaimed.